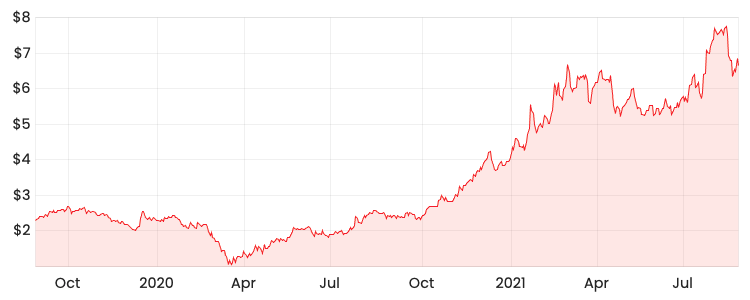

The Lynas Rare Earths Ltd (ASX: LYC) share price has been on a strong run of late. Could the Lynas share price run wild on the back of today’s strong set of FY21 results?

Lynas is a ‘rare earths’ minerals producer, used as inputs to create electronic devices e.g. mobile phones.

LYC share price

FY21 results

Lynas’ FY21 was an absolute bumper of a year. Here are the highlights.

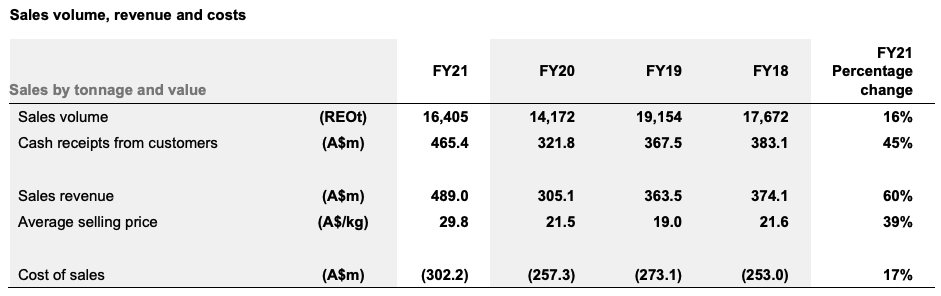

- Revenue rose by 60% to $489 million on the back of a record June quarter

- Earnings before interest, taxation, depreciation and amortisation (EBITDA explained) lifted 292% to $235.3 million

- Net profit after tax spun from -$19 million (FY20) to $157.1 million

- Net operating cash flow jumped from $32 million (FY20) to $215 million

- Free cash flow for FY21 was $174 million

The strong rise in revenue was a result of a deadly combination of high demand and favourable market conditions resulting in rising prices.

As you can see, the average selling price reached unprecedented highs.

For example, the China domestic price of NdPr (a Lynas product) nearly doubled from US$36kg in June 2020 to US$64.7/kg in June 2021. Lynas noted this trend continues to depend on the end product demand, in particular the automotive industry.

This makes sense, the pandemic has ramped up demand for auto vehicles as people replaced overseas trips with domestic adventures. Also, the risk of travelling on public transport enhanced the proposition of using a car instead.

And Lynas impressively controlled costs to a reasonable level, resulting in expanded margins.

Whilst Lynas holds a strong balance sheet with $680 million in cash, $425 million relates to a recent equity raising to upgrade its existing processing plants.

Scissor, paper, rock – who wins?

Remember that episode in the Simpsons where Bart thinks ‘rock’ always wins?

Well, rock definitely dominated this year but investors should be mindful that this has not always been the case.

The average selling prices of Lynas’ products from FY18 to FY20 show demand can go up and down at any time.

I think the pandemic induced demand for automotive will likely taper off over the next few years as the world returns to a pre-COVID environment.

In any event, if you plan on carrying out a valuation, it’s important to consider what Lynas’ earnings are like in normal market conditions.

If you want to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.