The Afterpay Ltd (ASX: APT) share price looks like it’s heading back up. But what’s lingering beneath the Afterpay share price bonnet?

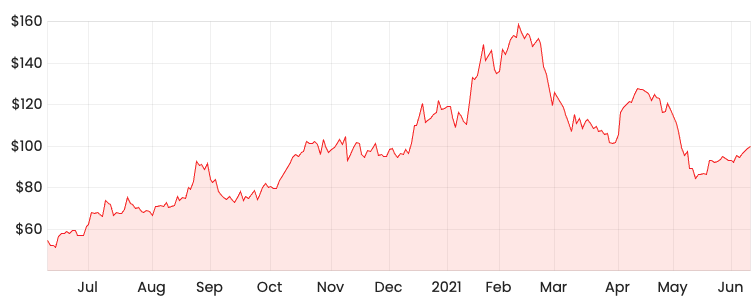

APT share price

More late fees = more attention?

As reported in the Australian Financial Review, Morgan Stanley published a report with a share price target of $145.

The five Morgan Stanley analysts believe Afterpay can achieve 70% compound annual growth in revenue until 2023.

Their model assumes Afterpay’s late fees will grow to $340 million by FY23, from $99 million this financial year. That’s quite a big jump right?

Well, in percentage terms, it doesn’t look like much, as such an increase corresponds to a jump from 10% to 13.6% of revenue by FY23.

Consumer groups concerned

Whilst the estimated surge in late fees may not seem like much, it’s drawn the attention of consumer groups.

In a worst-case scenario, an Aussie consumer could face a capped late fee of $68 on a $272 purchase if they miss four successive payments. This equates to 25% interest in a month.

Why the uproar?

Well, Aussies are subject to much higher late fee penalties compared to their overseas counterparts. That’s not fair game aye?

But there’s a valid reason, it’s because of different financial regulatory jurisdictions. For example, in the US, there are three small states that prohibit late fees. And more than half of them allow late fees but are capped at $US8 or $AU10.30.

Where there’s an opportunity, there’s also risk

Afterpay and fellow buy-now-pay-later players like Zip Co Ltd (ASX: Z1P) continue to benefit from the regulators’ innovation stance.

But how much juice can they squeeze from the lemon before things turn sour?

Regulators have noted the BNPL sector still only play a small role within the broader economy but what will happen once Morgan Stanley’s forecasts come to fruition?

Once these BNPL players get bigger, consumer groups will highlight the rapid increase in late fee revenue.

This is something to keep in mind because regulation could potentially constrain Afterpay’s total addressable market.

“If you’re on the hunt for ASX small-cap shares, check out the Rask Rockets Beyond

program. You might want to hurry – the first rocket is set to launch on Tuesday!”