It seems like Redbubble Ltd (ASX: RBL) shares can’t catch a break as it dropped by as much as 8% today. Is there light at the end of the tunnel for Redbubble shares?

RBL share price

Organic traffic still strong

Since I last reported on Redbubble’s share price demise, organic search traffic has actually risen from 23 million/month to 25 million/month according to Semrush.

It’s also closing in on its peak of 26 million/month in November 2020, just before the Christmas spending period.

Why is this important?

The market was disappointed to hear that management would deploy significant capital towards marketing because of the adverse impact on future earnings.

Given the increased focus on marketing expenditure, I would like to see some decent uptick in web traffic and a growing social media presence.

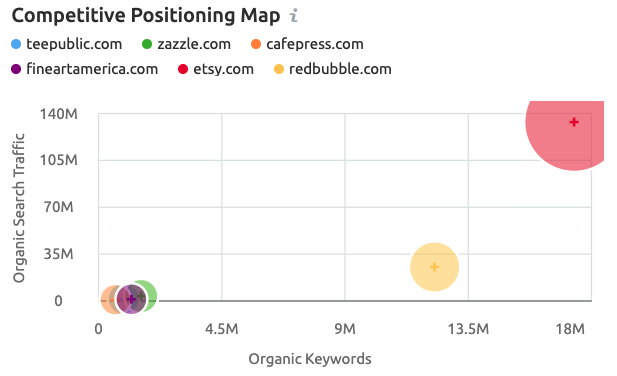

So, it’s encouraging to see Redbubble continuing to maintain the wide gap from its direct competitors as seen below.

Evidently, Etsy Inc (NASDAQ: ETSY) is a completely different beast and I’ll touch more on it later.

Whilst Etsy dominates in the web traffic domain, it seems like Redbubble is capitalising on the TikTok channel with 51,400 followers, which is more than 3x that of Etsy’s. Is it time for a TikTok video celebration?

Let’s not get too ahead of ourselves, web traffic remains the dominant channel but knowing Redbubble is exploring all channels is a positive sign.

Oranges and apples

Let’s compare the pair, as they say, I’m talking about Etsy and Redbubble.

Etsy operates a B2B model whereas Redbubble is more focused on artists selling to consumers. But the general concept is the same, being a marketplace of buyers and sellers.

Nearly a decade ago, Etsy was in a similar position where it was ploughing capital into the business.

Etsy managed to generate remarkable organic web traffic by reinvesting into tools that could empower the sellers in the marketplace.

In 2013, former CEO of Etsy, Chad Dickerson attributed the extraordinary user growth, in part, to sellers promoting their own shops on social media.

By providing the sellers with the resources and tools via third-party apps, they were able to develop stronger customer relationships.

This eventually resulted in a fly-wheel effect where sellers were generating more repeat purchases, which also led to more referrals.

Can this apple become an orange?

Investors should keep in mind that no two businesses are the same, each possessing unique nuances.

In saying this, I think it’s important to view Redbubble’s strategy in light of Etsy’s success.

A pessimist would say Redbubble is burning money but an optimist would think temporary pain is necessary for long term gain.

This is why I like to take both views and monitor data points like web traffic and social media presence to determine whether Redbubble can become an orange.