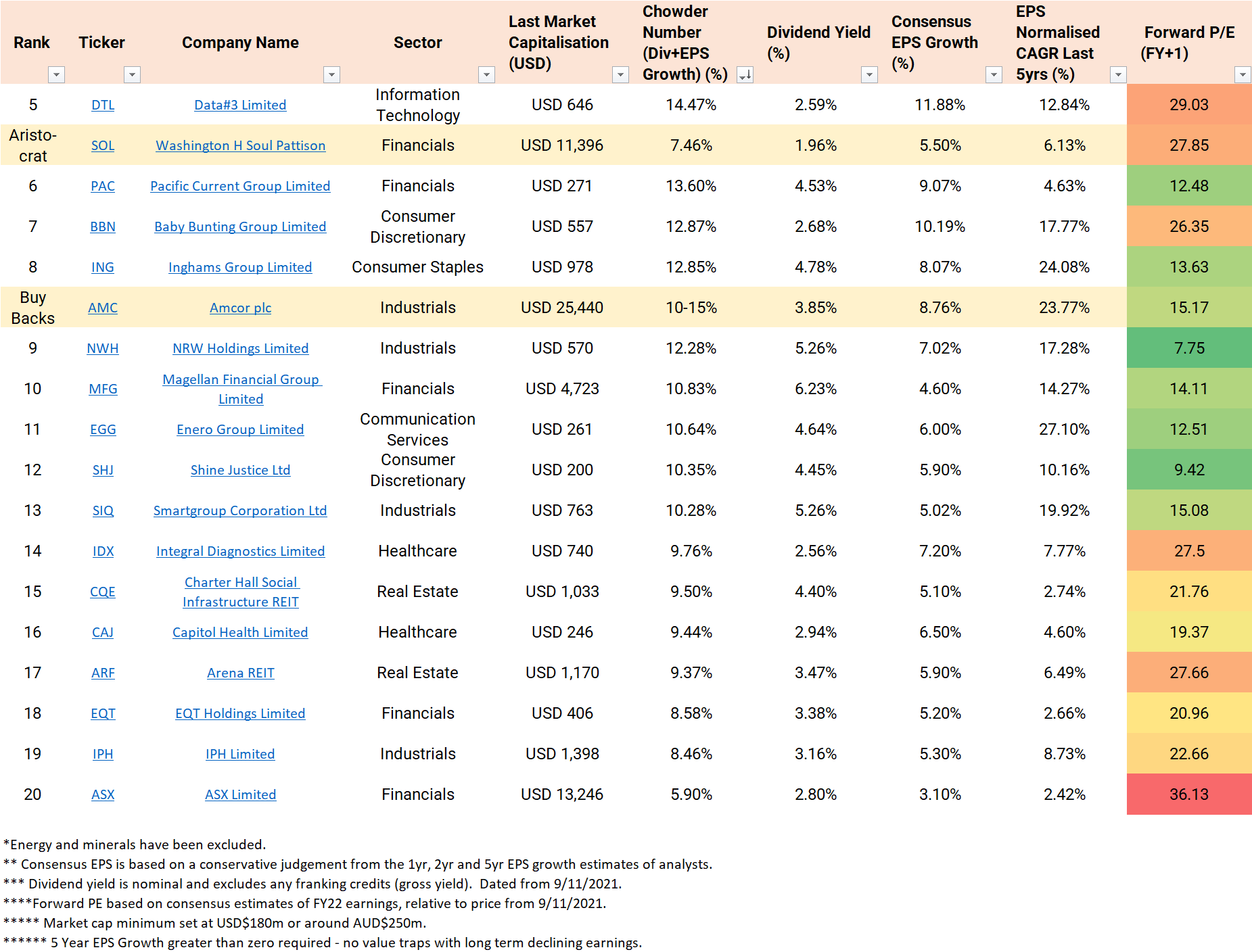

Data#3 Limited (ASX: DTL) has surfed the IT enterprise revolution for over 40 years to come in fifth on the Dividend Growth Investing list. Data#3 pays a respectable 2.59% fully franked dividend yield or 3.70% gross.

Over the past 5 years, Data#3 has generated 12.84% CAGR EPS Growth, and analysts forecast this will continue at 11.88% CAGR over the next five years. Data#3 kicks off the Top 5 with a stellar 14.47% Chowder Number.

