The Australian Competition and Consumer Commission (ACCC) announced it will not oppose the acquisition of PFD Food Services by Woolworths Group Ltd (ASX: WOW). The investigation concluded the transaction will not materially reduce competition.

PFD is a privately owned wholesale food distributor providing food products and distribution services throughout Australia. The company operates a national network of distribution centres and delivery vehicles providing food services to restaurants, cafés, fast-food chains, hotels, hospitals and clubs.

Woolworths Group will acquire a 65% share in PFD, with the incumbent Smith family retaining a 35% stake. Woolworths has the option to acquire the remaining 35% at a later date.

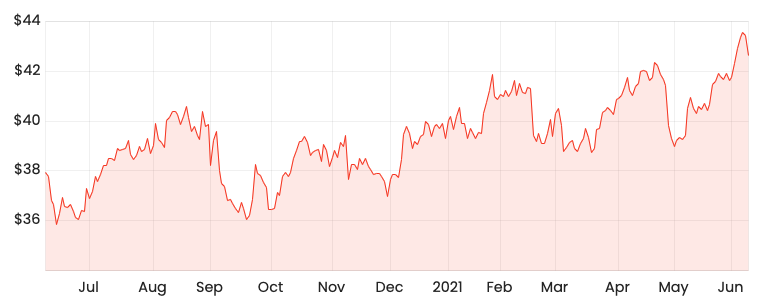

WOW share price

Why the holdup?

In December last year, the ACCC raised concerns that the proposed acquisition may increase Woolworths’ purchasing power, lessen competition in wholesale food distribution and allow Woolworths to foreclose competitors that are supplied by PFD. Woolworths Group and PFD share 350-400 common suppliers.

The investigation focused on the impact of the acquisition on suppliers of food and grocery products. The wholesale food distribution channel is an important alternative to the major supermarket outlets.

ACCC findings

While sharing common suppliers, Woolworths and PFD rarely compete for the same customers. PFD purchases products often in different sizes and recipes to Woolworths. Woolworths focuses on products suitable for direct retail sale such as convenience items (chocolate bars, candy, chips) whereas PFD purchases larger format products that are used as inputs (fruit, vegetables, spices, sauces).

Some food suppliers raised concerns, however, given PFD makes up 2% of the overall demand, many were indifferent about the acquisition. Moreover, suppliers have alternative channels such as supply to manufacturing, quick service restaurants and direct supply.

The ACCC acknowledges the acquisition will likely lead to Woolworths flexing its purchasing power. However, non-price aspects such as quality, service and range remain important market dynamics mitigating the effect of a low-price competitor.

Stakeholders highlighted the ineffectiveness of the Food and Grocery Code. Implemented in 2015, the code aims to protect small businesses and keep the big supermarkets in check. Many believe the code needs to be strengthened to include civil penalties and sanctions for non-compliance.

“We consistently received feedback that while the supermarkets’ conduct has improved since the introduction of the code, poor behaviour continues, and the significant imbalance in the bargaining position of suppliers and the supermarkets remains,” Mr Sims said.

My take

From a Woolworths shareholder perspective, I think the acquisition is sound and will allow Woolworths to leverage its scale to enhance the PFD business. However, I am surprised the ACCC didn’t implement further restrictions on Woolworths to protect suppliers.

I consider Woolworths to be a recession-proof business. For two more defensive companies listed on the ASX, check out this article.