With Sydney Airport Holdings Pty Ltd (ASX: SYD) shares hovering around $8.28 after a third takeover offer, it’s time to weigh up your options.

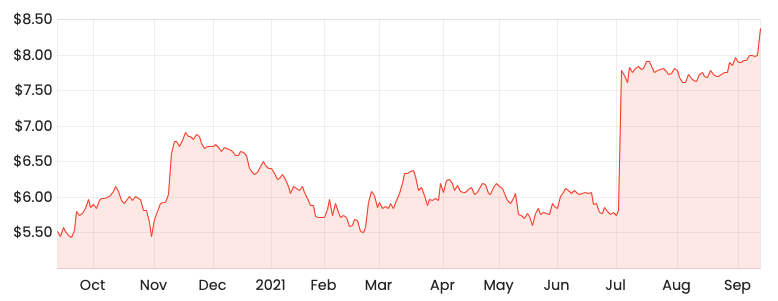

SYD share price

What’s been going with the Sydney Airport share price?

Sydney Airport has received three takeover offers from a consortium including IFM Investors, QSuper and Global Infrastructure Management – known as Sydney Aviation Alliance.

The initial offer made in July valued shares at $8.25 or $30 billion, a 43% premium to its last closing price. Subsequently, shares rocketed 34% on the news, however, the Sydney Airport board promptly rejected the offer, citing that it undervalued the business.

A month later, Sydney Aviation came back with an $8.45 proposal. Again, the Sydney Airport board sent them packing.

Third time lucky? You bet.

The consortium delivered an $8.75 offer on Monday valuing the company at $32 billion. With the Sydney Airport board extracting an extra $2 billion for shareholders and a 51% premium to the closing price pre-proposal, the company granted due diligence to the consortium.

Pending an independent report approving the takeover and a binding offer by the alliance, the Sydney Airport board will unanimously recommend the takeover. As a result, shares jumped by 5% to $8.40 on Monday.

What happens if the deal doesn’t go through?

The alliance now has four weeks to comb through the Sydney Airport accounts for red flags. If any are found, the offer may be reduced or entirely scrapped.

In both cases, Sydney Airport shares would continue trading on the market and shareholders would still own shares.

However, the share price would likely fall as the indicative offer no longer stands.

What happens if I hold onto my shares?

Assuming the deal goes through, Sydney Airport shareholders would receive $8.75 minus any distributions received.

There is no set timeline on when the deal could possibly be finalised. However, given it is such a large transaction, it will likely take months to complete all the necessary approvals.

Why should I hold Sydney Airport shares?

With Sydney Airport now granting due diligence, management has effectively conceded it will recommend the bid.

Therefore at today’s current price of $8.24, the deal would return 10.6%.

Assuming it takes no more than a year to complete the deal, 10.6% is an annual decent return.

However, if you think you can earn a better return elsewhere or want to eliminate the risk of the transaction failing, selling shares would be a good option.

Personally, I’d hold the shares. 10% is a great return for sitting on your hands and doing nothing for a few months.

Even if the offer is redacted, at least you know there is institutional interest around the $8 mark for the airport. Plus, you get to keep owning a fantastic monopoly asset.