Telecommunications infrastructure builder Uniti Group Ltd (ASX: UWL) share price has jumped 9.67% to $4.31 after the company announced a stellar FY21 result.

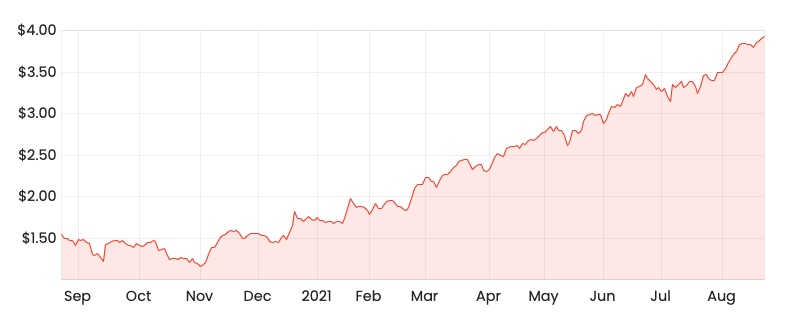

UWL share price

Who is Uniti Group?

Uniti is more than just a typical telco business. The company specialises in building fibre networks in new residential and multi-dwelling developments.

Uniti also operates as a retail service provider to households and bespoke premium services for businesses.

After a big acquisition spree over the past three years, the business is now the credible number two in fibre deployment.

Its main competitor is the government owned NBN.

How did Uniti fair in FY21?

For the year ending 30 June 2021:

- Revenue increased 175% to $159.9 million

- Earnings before interest, tax, depreciation and amortisation (EBITDA) improved 254% to $93.7 million

- Free cash flow soared 379% to $64.2 million

No wonder the Uniti share price is soaring!

The triple-digit increases across financial line items stem from the acquisitions of HarbourISP, OptiComm and Velocity in FY21.

Pleasingly, the business showed it can grow organically as well. In the second half of FY21, the EBITDA run rate increased 15% and total contracted premises increased 24%.

As a result of the strong earnings and cash flow generation, the company reduced its net debt by 19%.

At the end of the year, Uniti had a revenue run rate of $218.0 million and an EBITDA run rate of $133.4 million. The run rate is calculated by annualising June 2021 performance.

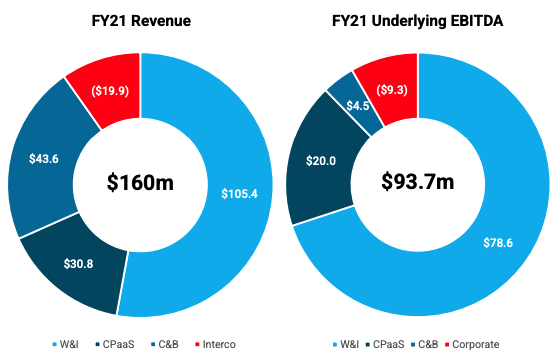

Results by division. Source: UWL FY21 presentation

From a divisional perspective, wholesales and infrastructure (W&I) was the star performer growing revenue 372% and EBITDA 441%.

Similarly, the retail service providers (C&B) and Communication platform as a service (CPaaS) segments performed strongly, recording 82% and 47% increases in revenue respectively.

Will these numbers be repeated in FY22?

I think that’s unlikely. However, management has flagged the business will continue to grow with roughly 250,000 contracted premises in its order book.

This is in addition to the existing 251,000 premises already up and running for which the business receives annuity-like earnings.

Management did not provide any further guidance.

My take

Its been a mixed bag for telecommunication companies reporting FY21 results.

Telstra Corporation Ltd (ASX: TLS) flagged it would return to growth in its update whereas TPG Telecom Ltd (ASX: TPG) lost market share.

Positively, Uniti has put all the puzzle pieces together over the past year despite integrating multiple acquisitions at one time.

Overall, I think this was a great result. Management noted its EBITDA number beat broker estimates and the order book will provide organic growth over the medium-term.

I own shares in Uniti and will be updating my valuation accordingly to decide if I will purchase more in the future.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.