The Sydney Airport Holdings Pty Ltd (ASX: SYD) share price is under the spotlight after another takeover offer has been rejected.

The takeover offer

Sydney Airport said that it had received a revised offer from the Sydney Aviation Alliance (the Consortium). The offer amount is $8.45 per share.

The offer is the second offer Sydney airport has received from the Consortium. The first offer was made in early July at $8.25 per share.

The Consortium is a group of infrastructure investors including IFM Investors and QSuper. In this latest offer AustralianSuper has joined the group of buyers.

Sydney Airport says no again

The Sydney Airport Board have unanimously decided that the revised offer undervalues the business and is not in the best interest of shareholders.

The Board said that the current challenges don’t change the long term value of Sydney Airport. Noting that vaccination rates in Australia are rapidly increasing and the government plans to lift restrictions as vaccination targets are met, which will see a re-opening of travel.

The Board said that the offer is “opportunistic in light of the COVID-19 pandemic”. However, it also said that it is open to engaging in discussions again if the Consortium are willing to lift the offer to “appropriately recognise long term value”.

Sydney Airport’s strengths

Management said that it has strengthened Sydney Airport’s balance sheet and tightly managed costs to maintain flexibility.

When making the decision the Board looked at multiple factors including the importance of Sydney Airport as one of Australia’s most important infrastructure assets, average shareholder returns, diversity of earnings and the significant value in land assets.

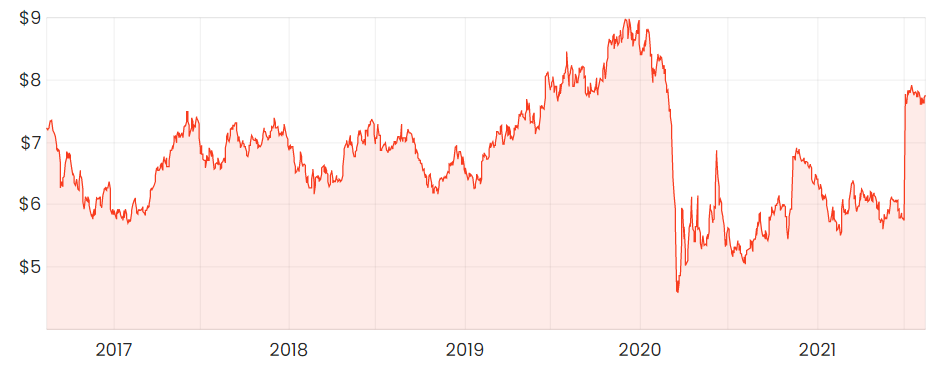

Sydney Airport share price graph

Final thoughts on the Sydney Airport share price

The Sydney Airport share price has only briefly been above the offer price of $8.45 for a short amount of time. Once when the share price hit $8.46 on 2 August 2019 and fell lower immediately after.

The second time it achieved above $8.45 was a four month period. It hit a share price of $8.63 on 25 October 2019, rising to an all time high of $8.97 on 6 December 2019 and remaining high until mid January 2019 until it dropped down again on 31 January 2020.

Looking at today, the share price dropped down 1.3% in early reaction. At the time of writing the share price is sitting virtually flat.

It’ll be interesting to see if the Consortium come back with yet another offer. I think the offer was quite reasonable. There is no knowing if, or when, the Sydney Airport share price might reach higher than $8.45.

I am not a buyer of Sydney Airport with the continued uncertainty and the fact that the offers have largely been priced in. If I were a shareholder I would be weighing up whether I think the Consortium will make another offer, if it doesn’t now might be the time to redeploy into more productive shares.