On Wednesday, the Commonwealth Bank of Australia (ASX: CBA) hosted its Annual General Meeting (AGM) with shareholders.

Both Chairwoman Catherine Livingstone AO and Chief Executive Matt Comyn addressed the audience.

Here are three notable points for shareholders to keep in mind from the prepared remarks.

1. Happy wife (workers), happy life

One set of statistics from the AGM stood out. Of the 42,000 people employed at CBA:

- 80% of employees feel engaged

- 89% of employees are proud to work for the bank

- 92% of employees feel their manager cares about their wellbeing

In comparison, Bank of Queensland Limited (ASX: BOQ) revealed this week its employee engagement is 64%.

It would be irresponsible to infer too much for three cherry-picked survey results, but it may go some way to explaining why CBA outperforms its peer group.

2. More than just a bank

The line “more than just bank” gets thrown around pretty loosely.

But CBA looks to be genuinely making progress towards becoming its customer’s financial hub.

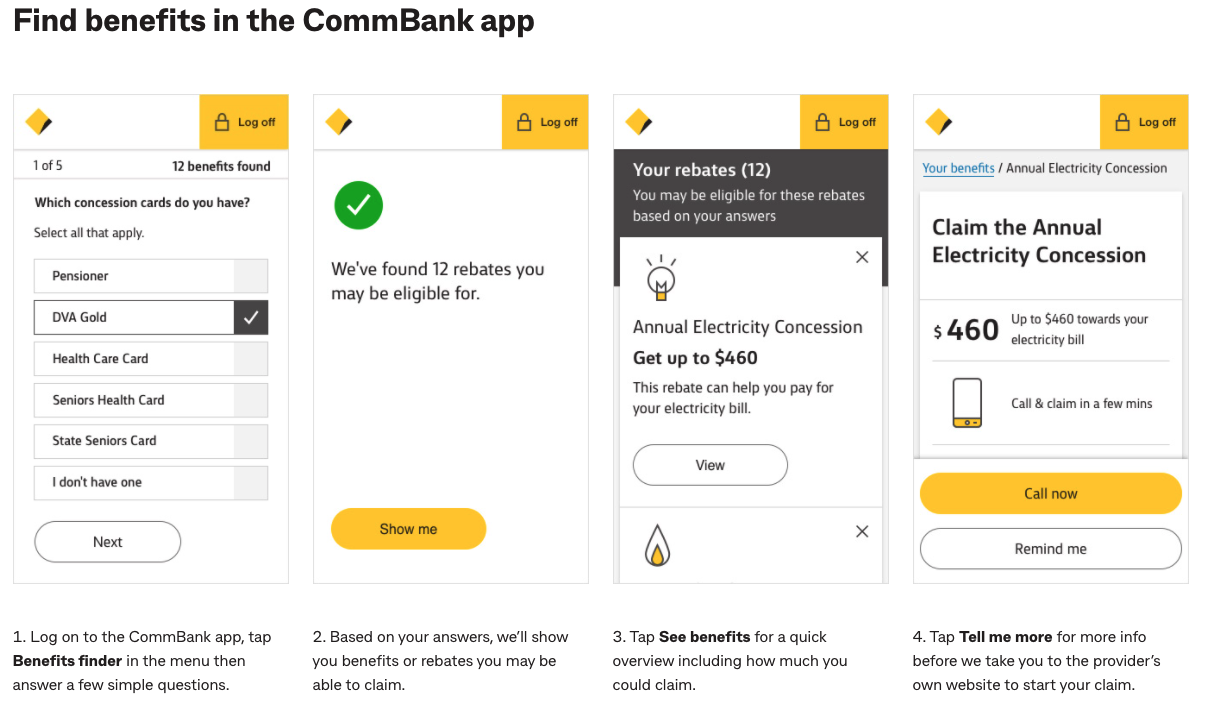

Its benefits finder helps households and businesses find potential rebates and concessions. For example, it will advise you if you’re eligible for a Health Card or electricity rebates.

It’s enabling the movement to renewable energy through Green Loans, allowing eligible home loan customers to buy and install eligible clean energy products such as solar panels, battery packs and solar hot water systems.

Partnerships with More Telecom, Amber and Little Birdie allow customers to find better utility rates. Additionally, the Bill Sense feature assists with budgeting by helping customers predict and plan for upcoming bills.

3. Not quite there yet

Ms Livingstone outlined the progress made over the past three years by the bank’s Remedial Action Plan (RAP).

RAP was the result of misdoing found by APRA’s 2018 Prudential Inquiry into CBA’s governance, culture and accountability.

The report identified amongst other things “inadequate oversight and challenge by the Board”, “lack of ownership of key risks at the Executive Committee level” and an “operational risk management framework that worked better on paper than in practice”.

“CBA’s continued financial success dulled the senses of the institution” – Prudential Inquiry into the Commonwealth Bank of Australia Final Report

Ms Livingstone recognised that sustaining the gains of the past three years would require a “permanent commitment by the Bank at all levels”.

However, it looks like those improvements were short-lived.

The day before the AGM APRA alleged the bank knowingly underpaid 7,000 staff to the tune of $16.4 million.

For all its improvements, CBA still has work to do. Possibly, the remaining 20% of employees would feel more engaged if they were remunerated properly?