Shares in online bookmaker Pointsbet Holdings Limited (ASX: PBH) finished the day nearly 20% lower today after its Q1 FY22 results failed to impress some investors.

Since reaching over $17 per share at the start of the year, Pointsbet’s market valuation has more than halved.

For a full breakdown of the results, check out Lachlan Buur-Jensen’s article here: Here’s why the Pointsbet (ASX: PBH) share price plummeted 18% today.

Results recap

Turnover for the first quarter was $979.9 million, up 42% on the prior corresponding period (pcp) but slightly down from $986.1 million from Q4 FY21.

Net win (a proxy for revenue) came in at $69.5 million, up 82% on the pcp and 17% on last quarter.

Cash burn from operating activities was $38.1 million, down from outflows of $43 million from last quarter. As of 30 September, Pointsbet had a cash balance of $626.7 million with no debt.

Marketing spend was $46.5 million, which has exceeded the amount of gross profit generated throughout the quarter. However, here’s an interesting quote from CEO Sam Swanell from the earnings transcript:

“It should be noted that a large portion of our U.S. marketing budget for the quarter is focused on audiences outside of our current seven live states. As I stated previously, whether it be for states that are future imminent launches or more national brand awareness, we continue to focus on building a brand and a database to assist in future acquisition efficiency”

So, Pointsbet is effectively putting money towards states that aren’t making any money at the moment. This would partly describe why it’s not seeing a large uptick in sales in line with the increased marketing spend.

Market share decreases

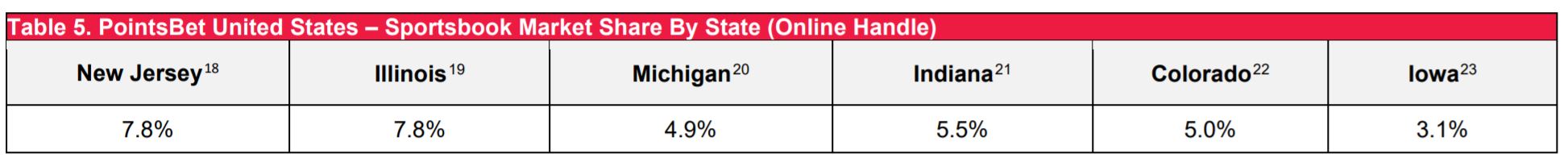

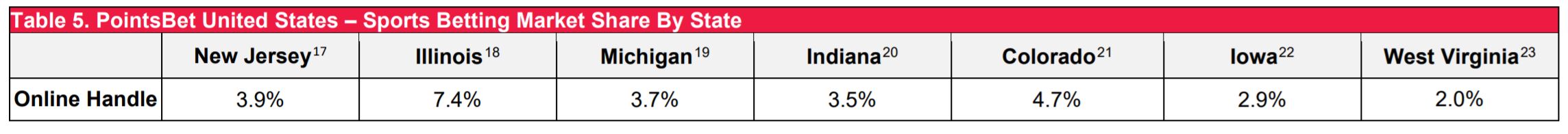

Perhaps what also contributed to the sell-off were the numbers around Pointsbet’s market share in the US. The first image below shows Pointsbet’s market share in the previous quarter (Q4 FY21). The second image shows the most recent quarter (Q1 FY22). As you can see, Pointsbet’s market share has decreased in every US state that it’s currently live in.

Q4 FY21 market share

Q1 FY22 market share

New Jersey had a particularly high net win margin across the quarter, in other words, wagerers placed more losing bets. As such, it seems reasonable that turnover would compress like it has. Management also noted that promotional activity around the NFL contributed to the fall in market share. It seems normal that many bettors would only place bets when promotions are running.

My take

$38.1 million in quarterly cash burn is clearly not ideal, but perhaps a 20% drop in the share price was excessive. Shares are now trading around their issue price from the capital raising last year.

If you take the view that Pointsbet will one day have a much larger share of the US market, today’s quarterly doesn’t seem too bad.

For some more share ideas, click here to read: 2 fast-growing ASX software shares for your watchlist.