Australia’s second-largest internet provider TPG Telecom Ltd (ASX: TPG) has recorded a 3% sales fall in HY21 as a result of NBN headwinds and a reduction in mobile customers.

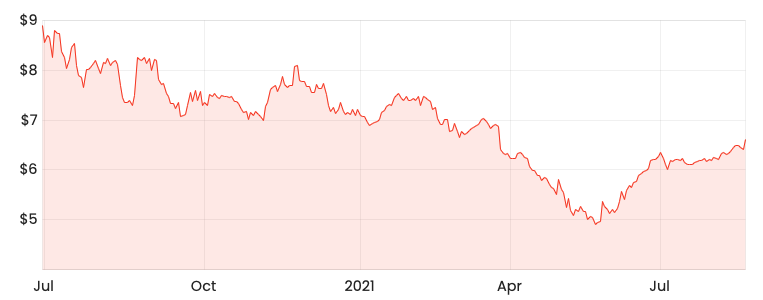

The market has reacted indifferently to the announcement, with the TPG share price up 0.15% to $6.62.

TPG share price

Sales fall on external headwinds

TPG’s key financial metrics for the half ending 30 June 2021 include:

- Pro forma revenue down 3% to $2.630 billion

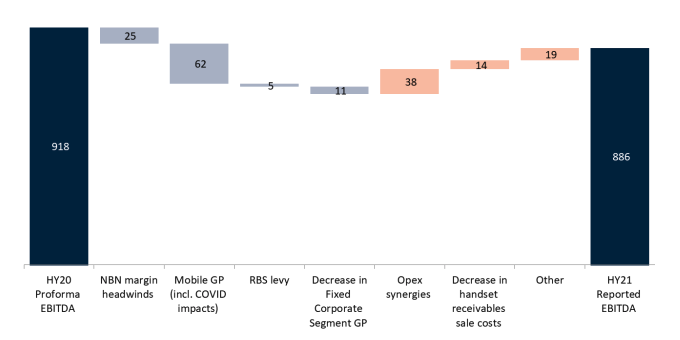

- Pro forma earnings before interest, tax, depreciation and amortisation (EBITDA) falling 3% to $886 million

- First-half dividend of 8 cents per share

- Pro forma net profit after tax dropping 6% to $189 million

Pro forma numbers have been used to more accurately reflect the merger between Vodafone and TPG Telecom since the statutory results only include four days of the combined entity.

TPG suffered from falling gross profit across its mobile division impacting the EBITDA line. This was primarily a result of a reduction in customers in addition to reduced roaming revenue due to pandemic-related border closures.

The company also faced headwinds in its fixed broadband business, as customers shift from higher-margin DSL services onto the NBN.

The reduction in EBITDA is somewhat mitigated by TPG’s merger synergy program, which aims to reduce $70 million of groups costs in 2021.

TPG delivered $38 million of those cost savings in the first half, resulting from eliminating duplicated costs and optimising network backhaul.

Operational update

TPG added 23,000 new fixed broadband customers in the half, bringing the total customer base to 2.2 million.

Conversely, mobile customers fell 1.8% across its postpaid subscribers and 3.4% across its prepaid mobile customers.

Positively, the company expects to surpass 85% population coverage in the top six Australian cities by year-end, which should help spur mobile growth.

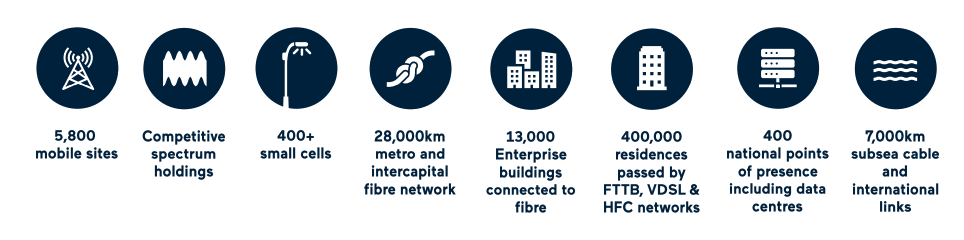

TPG is also undertaking a “strategic review of its telecommunications tower assets”.

The company operates a mobile network of 5,800 rooftops and towers and owns the infrastructure on 1,200 of these sites.

Recently, Telstra Corporation Ltd (ASX: TLS) also undertook a review of its telecommunications assets. This led to the sale of a 49% stake in its 8,200 mobile towers for $2.8 billion.

TPG did not provide any further guidance for FY21.

My take on TPG’s results

Overall, I think it was a disappointing result.

Key competitors Telstra and Aussie Broadband Ltd (ASX: ABB) look to be eating TPG’s lunch. Growth in its broadband division is subdued while mobile is going backwards.

On the positive side, it makes sense for TPG to hive off some of its telecommunication assets.

These assets have a long shelf-life and provide predictable earnings that are in high demand in a low-interest rate world.

This will allow TPG to realise cash on its passive assets and redeploy the proceeds into growing its two stagnating operating divisions.

To keep up to date on all the latest news regarding TPG and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.