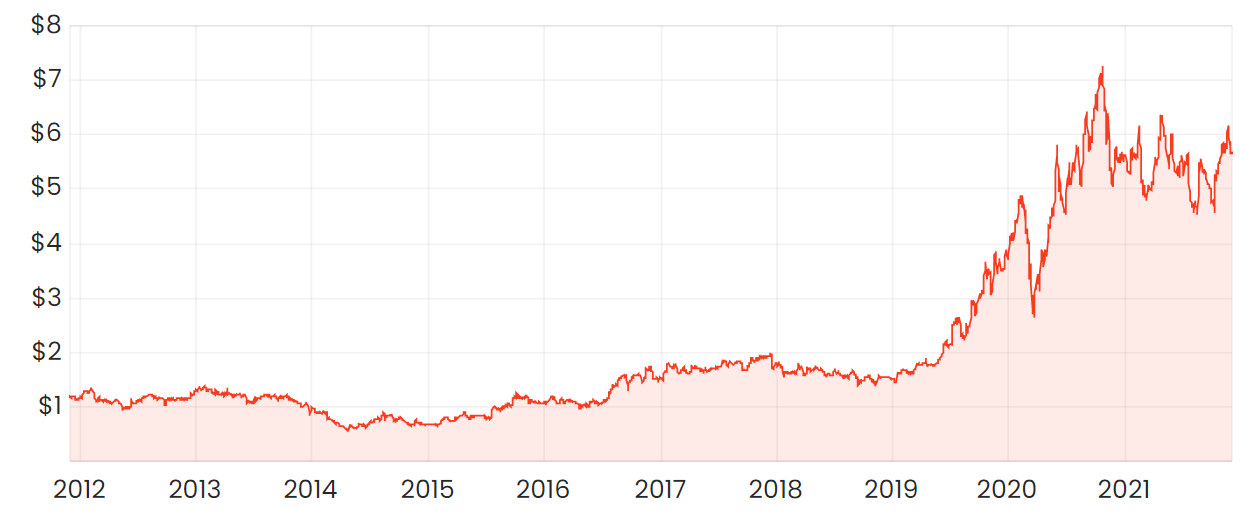

DTL share price

What does Data#3 do?

