Shares in Southeast Asian buy-now-pay-later (BNPL) IOUpay Ltd (ASX: IOU) came out of their trading halt today on the news of an acquisition.

The market initially reacted positively, with shares up 20% in the first few hours of trading. The excitement quickly wore off, however, with IOU’s shares finishing the day 3.2% in the red.

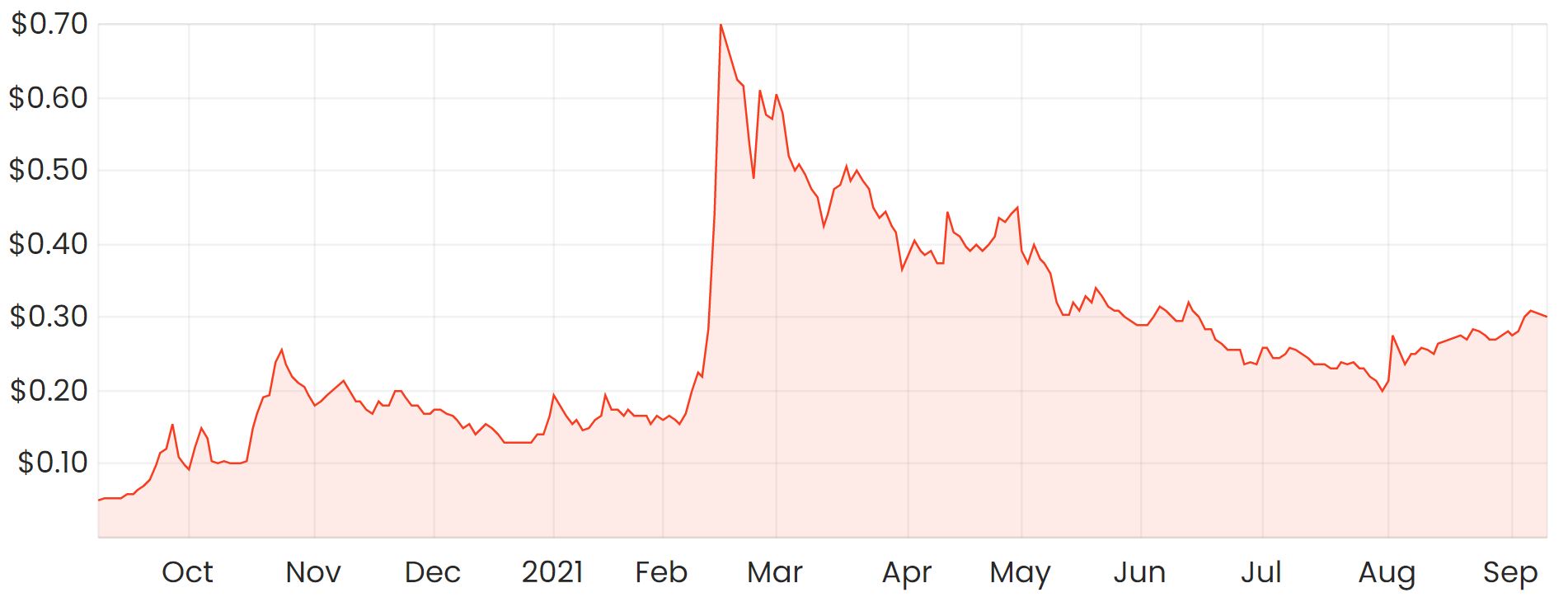

Taking a look over the past year, IOU’s shareholders have been on a rollercoaster ride, with IOU’s share reaching a peak of 85 cents back in February.

Acquisition details

IOU told the market today that it will be acquiring a 42% stake in IDSB, a leading Malaysian provider of long-term installment-based consumer credit services.

The deal is valued at around $41.3 million, which will be paid in two tranches over a six-month period.

IOU will be gaining access to IDSB’s 37,573 customers with a loan book worth $850 million. IDSB generates revenue through upfront transaction fees and ongoing fees, based on the number and value of loans originated and serviced by IDSB.

Not much colour was provided around the financials of IDSB. However, it did note that the purchase price might be lowered if IDSB’s profit before tax comes in less than $9.8 million in FY21. One could speculate this implies that IDSB generates around $10 million of pre-tax profits per year, meaning IOU’s share will be around $4.2 million of pre-tax profits.

IDSB holds a unique AG code licence (1 of only 2 in Malaysia), which allows it to deduct installment payment obligations for government employees that have their salaries processed by the Malaysian Government civil servant payroll agency, ANGKASA.

My take

Only time will tell if the transaction adds value to IOU and its shareholders. With little information provided into IDSB’s financials, I find it hard to assess the value of the transaction and how it could affect the future outlook for IOU.

IOU’s management took advantage of its high share price and raised $50 million to accelerate growth in BNPL opportunities. Now, $40 million is being spent on buying a non-controlling stake in a 40-year-old finance company that might or might not be growing.

The idea is that IOU and IDSB will cross-sell their products to each other’s customers. But again, only time will tell how this plays out.

The growth story behind IOU has always been about the BNPL opportunities. I find it somewhat odd that it’s focusing its attention on a traditional finance company rather than enhancing its own BNPL platform, for example.