The Pilbara Minerals Ltd (ASX: PLS) share price jumped by 10% yesterday and it’s just announced some more positive news. Can the Pilbara share price keep going up?

Pilbara is an Australian lithium miner located in Western Australia.

The company operates its 100%-owned Pilgangoora Lithium-Tantalum Project – one of the largest lithium ore deposits in the world.

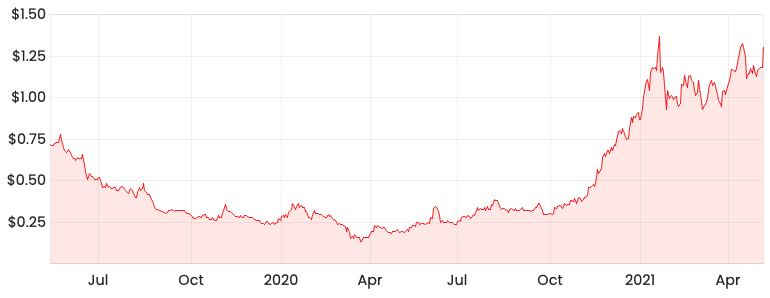

PLS share price

Pilbara enters a joint venture with Calix

Calix Limited (ASX: CXL) has executed a memorandum of understanding (MOU) to cover the development of a joint venture project to develop a “midstream” lithium chemicals refinery.

Pilbara will bear the costs of the scoping study utilising Calix’s core technology.

Once the scoping study is successful, both companies will develop a demonstration plant with a view to further commercialise the technology developed.

Pilbara notes this is a world-first development of a commercial-demonstration-scale, low-emissions lithium salt production facility.

My take

As Pilbara stated in its announcement, this development could cornerstone a full battery production supply chain in Australia.

The mining company appears to be gaining a lot of momentum in a structurally growing industry

.

As covered by my colleague, Patrick Melville in 2 promising ASX lithium shares to watch closely in 2021, Pilbara’s ultimate objective is to become a fully integrated participant in both raw materials and the high-value lithium chemical supply chain.

This is an important reminder because Pilbara is focused on achieving economies of scale over the long term.

Larger companies have greater sway with suppliers and can spread overhead costs over a bigger base. This recent joint venture will likely assist Pilbara in achieving such a position.