The Myer Holdings Ltd (ASX: MYR) share price is rising higher after it announced a new national distribution centre.

Myer’s new distribution centre

Myer said that is has signed a 10 year lease on a new 40,000 square metre facility in Victoria. This new facility will act as its national distribution centre for both stores and online fulfilment.

The company said that the national distribution centre represents the next phase of the supply chain ‘factory to consumer’ initiative. Myer has been making changes to its online operations and international freight arrangements.

The new facility is under construction and is located in ‘Horizon 3023’ industrial estate in Ravenhall, Victoria. Myer expects to begin using it in a phased in approach from August 2022.

Increased efficiencies

Management said that it will be a state of the art facility holding over 100,000 SKU’s (stock-keeping units – the number of different products it sells). Myer expects this facility to have widespread benefits and efficiencies with multiple automation solutions.

Myer expects that the new national distribution centre will centralise fulfilment for stores, with priority for the stores which sell the most. This is expected to maximise sales and reduce product markdowns.

For its online business, Myer anticipates that up to 70% of online fulfilment will be made by the distribution centre. This will increase operational efficiencies and reduce the cost per order.

Stores will remain key for click and collect services, as well as ‘last mile’ deliveries in some areas.

Management comments

Myer CEO John King said: “Today’s announcement is another important step in our Customer First Plan… Having a centralised fulfilment centre for stores replaces our historical push model, and will result in improved inventory management, reduced markdowns and maximised sell-though whilst also producing significant efficiencies in our online fulfilment operations.”

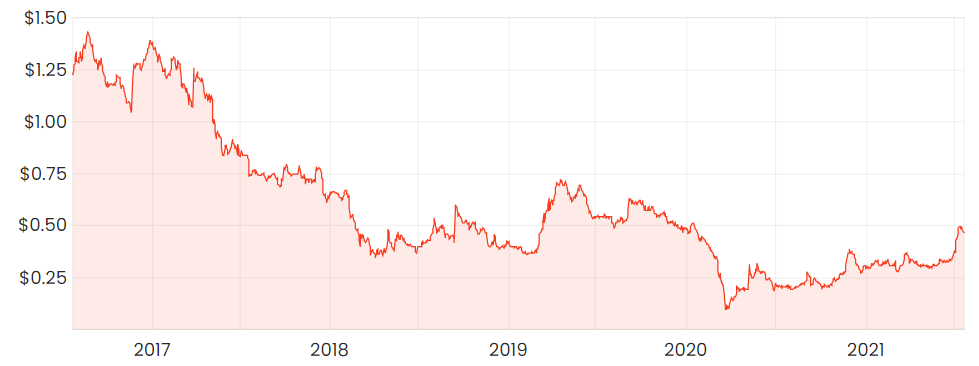

Myer share price

Summary thoughts on the Myer share price

Recently Premier Investments Limited

(ASX: PMV) increased its stake in Myer to more than 15%. That would suggest that Premier think Myer has good potential.

Myer is making changes to its business to turn things around, which is being reflected in the recovery of the share price, having gone up over 123% in the past year. However there is still a long way to go for Myer to get back to where it was 5 years ago.

This new distribution centre sounds like it’s a positive step in the right direction, unfortunately we won’t see the tangible results from the facility until Myer’s FY23 result.