Newly listed Airtasker Ltd (ASX: ART) has provided its first full-year report since its initial public offering (IPO) underlined by a 35% jump in revenue.

The market has reacted indifferently to the announcement, with shares trading up 0.5% to $1.005.

In simple terms, Airtasker is a digital version of the yellow pages, enabling contractors and potential customers to connect.

ART share price

Key metrics beat prospectus guidance

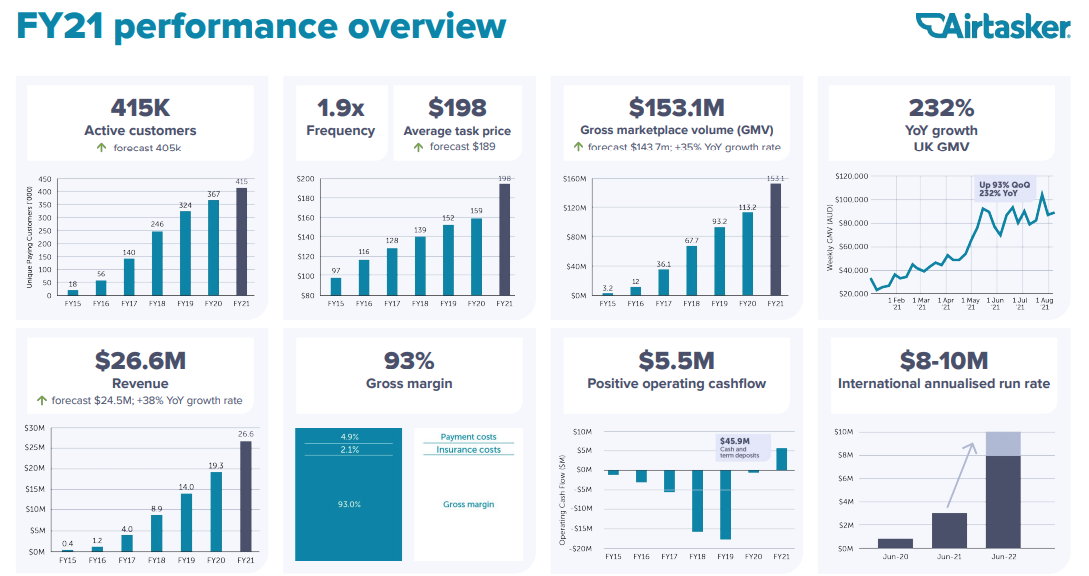

Airtasker has delivered some impressive numbers full-year numbers for its reporting date of 30 June 2021:

- Gross marketplace volume (GMV) of $153.1 million, increasing 35% on FY20

- Revenue of $26.6 million, growing 38% on FY20

- Gross profit of $24.8 million, jumping 39% on FY20

- $45.9 million cash on hand

- Positive operating cash flow of $5.5 million

- Active customers of 415 million, increasing 13%

Despite being listed for a little over three months, the company beat its prospectus guidance across a number of metrics including revenue, GMV and operating cash flow.

Its operating metrics remain strong, with the average task price increasing 24% to $198 and an average frequency of 1.9x per user.

The business’s entry into the United Kingdom (UK) remains on track with GMV up a whopping 232% year on year. Keep in mind this is off a very low initial base.

Outlook for FY22

Lockdowns have impacted marketplace activity in the first quarter of FY22 with weekly GMV down ~12% during July compared to pre-lockdown.

Positively, the company is set to launch its platform in three cities in the United States (US) – Kansas City, Dallas and Miami.

Quantitative guidance provided by management for FY21 includes

- GMV to exceed $200 million

- Revenue to exceed $35 million

- International GMV run rate of $8 million to $10 million

- Invest $20 million over FY22/FY23 into the United States and the UK

My take

It’s tough to get a read on Airtasker.

All its reporting metrics seem to be tracking in the right direction. Moreover, beating its own prospectus guidance is a tick for management.

However, the current take rate of 17.4% (the percentage Airtasker takes for facilitating each job) seems very high.

To illustrate, you hire an electrician to do an hours work. She charges $200. Airtasker takes $34.80 and the electrician takes home $165.20.

Then the electrician has to pay GST and income taxes on the ~$165.

I’m unsure if this is sustainable. Moreover, Airtasker is not the only online jobs marketplace. For example, the company competes with Hipages Ltd (ASX: HPG) for tradies.

To understand the business better, I’d need to take a deeper look at the financial report and undertake a discounted cash flow valuation.

To keep up to date on all the latest news regarding Airtasker and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.