ASX growth shares have had a stellar year, buoyed by low interest rates and all-time highs for most developed markets.

But if the market did pull back, here are three ASX growth shares I’d love to buy.

1. Xero Limited (ASX: XRO)

Ask any small business owner for their favourite accounting system. Then ask any accountant for their preferred client software.

If both don’t answer Xero, I’ll fall off my chair.

Xero is loved for its rich functionality yet simple accounting software.

It acts as the front page for a business, slashes accounting fees and is mission-critical to daily operations.

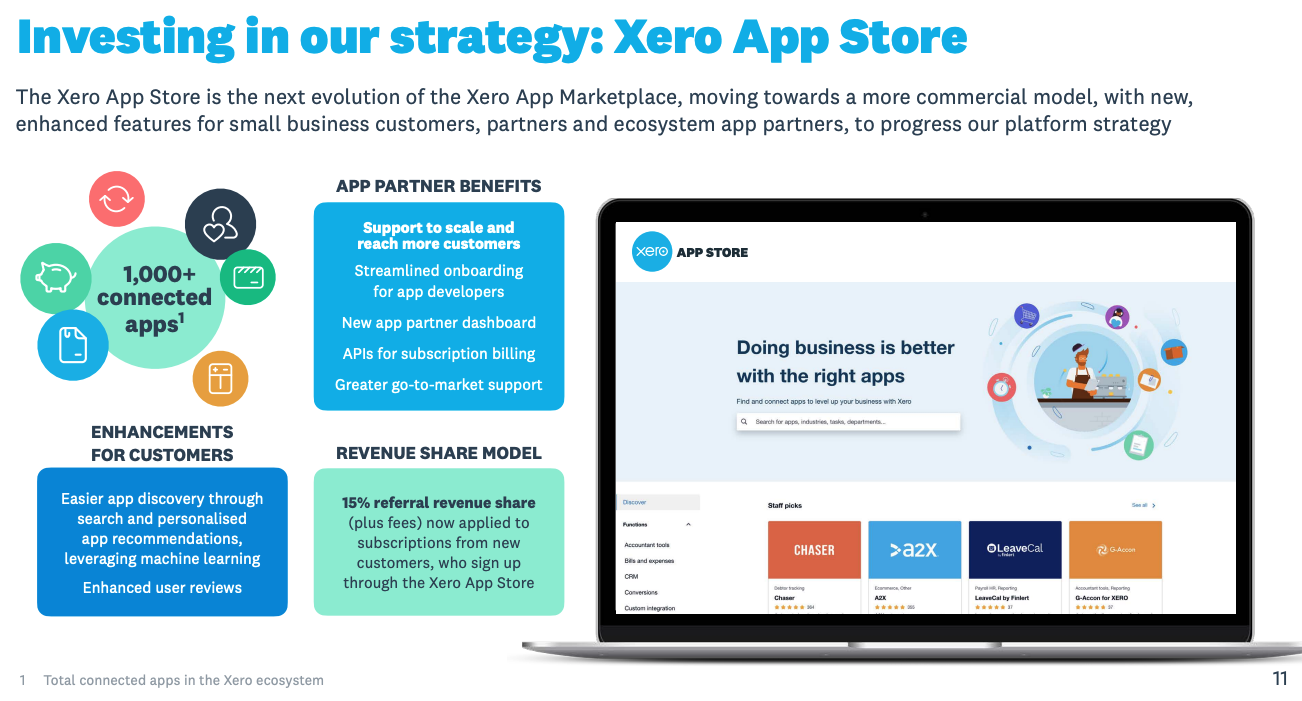

But Xero is becoming more than just software. It’s shifting toward a platform model, where other developers can create add ons to help a business with inventory, reporting and bookings.

Currently trading on a sales multiple of 18, Xero is one of the most expensive stocks on the market. But this is certainly one I’d love to pick up on any pull back.

2. REA Group Limited (ASX: REA)

REA Group owns the prized realestate.com.au property portal amongst other investments across the world.

It’s a wonderful example of networks effects, where more prospective buyers result in more listings by agents. This cycle goes round and round leading to an incredibly dominant business.

Realestate.com.au has 3.3 times the number of website visits as its nearest competitor and is the 8th most visited website in Australia behind only the likes of eBay, Google and Facebook.

It’s currently trading on a price-to-earnings (P/E explained) ratio of 65, which reflects the quality of the business as viewed by the market.

Personally, this is a little high for me, but anything below a P/E of 50 would be a buying opportunity in my opinion.

3. Domino’s Pizza Enterprises Ltd (ASX: DMP)

This pizza retailer has what I would argue is the best management team in Australia.

The fact that it’s been executed now in over 11 different countries is a testament to the culture and quality of the company.

The business sets ambitious long-term targets such as a store network of 6,500 by 2033.

It had 2,949, inferring the business expected to increase its store count by 7% over the next decade.

It will likely always be a business that is expensive on historical valuation metrics, but as long as CEO Don Meij is at the helm, I’d be willing to buy a slice of Domino’s shares.

If you enjoyed these three share ideas, consider signing up for a free Rask account and accessing our full stock reports.