The PolyNovo Ltd (ASX: PNV) share price struggled today, falling more than 4% as investors got their hands on the company’s FY21 results.

Polynovo is an Australian medical device company that designs, develops, and manufactures dermal regeneration solutions using its patented NovoSorb biodegradable polymer technology.

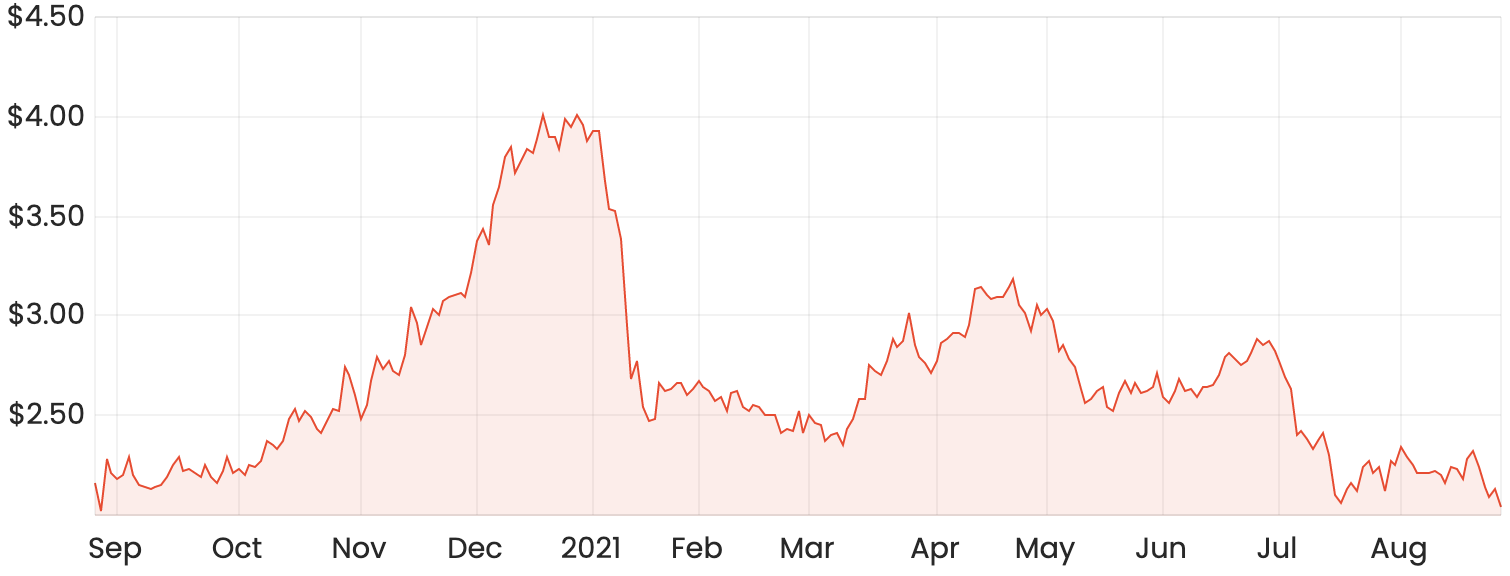

PolyNovo rose to ASX fame in 2019 but has struggled so far this year. The PolyNovo share price closed just above $2 today, meaning shares are down nearly 50% year to date.

PolyNovo share price chart

NovoSorb sales race higher

In FY21, PolyNovo grew its NovoSorb sales by 34% to US$25.5 million with US sales growing at a faster clip, up 49% to US$15.5 million.

The company experienced momentum throughout the year, with second-half NovoSorb sales in the US outpacing the first half by 38% or US$2.5 million. In fact, Q3 and Q4 were both record quarters, with Q4 coming in just shy of all 2019 sales.

Closer to home, the company grew NovoSorb revenue in Australia by 25% and volume by 35% compared to the prior year. The volume increase reflects penetration into smaller wounds/elective procedures.

In the UK, PolyNovo achieved NovoSorb sales in 23 NHS trusts, with these sales predominantly in elective and trauma. The company has its sights set on an expansion into burns in FY22.

PolyNovo zeroes in on breakeven

PolyNovo’s operating expenses increased by 26% to US$27.3 million, reflecting continued investment in growth as the headcount increased from 78 to 106.

Excluding non-cash items, PolyNovo’s net loss after tax narrowed to $259,000. This compares to a loss of $1.2 million in the prior year. But on a statutory basis, the net loss slightly increased year-on-year to $4.5 million.

The company finished the year with $7.7 million cash on its books and $7.6 million in debt. PolyNovo hovered around operating cash flow breakeven for the year, but free cash outflows amounted to roughly $3.8 million.

Distributor markets

In its distributor markets, PolyNovo highlighted strong performances in Germany, Austria, Switzerland, Belgium, Netherlands, Finland, Norway and Denmark.

The company experienced 53% growth in distributor sales compared to the prior year, benefitting from peer to peer referrals through webinars and conference presentations.

PolyNovo added seven new distributors covering nine markets in FY21.

Looking ahead, PolyNovo’s Belgium-based distribution centre is set to come online in September 2021. The company is also working on entry into France, Portugal and Spain for FY22.

New products

PolyNovo’s Syntrel hernia product continues to progress, with the final fully commercial versions of the product manufactured and a large animal study underway.

The company has manufactured 1,300+ devices in various SKU sizes for the validation processes and testing programs.

As for its Synpath chronic wound product, the reimbursement study is still in progress. The first 10 patients with diabetic foot ulcers have healed. The next phase will recruit 100 patients, and the company is eyeing off a launch in late 2023 to early 2024.

Now what?

Moving into FY22, PolyNovo said it will continue to reinvest cash flows to expand its market share in existing markets, enter new markets, and develop new products.

The company is targeting aggressive revenue growth through the expansion of its sales team, geographic expansion and targeted marketing programs. R&D resources will also continue to expand to concurrently develop multiple new NovoSorb devices.

PolyNovo is going through a period of rapid growth, but it’s a company that may fall outside of many investors’ circle of competence.

Other big ASX reports that hit the market today include Appen Limited (ASX: APX), Qantas Airways Limited (ASX: QAN) and Woolworths Group Ltd

(ASX: WOW). Check out Rask Media’s ASX reporting season calendar

to find links to the relevant news coverage and analysis.