The Codan Limited (ASX: CDA) share price is taking a hit today, down more than 5% at midday as the market reacts to the company’s full-year FY21 results.

Sentiment has been running hot for Codan recently, with shares up 40% year-to-date despite today’s setback.

Codan share price chart – 2 years

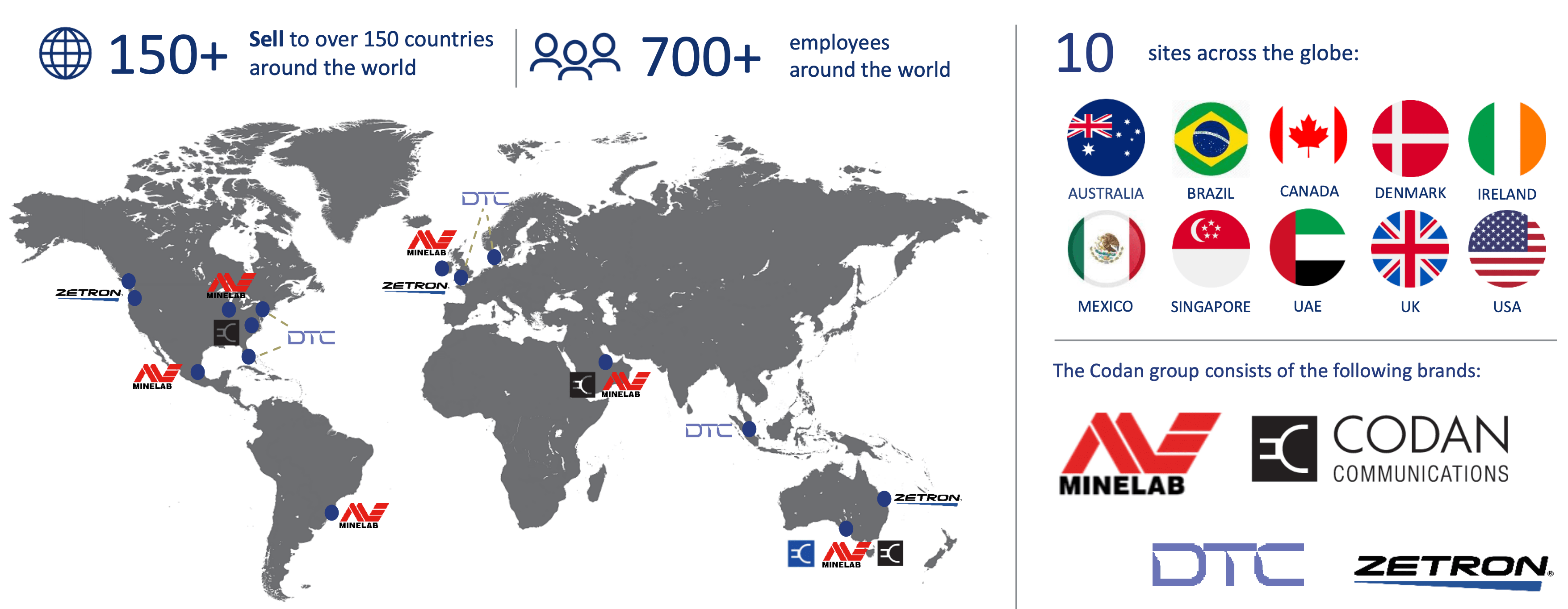

Codan is a technology company that specialises in metal detection, communications and mining technology. It’s based in Adelaide but the company operates across the world, with offices in Canada, the US, Ireland, the UAE and Brazil.

Codan’s customers include humanitarian organisations, security and military groups, mining companies and governments.

How did Codan perform in FY21?

Codan broke a bunch of records in FY21. For one, it achieved its highest full-year sales in the company’s history, up 26% over FY20 to $437 million. This was driven by 38% revenue growth in the company’s Metal Detection division, which delivered another record sales year in both recreational and gold mining.

Growth in Metal Detection was partially offset by an 8% decline in Communications revenue as the Tactical Communications business suffered the brunt of the pandemic. The company also flagged its exposure to Afghanistan, with sales into the region making up 9% of its Communications business. In light of the recent developments, the company’s sales team will continue to focus on the other markets in the Central Asia region.

Moving further down the income statement, Codan achieved a record profit result, delivering a 41% increase in statutory net profit after tax (NPAT) to $90.2 million. It’s encouraging to see sales growth translate into a blossoming bottom line as operating leverage kicks in.

The record profit result supported an increased final dividend of 16.5 cents per share. This takes Codan’s total FY21 dividends to 27 cents per share, up from 18.5 cents in FY20, putting shares on a dividend yield of around 1.7%. The board expects to continue its policy of paying out 50% of full-year profits as dividends.

Featured video: How to analyse an annual report (in 5 minutes)

A year for M&A activity

Throughout the year, Codan was busy taking advantage of a heated M&A market, buying up a couple of businesses and offloading one of its own.

In Communications, the company completed the acquisitions of Domo Tactical Communications (DTC) and Zetron in May 2021 for upfront payments of US$88 million and US$45 million, respectively.

The company also received a capital injection and streamlined operations by selling its Minetec business to Caterpillar for US$14 million.

Codan finished the financial year with $22 million cash on its books and $24 million of debt. The company remains in a strong cash position, generating more than $100 million of free cash flow excluding the acquisitions.

What’s next?

In FY22, Codan is focused on integrating the new businesses and realising the planned sales and cost synergies.

Management said it was too early to provide guidance, but it did note the following items when thinking about the company’s outlook:

- strong start to the year and in line with the FY21 run rate;

- demand for Codan’s metal detection products remains strong;

- Minelab will benefit from a full year of GPX6000 sales;

- Communications segment to include a full year of the newly acquired DTC and Zetron businesses.

- uncertainty around Tactical Communications and supply chain due to COVID-19 still exists.

Tucked away in the annual report was news that Managing Director Donald McGurk will retire from his role at Codan sometime within the next 9-12 months. The exit appears rather sudden, with the announcement stating that Mr McGurk only broke the news to the board today.

Mr McGurk’s departure, combined with the optimism baked into the current share price, is likely what’s driving Codan shares lower today. Other shares to watch today include Origin Energy Ltd (ASX: ORG) and Evolution Mining Ltd (ASX: EVN), which also handed in results.