The Betmakers Technology Group Ltd (ASX: BET) share price is charging ahead and is up over 9% after the first U.S state legalises fixed odds horse race betting.

New Jersey legalises fixed odds horse race betting

New Jersey has become the first U.S state to legalise fixed odds betting on horse racing.

On 21 June 2021 New Jersey government voted in favour to make fixed odd betting on horse racing legal. This has now been signed by the Governor of New Jersey to become law.

The U.S lobbyist, Bill Pascrell, from Princeton Public Affairs representing Betmakers said that he expects other U.S states to follow suit with legalising fixed odds betting on horse racing. Betmakers, with the assistance of Princeton Public Affairs, is continuing to work towards discussions across the U.S.

What does this mean for Betmakers?

Betmakers said that it has an exclusive 10 year fixed odds agreement on thoroughbred horse racing in New Jersey with the operator of Monmouth Park racetrack.

The company believe that the legalisation of fixed odds betting on horse racing in New Jersey and the Betmakers recent acquisition of Sportech will accelerate its expansion in the U.S.

Management comments

Betmakers CEO Todd Buckingham said: “Legalised fixed odds betting on horse racing in the U.S has been a pillar of Betmakers’ stategic vision and today’s announcement enables the company to press forward with the roll-out of fixed odds betting in New Jersey while also setting a precedent legal framework that is relevant for our discussions with other states in the U.S.

“… Horse racing in the U.S has the potential to significantly benefit in the current environment of sport betting and Betmakers is now at the forefront of this opportunity.”

Betmakers share price

Final thoughts on Betmakers and the share price

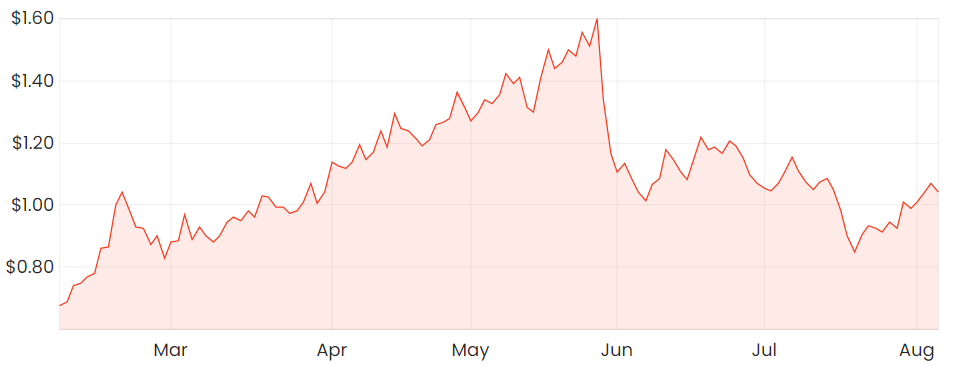

Management are delighted that its plans are coming to fruition. The market seems to be in agreement, with the share price up over 9% at the time of writing.

The Betmakers share price has had quite a journey over the last six months, it was $0.68 at 5 February 2021, climbing up by a staggering 135% in less than four months to $1.60 on 27 May 2021.

It fell sharply after announcing that it was attempting to acquire Tabcorp Holdings Limited‘s (ASX: TAH) wagering and media business for $4 billion. Maybe the sell off was a little harsh considering that the Tabcorp offer hasn’t resulted in anything.

I’m glad for Betmakers shareholders that the company is recovering some lost ground in the share price. I’m looking for other ASX growth shares and this is one of my favourite places to start looking for ideas.