The Digital Wine Ventures Ltd (ASX: DW8) share price has fallen another 11.43% this morning despite releasing a positive trading update to the market yesterday.

After reaching highs of 21 cents per share last month, Digital Wine’s valuation has now tumbled more than 55% from the height of the rally.

Fundamentally, not too much has changed within the company and it appears to be steadily growing in terms of suppliers and cases of wine it’s shipped recently.

Long-term believers of the company would likely see the fall in the share price as a great opportunity to buy the same company at half the price.

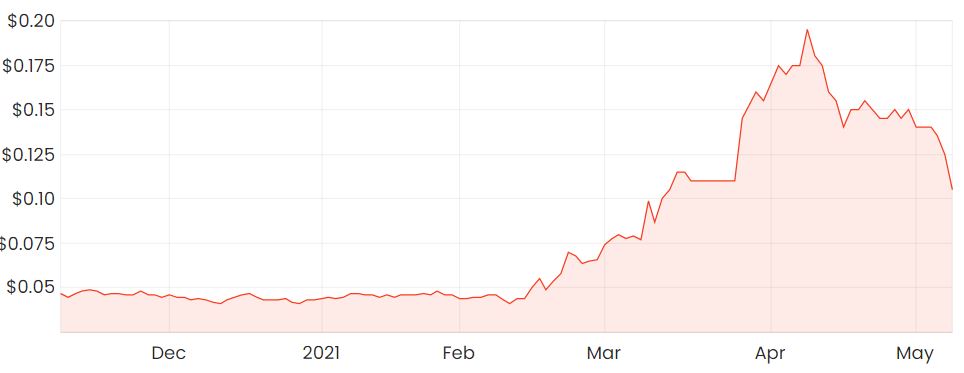

DW8 share price

Company trading update

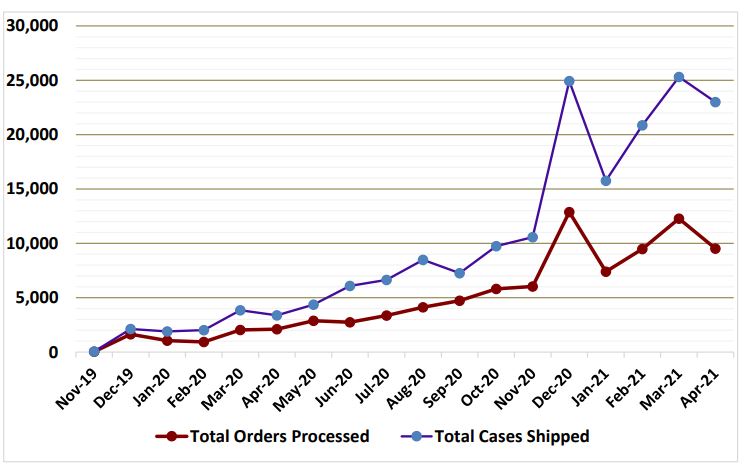

Digital Wine advised yesterday that it had shipped a total of 23,006 cases during the month of April, representing a jump of a 580% compared to the previous corresponding period (pcp).

Cases shipped last month were 25,311, so this represents a month-on-month (MoM) drop of 10%, which could’ve potentially spooked the market and contributed to the sell-off.

The company processed 9,500 orders, which was up 350% pcp but down 22.5% MoM.

Digital Wine noted that the slowdown in April was mostly a result of the extended vintage preoccupying many winemakers. As you can see from the chart below, growth numbers haven’t moved up in a straight line, but it seems as though the underlying trend remains to be on an upwards trajectory.

Winedepot secures licence

In yesterday’s announcement, Digital Wine also revealed that an application for an online liquor licence, allowing it to sell and deliver wine to the general public had been approved.

This licence will be used to launch Insider Trading – an invitation-only membership for the company’s shareholders, staff and employees of suppliers to purchase products listed on the marketplace for discounted prices.

Why has the share price fallen?

Despite the latest company update confirming the growth trend, it’s important to remember that it was only recently that the company’s shares were trading at just 4.5 cents each, meaning its market valuation had risen by over 350% by the time shares had reached 21 cents.

It seems like most of the good news was already priced into the valuation at the time and yesterday’s update wasn’t enough to keep the momentum going.

Even after the recent sell-off with a $175 million market capitalisation, Digital Wine’s shares are still priced at a premium compared to the company’s revenue-generating capacity.

For some other ASX share ideas, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.