Hansen Technologies Limited (ASX: HSN) and Altium Limited (ASX: ALU) shares were small from the beginning. But now both are billion dollar plus market cap companies.

So, it’s no surprise that BGH Capital is looking to buy Hansen and Autodesk wants to acquire Altium.

Beast-like companies want to gobble up great businesses like Hansen and Altium.

But what made them so great?

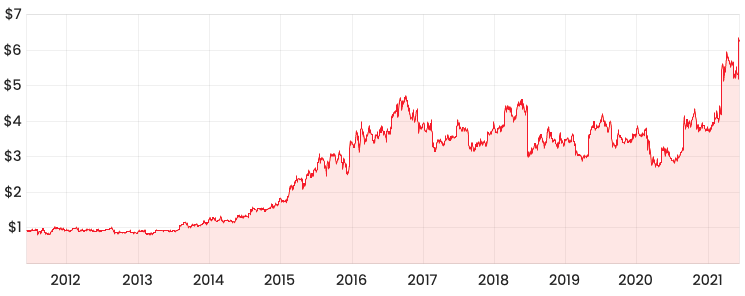

HSN share price

Hansen develops, integrates and provides support of billing systems software for the energy and communication sectors. Other activities include IT outsourcing services.

As you can see, the Hansen share price hit an inflection point in 2015.

At that time, the business had sticky customers, thick margins and a global customer base. It was also already free cash flow

positive.

A mission-critical product and a structurally growing industry were key drivers behind Hansen’s strong revenue growth.

Another often overlooked factor is that Hansen is a found-led business as Andrew Hansen has been the CEO since 1993.

ALU share price

Altium develops and sells computer software for the design of electronic products, in particular circuit boards.

Hansen took much longer than Altium to reach an inflection point. How come though?

Well, Altium’s key competitive advantages it was developing early on, were its pricing power and customer retention.

Why are these such important growth accelerators?

Obviously, more money flows to the bottom line – duh! But more importantly, it’s a strong indicator of the quality of the product, which leads to greater customer retention.

Similar to Hansen, Altium was operating in a structurally growing industry with an expanding total addressable market.

As a result, it was able to rapidly generate high free cash flow between 2017 and 2019.

As you can see from these 2 ASX growth shares, they exhibit characteristics that align with the Rask Investment Philosophy.

If you’re on the hunt for ASX small-cap shares that could become the next Hansen or Altium, check out the Rask Rockets Beyond program. You might want to hurry – the first rocket is set to launch on Tuesday!