The Betmakers Technology Group Ltd (ASX: BET) share price shot up 6% after releasing its FY21 results this morning. Will the Betmakers share price gallop ahead?

The sharp drop in the Betmakers share price in May was due to an attempt to acquire Tabcorp Holdings Limited (ASX: TAH).

However, the unsuccessful attempt has led to a bounce back in the Betmakers share price.

BET share price

FY21 results

Here is a snapshot of the key highlights from the FY21 results:

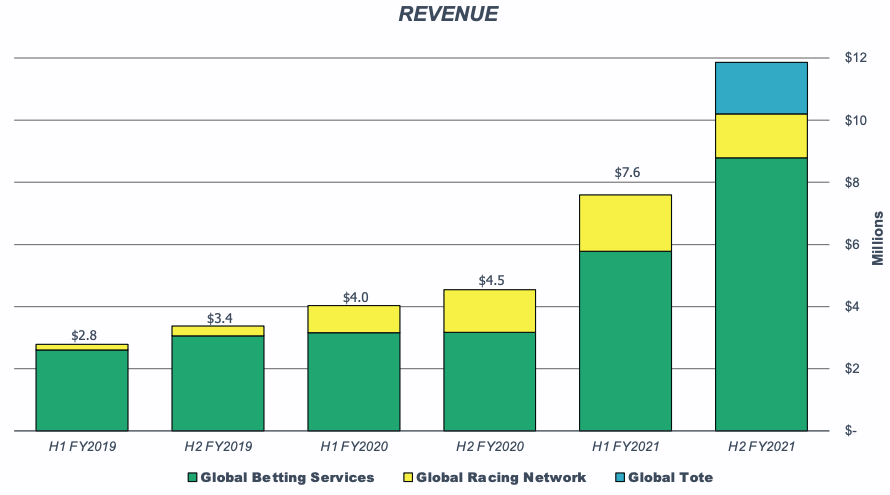

- Revenue shot up 127% to $19.5 million relative to FY20

- Gross margins fell to 52% from 74% (FY20)

- Net loss after tax widened by 716% to -$17.46 million from -$2.14 million (FY20)

- Diluted earnings per share went backwards to -2.59 cents per share to -0.47 cents per share (FY20)

- Net operating cash flow dropped to -$2.02 million from -$0.5 million (FY20)

The Betmakers top line continues to gain momentum with the recent Sportech acquisition contributing around $2 million in the first fortnight after completion.

Expansion of the Platform and MTS Services clients along with the international content offering drove higher revenue growth.

The top line looks flash but the bottom line, not so much.

The big expansion in the net loss was primarily caused by a significant increase in employee benefits expenses, share-based payments and other expenses.

Employee benefits expenses rose by 122% compared to FY20.

After an incredible performance in the Betmakers share price, employees cashed in on their options as 38.69 million shares in the form of options were exercised. As a result, the share-based payments stormed from $0.88 million in FY20 to $12.36 million in FY21.

In terms of other expenses, this lifted as a result of administrative costs of $2.8 million associated with the Sportech acquisition.

Is it time to giddy up?

Management is excited about the future, particularly after New Jersey became the first U.S state to legalise fixed odds betting on horse racing.

And I understand why because there could be a domino effect where a lot of other U.S states present more opportunities for Betmakers.

The strong optimism in the Betmakers share price lies in the growing total addressable market ahead.

Betmakers seems to be in a sound position with its core segments remaining resilient through the pandemic and growing optionality.

If you take out one-off expenses like share-based payments and the lift in the acquisition costs, the total net loss actually ends up being similar to FY20.

So, Betmakers needs to maintain expenses and keep driving revenue higher to scale successfully.

This company is outside of my circle of competence and ethical paradigm, so I’ll be watching this one from the sidelines.

If you want to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.