The Ramsay Health Care Limited (ASX: RHC) share price has dipped slightly upon an update for Q3 FY21. The Ramsay share price has gone up and down since its HY21 results.

What’s happening with the Ramsay share price?

RHC share price

Ramsay Australia

Australian operations performed quite well as revenue increased by 4.6% for Q3 as total admissions ramped up over the same period.

It remained resilient in the face of reduced activity levels brought on by snap lockdowns across Australia. However, activity levels in Victoria continue to lag other states.

Overseas

Ramsay’s UK operations continue to recover as admissions for the nine months to 31 March 2021 are at around 83% of the prior corresponding period (PCP).

The continual relaxation of lockdown restrictions across the UK has resulted in a slight uptick in private and self-funded patients but still remain below the PCP.

The level of admissions for the European segment for Q3 was materially below the PCP due to restrictions imposed by the French Government on elective surgery.

As for the Nordic region, it has been adversely impacted by ongoing COVID cases.

My thoughts

It’s evident that admission levels are improving but at a slow rate and still remain below levels seen in the PCP.

This has contributed to an adverse impact on Ramsay’s earnings for Q3.

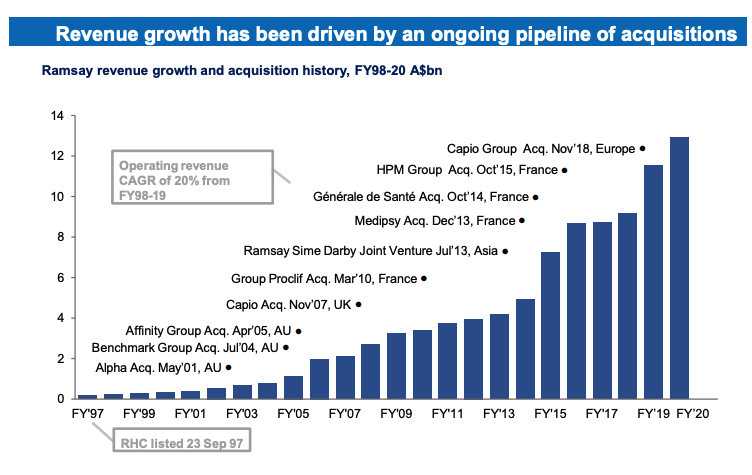

It’s interesting to note growth has been primarily driven by acquisitions as seen below.

Since FY13, both gross margins and operating margins have consistently declined.

Whilst I appreciate Ramsay is striving to gain market share overseas, investors should also consider whether this is a value-accretive strategy.

If you are interested in other ASX share ideas, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.