Pointsbet Holdings Ltd (ASX: PBH) announced yesterday it has launched operations in its eighth US state, Virginia.

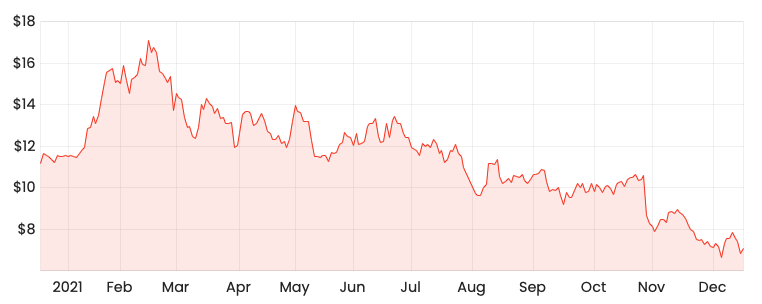

Shares finished 3.51% higher for the day, however, have lost 38.41% of their value since the start of 2021.

Is now the time to consider Pointsbet shares?

PBH share price

Pointsbet launches 8th state

In November, the Virginia Lottery issued Pointsbet, together with racetrack Colonial Downs, an official license to offer online sports wagering within the state.

This is in addition to existing licenses held by Pointsbet in New Jersey, Iowa, Indiana, Illinois, Colorado, Michigan, and West Virginia.

“Virginian sports bettors will now have access to PointsBet’s fast online sports betting product with the most betting options, including robust in-play capabilities.” – Johnny Aitken, PointsBet USA CEO

The business has utilised its partnership with NBC Sports to promote the Pointsbet brand across its network.

Pointsbet has already appeared on local programming for the Washington Football Team, Wizards and Capitals.

However, residents have been unable to place bets while it awaited Pointsbet’s operational launch.

“Viewers who have become familiar with the PointsBet brand through our odds integrations and expert analysis during television broadcasts can now truly experience what sets PointsBet apart.” – Kyle Christensen, PointsBet USA CMO

Show me the money

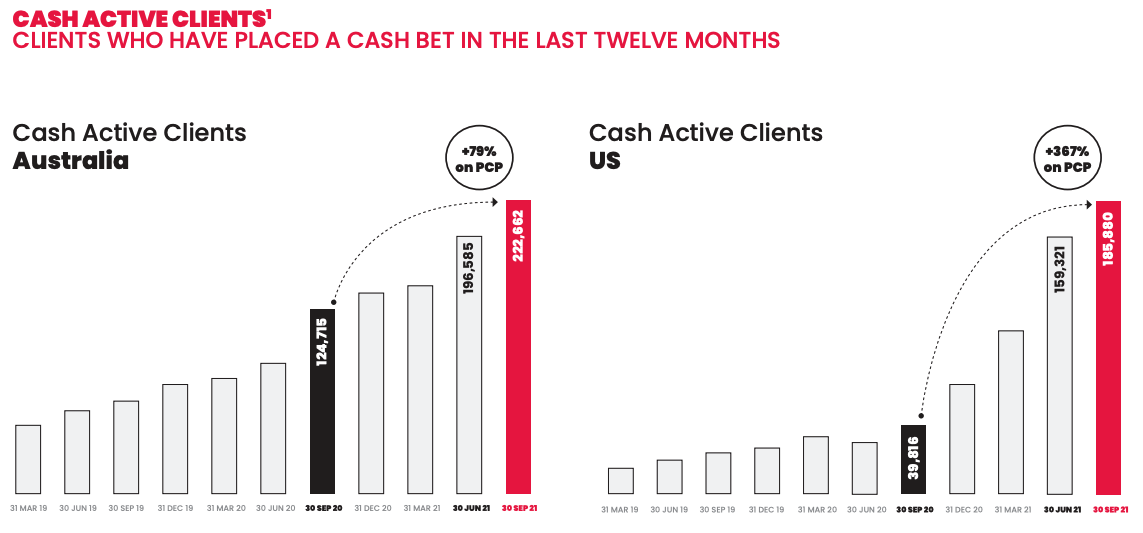

Despite the business growing betting turnover of 42% over the past year, the market has punished Pointsbet for its cash flow (or lack of).

In the last quarter, the business spent more on marketing than it retained in gross profit.

Put simply, Pointsbet in its current form is unsustainable.

Subsequently, the market has turned sour on the company, betting its plan to roll out across the US will prove fruitless.

Is now the time to buy Pointsbet shares?

The Pointsbet share price has fallen nearly 60% since its high in February.

Clearly, the market has been spooked by the lack of profitability. It should also be noted Pointsbet is taking on some large competitors including Flutter and DraftKings.

Personally, I think the business could succeed if it’s able to capitalize on the NBC partnership.

But at the moment I don’t see any catalyst to rerate the share price. It will likely be burning cash for the foreseeable future, and unless it can rapidly grow, the market will lose interest – if it hasn’t already.

If you’re looking for new ASX share ideas, check out three I’d be willing to buy on any market pullback.