The IOOF Holdings Limited (ASX: IFL) share price took a tumble today, ending the day more than 10% lower as the market reacted to the company’s full-year FY21 results.

IOOF shares have been known as an underperformer in recent years. But even after today’s fall, the IOOF share price has still gained nearly 30% over the last year.

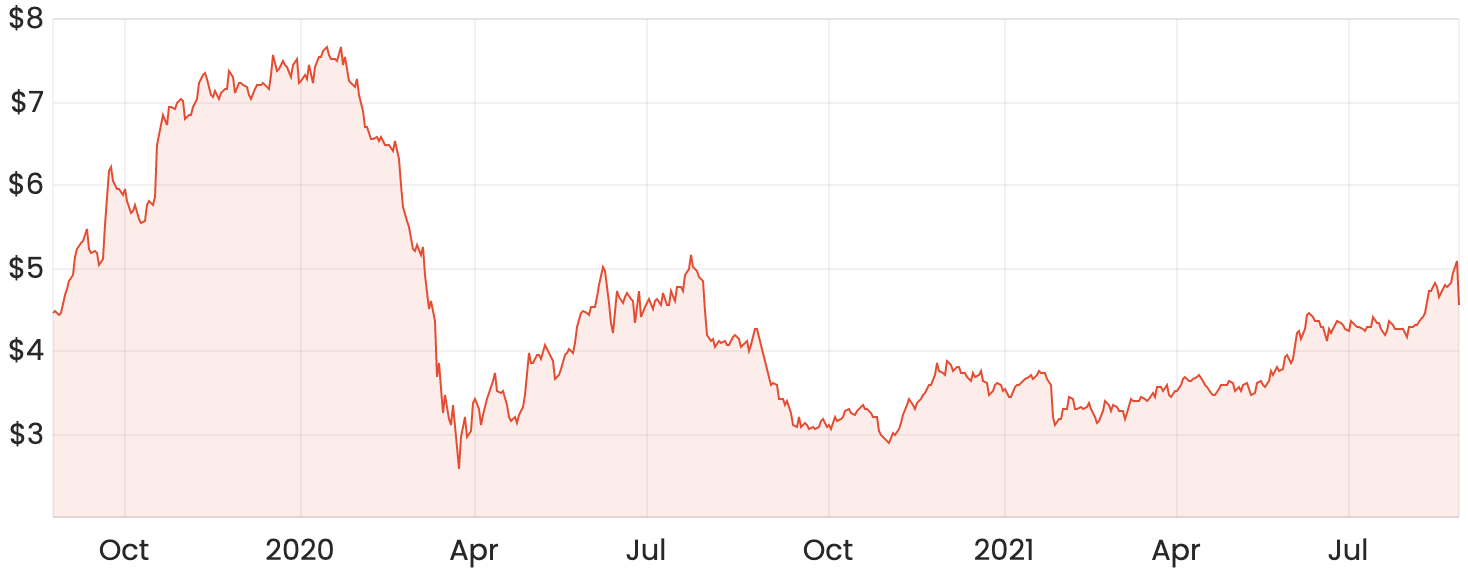

IOOF share price chart

How did IOOF perform in FY21?

IOOF delivered revenue growth in FY21, boosted by acquisitions. Revenue came in at $770 million, up 31%, which includes a full 12-month contribution from ANZ’s Pensions & Investments (P&I) business and a one-month contribution from the MLC acquisition.

Management noted that the company achieved organic revenue growth through higher Funds Under Management and Administration (FUMA) balances, driven by positive equity market growth. This was partially offset by a reduction in the gross margin from 0.40% to 0.37% and the cessation of BT’s open architecture contract.

Excluding MLC, FUMA finished the financial year at $152.2 billion, up 15% from $131.8 billion in the prior year. Adding in the contribution from MLC, FUMA closed at $453.4 billion.

IOOF’s expenses stepped up during the year, increasing by 37% to $526.5 million. But in the investor presentation, the company highlighted disciplined cost management through FY21, with contribution from in-year cost synergies from P&I integration activities of $16.0 million.

Moving down the income statement to the bottom line, IOOF turned in a statutory loss after tax of $143.5 million. This includes a non-cash impairment of $200 million, as flagged in a recent trading update, and integration expenses associated with P&I and MLC acquisitions. Underlying net profit after tax (NPAT) came in at $147.8 million.

In terms of IOOF’s financial strength, the company had pro-forma cash and available undrawn facilities of $890 million as at 30 June 2021. Senior debt facilities of $476 million were drawn.

IOOF’s dividend

Despite reporting a statutory loss, IOOF still declared a final dividend, albeit at a lower level than prior periods. The final ordinary dividend was 9.5 cents per share along with a special dividend of 2 cents per share. This takes total FY21 dividends to 23 cents per share, consisting of an ordinary dividend of 17.5 cents and a special dividend of 5.5 cents.

Just taking the full-year ordinary dividends, this puts IOOF shares on a dividend yield of 3.8%.

FY22 outlook

Looking ahead, IOOF CEO Renato Mota said:

“Through the transformation of our business, we expect to deliver synergy benefits during FY22 and beyond. We continue to deliver on a programme that sees us build leading capabilities in our products and services and to focus on delivering better outcomes for clients, members and shareholders.”

Mr Mota added that there were clear and achievable priorities for the next financial year, including:

- Completion of the Evolve21 migration and decommissioning of the Orion platform.

- Completion of the product and platform review, and progress on decommissioning additional legacy platforms.

- Substantial improvement in financial performance of the advice business by leveraging technology and capabilities across the advice business, and increasing revenue and cost efficiencies.

- Taking advantage of the expanded range and capabilities of the asset management business.

- Substantial further progress in the settlement of the remediation provisions.

- Delivery of annualised run-rate synergies of $80-$100 million.

The IOOF share price actually opened higher today before drifting lower throughout the day. It was a busy day for ASX reports, with the likes of a2 Milk Company Ltd (ASX: A2M) – down 11.8%, Appen Limited (ASX: APX) – down 21.4% and Blackmores Ltd (ASX: BKL) – up 15.4% all releasing results.

To keep up to date, make sure to bookmark Rask Media’s ASX 200 reporting season calendar.