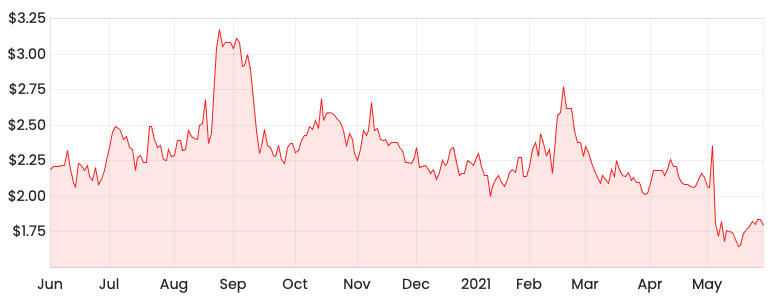

The Nearmap Ltd (ASX: NEA) share price continues to feel the heat as it fell by as much as 4% today. Can the US government budget help the Nearmap share price?

NEA share price

Biden plans to spend big on infrastructure

Joe Biden

submitted a $6 trillion budget plan that would focus on infrastructure, education and combatting climate change.

The key area of focus for Nearmap is infrastructure.

If this budget plan gets approved, this will assist Nearmap’s penetration in the US market. How so?

Nearmap provides aerial imagery, which assists engineers as well as construction developers when building infrastructure. As a result, there will be greater demand for Nearmap’s technology if the US government rolls out funding for more infrastructure.

What now for Nearmap?

Whilst it’s encouraging to see the industry tailwinds being potentially propelled by the US government, a dark cloud remains.

Nearmap is currently in a legal stoush with a US-based competitor, Eagle View Technologies.

It may seem like a great value play but what does the quality of its competitive advantage look like in the future?

If you are on the hunt for small-cap share ideas, you may want to check out the Rask Rockets Beyond program.