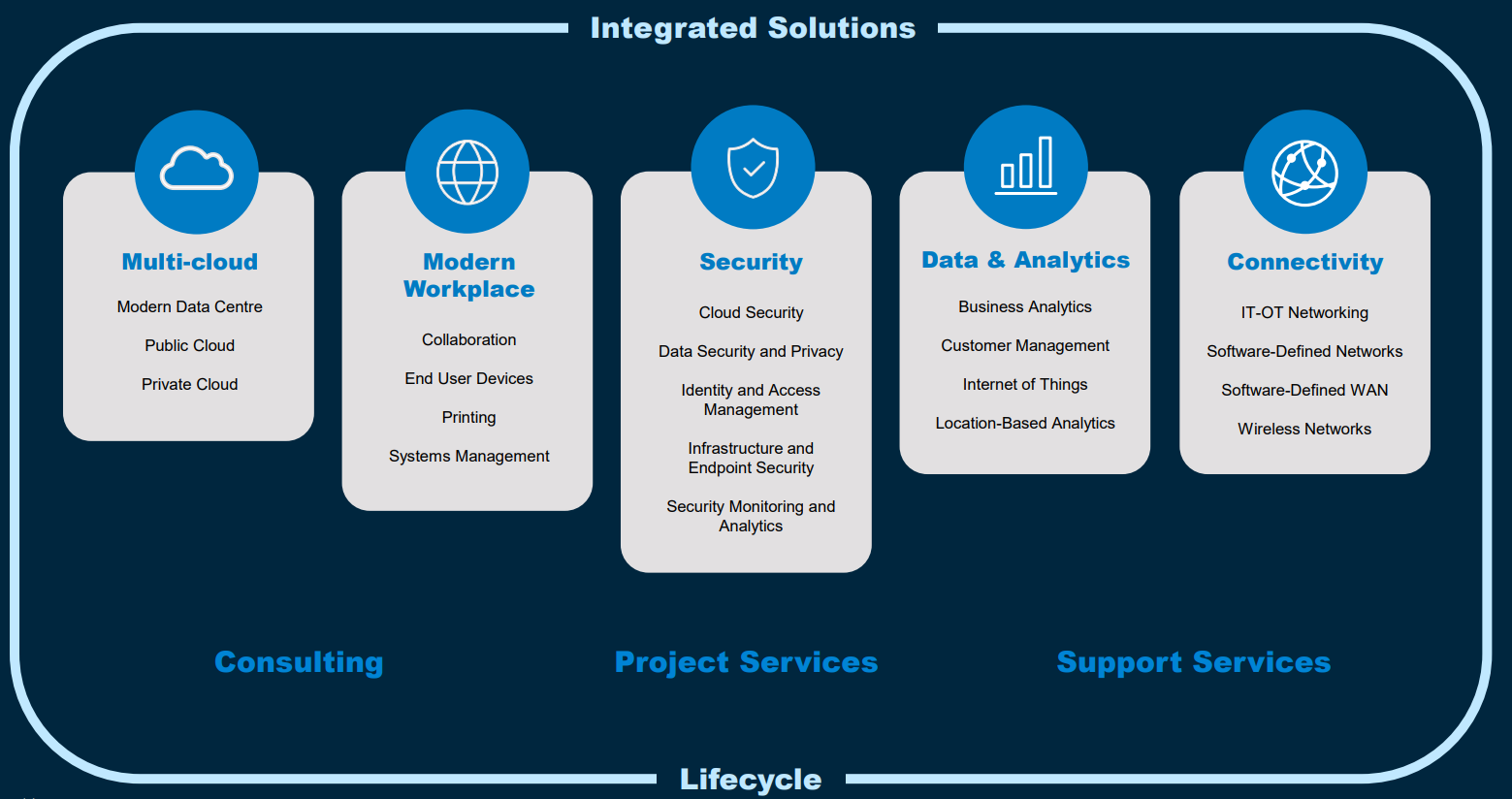

Data#3 is a Queensland-based software company, helping enterprises with most facets of their technology stack, implementations, IT needs, and security. It’s an IT services business, which was founded in 1977 and listed on the ASX 20 years later, in 1997. Data#3 has 1200 staff operating out of nine offices in Australia and Fiji.

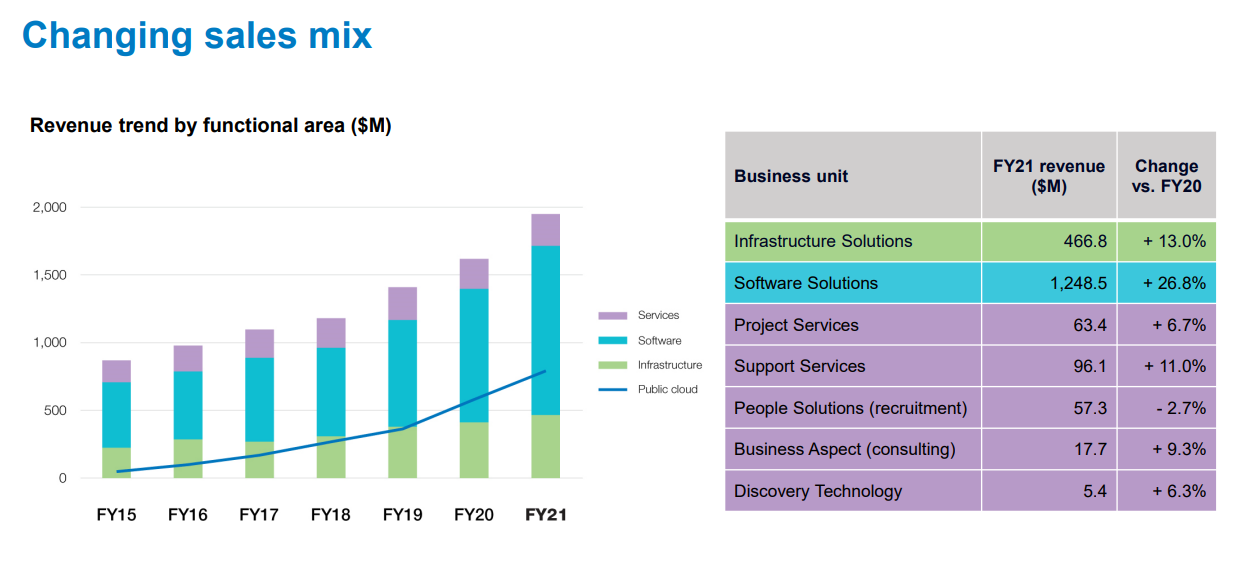

Data#3 has a very resilient customer base, with over 5,000 customers and 62% recurring revenue. They focus on large corporate enterprises and the public sector, particularly in health, education, and resource industries. They continue to expand their services, most recently into the cloud, which has been the main engine of growth since 2017 and now accounts for ~40% of revenue.

