Buy-now-pay-later (BNPL) leader Afterpay Ltd (ASX: APT) is just one step away from being gobbled up within the Block

(formerly Square) ecosystem after shareholders voted overwhelmingly in favour of the takeover.

One step closer

Today, shareholders were asked to vote on the proposed acquisition of Afterpay by Block via a scheme of arrangement.

A scheme of arrangement is where the acquirer requires 75% of the takeover companies’ shareholders to vote in favour of the deal.

The original meeting was scheduled for last week. However, it was pushed back due to the Bank of Spain (BoS) failing to provide approval by the scheme date despite all other regulatory authorities giving it the green light.

With the BoS still yet to give an answer, Afterpay has gone ahead and got the vote out of the way.

The results were overwhelming in favour of the acquisition, with 99.95% of shareholders giving it the tick of approval.

Moreover, 95.34% of shareholders present at the meeting voted in for the takeover.

Waiting on the BoS

It’s almost comical that the final regulatory clearance Afterpay and Block are waiting for is the BoS, a market that is not core to either business.

Scheme approval will remain in place until April 14, providing plenty of time for the final tick of approval.

Afterpay has previously said it expects BoS approval by mid-January 2022.

Take the money and run

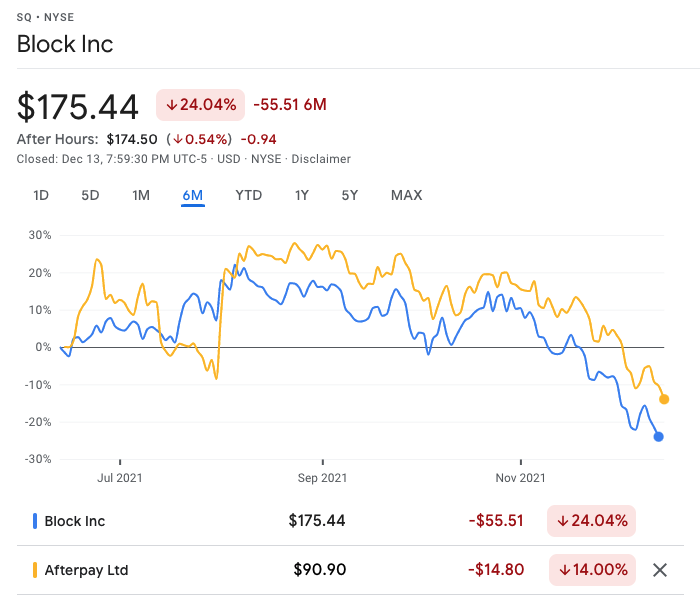

Since the announcement of the takeover in August, the Block and Afterpay share price has traded in tandem with one another.

However, the Afterpay share price is down 26% since the announcement was made, as the Block share price has fallen.

Recall that Afterpay shareholders will receive 3 shares in Block for every 8 shares in Afterpay.

Hence if the share price of Block falls, so does the implied valuation of Aftperpay.

Nevertheless, Afterpay shareholders have taken the money (shares in Square) and ran.

A bittersweet moment

While the BoS approval remains outstanding, it’s a bittersweet moment for Afterpay, its shareholders and investors on the ASX.

It’s been a phenomenal ride for the business, which has gone from a minnow to an ASX 20 company in less than four years.

Commenting at the end of the vote, Chairwoman Elana Rubin summarised Afterpay’s conclusion as a public company:

“…subject to receipt of approval by Bank of Spain, this meeting heralds the close of this chapter on Afterpay as a stand-alone company. But the innovation, customer centricity and the desire to empower an economy where everyone wins, will remain”

If you enjoyed this Afterpay update, consider signing up for a free Rask account and accessing our full BNPL report written by our superstar analyst Cathryn.