The Afterpay Ltd (ASX: APT) share price sunk 6.08% today after announcing its takeover by Square Inc (NYSE: SQ) has been delayed while it waits for regulatory approvals.

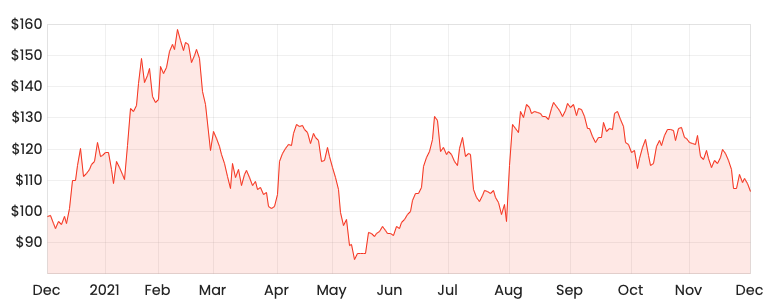

APT share price

Spain puts the brakes on takeover

Afterpay and Square are awaiting regulatory approval from the Bank of Spain.

The announcement did not provide any reasons for the delay, other than it is confident it will be approved.

This likely led to the sell off in the Afterpay share price, with the market pricing in the unlikely possibility it does not gain approval.

“Afterpay and Square are confident that the Bank of Spain condition will ultimately be satisfied”.

The bank has until February 21 to approve the deal, however, Afterpay expects the condition will be satisfied in mid-January.

As a result, the scheme of meeting scheduled for December 6 has been postponed until later this month.

Monday’s meeting will still formally go ahead, however, will be immediately adjourned until further notice.

Given its approaching holiday season in both North America and Australia, the meeting may be pushed back into the first quarter of 2022.

Positively, Afterpay noted that all other regulatory conditions have been approved.

Additionally, current Afterpay shareholders who wish to hold their shares and receive Squares shares will be granted capital-gains rollover relief from the Australian Tax Office.

This means no tax will be payable when the Afterpay shares become Square. Rather, the capital gains (or losses) will be recognised when the Square shares are sold.

Square changes name to Block

Also announced today is that Square will change its corporate name to Block.

The name change will differentiate Square, which represents the seller ecosystem, from the broader activities and divisions of the company.

Block has added several new divisions over the years including Cash App, Square Crypto now known as Spiral, music streaming service Tidal and developer platform TBD54566975.

https://twitter.com/blocks/status/1466154290137894912?s=20

“The name has many associated meanings for the company — building blocks, neighborhood blocks and their local businesses, communities coming together at block parties full of music, a blockchain, a section of code, and obstacles to overcome”.

Block’s name change is a result of a larger trend of companies renaming themselves to better illustrate the sprawling activities of mega-technology businesses.

For example, Facebook recently renamed itself to Meta to encompass its broader ambitions in the Metaverse.