As the world continues to shift away from fossil fuels, optimism surrounding lithium has been on an upwards trajectory.

The last time the lithium industry had a similar growth phase was in 2018 when increased consumption primarily from China drove up the price, which was supported by various subsidies.

When lithium demand was actually lower than expected, an oversupply of the commodity resulted in a significant price decrease.

The recent rotation into clean energy stocks is being driven by some large structural changes, but there’s been a number of recent catalysts which have undoubtedly added some fuel to the fire.

Most importantly, it’s worth noting US President Joe Biden’s US$2 trillion clean energy plan. Biden’s plan is to channel investment into clean energy and transition the country to electric vehicles, with the ultimate goal of the USA becoming a “clean energy superpower” with a 100% clean energy economy (net-zero emissions) by 2050.

Of course, the USA is just one country, but the overall global thematic is positive and while difficult to quantify, it certainly appears to be on an upwards trajectory.

With an increase in demand for electric vehicles, the underlying demand growth for lithium compounds is also expected to remain strong over the next decade.

And with Australia being the largest Lithium producer in the world in 2019, the rationale behind the lift in sentiment would presumably be that some of the ASX lithium miners could be a major beneficiary of the increased demand.

In light of the above, here are just a couple of clean energy companies that have been some of the most traded on the ASX recently.

Pilbara Minerals

Pilbara Minerals Ltd (ASX: PLS) in an Australian lithium miner located in Western Australia. The company operates its 100%-owned Pilgangoora Lithium-Tantalum Project – one of the largest lithium ore deposits in the world.

Despite the effects of COVID-19, demand for the lithium raw material known as spodumene has been resilient, with a record-breaking 70,609 metric tonnes shipped during the last December quarter, which was 40% higher than the corresponding period. Most of Pilbara’s lithium is shipped to China where it’s further processed.

One of the primary catalysts behind the recent run in the Pilbara share price was its US$175 million acquisition of its insolvent neighbour Altura Mining. Due to Altura sharing the same assets, Pilbara management estimates it could save between $18 to $27 million in costs per year and increase production capacity in response to the recent rise in demand for lithium.

Further growth will also be driven by Pilbara’s partnership with POSCO through a joint venture of a lithium chemical conversion facility in South Korea.

This venture aligns with the company’s ultimate objective of becoming a fully integrated participant in both raw materials and the high-value lithium chemical supply chain.

Pilbara seems well-positioned to accommodate the recent rise in demand due to the size of its lithium deposit and a recent acquisition.

Vulcan Energy Resources

As the world attempts to harness cleaner forms of energy, the unfortunate irony is the environmental impact of some forms of lithium mining. A common extraction method involves drilling a hole in a salt flat and pumping mineral-rich water to the surface, which is then evaporated over several months.

This process is water-intensive (500,000 gallons per tonne of lithium) and there’s also the potential for toxic chemicals to leak into nearby water supplies. While there are other methods that don’t involve this process, many of them still use other fossil fuels, and have adverse effects on the environment.

Perth-based Vulcan Energy Resources Ltd (ASX: VUL) is attempting to produce the world’s first zero-carbon lithium hydroxide by using geothermal energy.

Vulcan’s resource is located in Germany and it intends to satisfy Europe’s growing lithium needs for years to come. According to the company, Europe currently has zero local supply, but one of the fastest-growing lithium chemicals market.

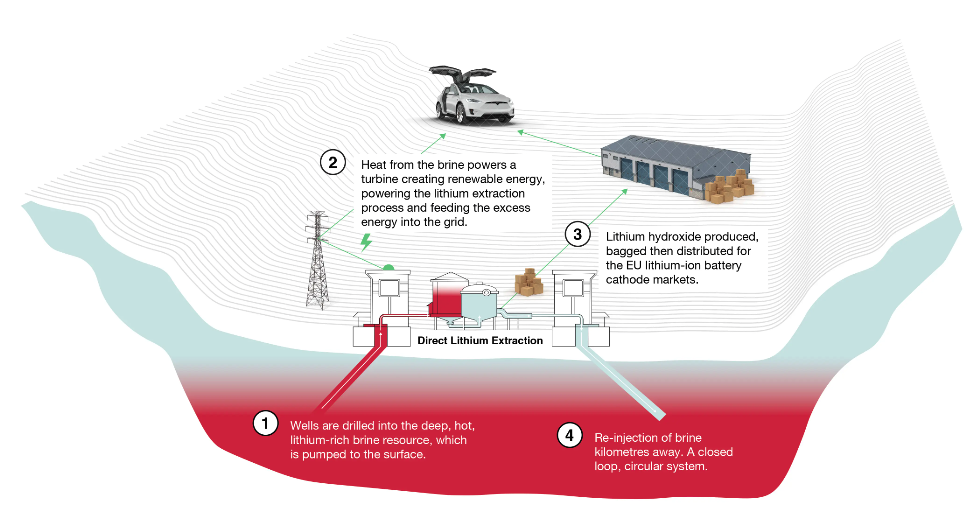

The diagram below will most likely give a clearer picture, however, Vulcan plans to extract hot brine from wells (without the use of fossil fuels), which will generate steam and power turbines and produce renewable electricity.

Lithium is then extracted from the solution with the brine, then re-injected back into the ground. All water is recycled and emits no toxic waste or gasses.

The technology is exciting, but it’s worth noting that full-scale production is still a long way away. Glancing momentarily at Vulcan’s latest cash flow statement, for obvious reasons, the company has no form of cash inflow from operating activities and relied on the exercise of options to bring it back into cash flow positive territory.

The latest rally last month saw the Vulcan share price reach $14 at one point, giving the company an extraordinary market capitalisation of over $1.2 billion.

While the Vulcan share price has come back down to around $7.80 (market cap ~$700 million), my point is just to emphasise that it might be quite some time before the company generates revenue and as such, the valuation is something to consider while taking into account potential capital raisings.

For some other share ideas, click here to read: 2 ASX growth shares to add to your 2021 watchlist.