The Ramsay Health Care Limited (ASX: RHC) share price has tumbled into the red today after the global private hospital network provide an FY22 trading update.

At the time of writing, the Ramsay share price is down 5.1% to $68.58.

Cost pressures weigh on profits

Key financial results from the first three months of FY22 include:

- Unaudited revenue up 1.3% to $3.2 billion

- Earnings before interest and tax (EBIT explained) down 27.8% to $197.4 million

- Net profit declined 39.5% to $58.1 million

Asia Pacific

Notwithstanding a 0.7% revenue decline, Asia Pacific was the standout performer with earnings increasing 5.3%.

Pandemic restrictions across New South Wales, Victoria and to a lesser extent in Queensland and Western Australia led to a reduction in elective surgery.

Additionally, COVID-19 costs remain elevated, adding $55 million in one-off expenses.

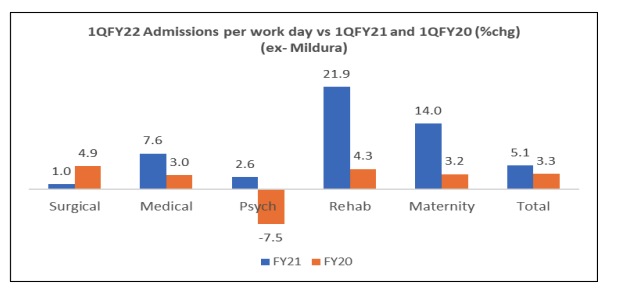

Despite the disruption, admissions remain largely above both FY21 and pre-pandemic FY20.

Into October, elective surgeries still remain interrupted. For example, in Greater Sydney, elective surgery is capped at 75%. Furthermore, Victoria has requested day surgery cap lists at 50%.

“The current state government timetables around lifting COVID related movement restrictions and border closures combined with the underlying demand for healthcare services should create a more favourable operating environment in 2HFY21”.

Across Asia, Ramsay benefitted from the provision of COVID-related services such as testing, vaccination and treatment. Subsequently, revenue increase by 15.4%.

United Kingdom

The United Kingdom achieved a 20.6% jump in revenue however recorded a loss over the quarter.

Isolation orders on staff and patients created enormous disruption and significant cancellations.

The business was unable to reduce staff costs in conjunction with cancellations, resulting in higher personnel expenses.

Management noted the admissions pipelines remain strong from private insurers and self-funded patients.

Positively, operating conditions have improved from the relaxation of isolation and COVID protocols over October.

Europe

Similar to the United Kingdom, Ramsay Europe saw profits fall 45.4% despite revenue growth.

The region benefitted from subsidies and a significant catch-up of volumes.

However, staff turnover and mandatory vaccinations have led to a shortage of nurses.

A fourth wave in France has impacted activity, while the Nordic regions are recovering well.

Cheap cash

Ramsay has cancelled two fixed-rate loans to take advantage of record-low interest rates.

The upfront cost is $11.3 million, however, Ramsay will receive $20.2 million in interest expense savings over the next four years.

My take

It’s not a surprise to see disruption among elective hospital networks such as Ramsay’s.

However, what is frustrating is that the business is seeing its costs blow out as a result of the onerous restrictions placed on hospitals.

The Ramsay share price was up 17% this year before today’s update. So today’s selling is likely just some profit-taking.

The long-term outlook for private hospitals remains positive, as populations age and household wealth rises.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.