Data#3 has an extensive range of partnerships with technology providers. Notably, Microsoft (NASDAQ: MSFT) has been their mainstay for over 15 years, as well as Cisco (NASDAQ: CSCO), HP (NYSE: HPQ), and IBM (NYSE: IBM).

This is perhaps also their main risk. The partnerships are generally with legacy companies that have sticky products but are not best-in-class. Data#3 lacks partnerships with Amazon (NASDAQ: AMZN) AWS and Google (NASDAQ: GOOG) Cloud. Nor does Data#3 have exposure to the growing number of Asian technology companies, including the likes of Alibaba (NYSE: BABA) AliCloud.

Data#3’s dividends

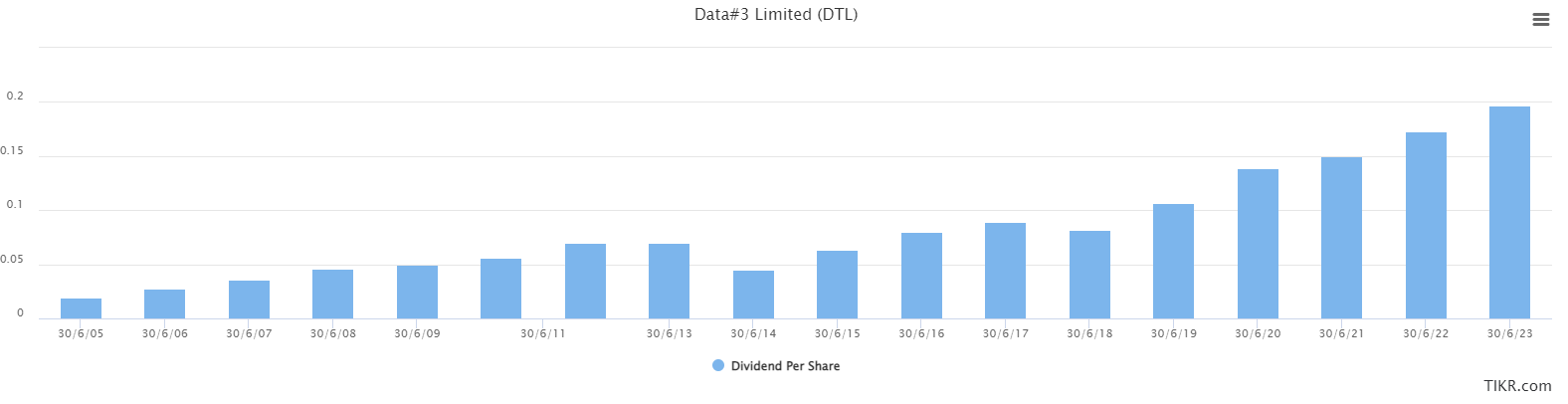

Data#3 has ridden the enterprise technology revolution, growing revenue 15.47% CAGR since 2005.

Similarly, dividends have been relatively consistently increasing over that time – though due to a slight reduction in 2018, their current streak is only 3 years.

Looking to forward returns

Patrick did a good write-up of their FY21 results, showing real growth in public cloud. The pullback in Australian IT spending in FY21 after a record FY20 was a headwind, and so is the current global chip shortage. However, looking forward, management and analysts believe there is a lot to be optimistic about.

While some analysts are forecasting up to 18% EPS CAGR over five years, I have been more conservative at 11.88%. This is the lowest forecast and is reflective of the company providing no guidance for FY22 and other short-term risks.

Valuation

The share price has tripled since Covid, and even though it’s flat since May 2020, it got ahead of itself. Data#3 is trading at a price to earnings of ~35x and forward PE of ~29x, well above the ~16x average since 2005. Similarly, they are about double the historical average for a price to sales, enterprise value to EBITDA or price to free cash flow.

Risks

Valuation is the main risk in the short term, with potential drawdowns of 50% back to their long-term average. In terms of business strategy, not having partnerships with the next generation of companies (excluding Microsoft) could become a risk of omission.

Final thoughts

Data#3 is an excellent company with a resilient customer base in a growing sector. The dividend is safe and will likely grow considerably from here. I’m keeping this on my watchlist.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.