The Westpac Banking Corp (ASX: WBC) share price hasn’t moved much since releasing its HY21 results. However, ASIC today announced it has commenced proceedings, what does this mean for the Westpac share price?

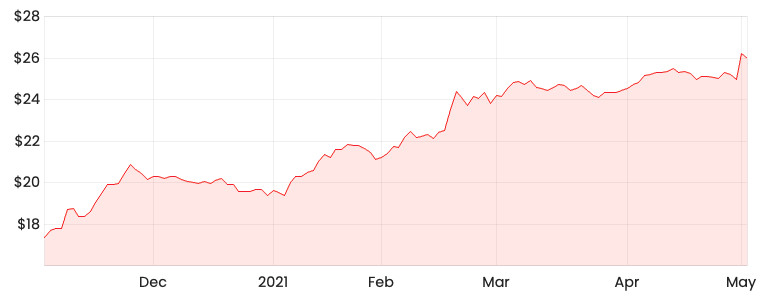

WBC share price

Possible insider trading

ASIC’s proceedings relate to possible insider trading, unconscionable conduct and breaches of Westpac’s Australian financial services licensee obligations.

The possible misconduct is associated with the largest interest rate swap transaction executed in one tranche in Australian financial market history.

The transaction occurred on 20 October 2016 to support the privatisation of a majority stake in the electricity provider, Ausgrid by the NSW government.

ASIC alleges Westpac possessed inside knowledge or information that was not generally available to other market participants when the trade occurred.

This action could result in pecuniary penalties for Westpac as well as orders to address the alleged misconduct.

What now for Westpac?

Westpac provided an encouraging update to investors two days ago as it declared an interim dividend of 58 cents per share.

However, ASIC’s action will likely dampen any positive impact generated from the HY21 results.

The allegations will not help Westpac’s drive to take market share away from its competitors like Commonwealth Bank of Australia (ASX: CBA) and National Australia Bank Ltd. (ASX: NAB).

If you are interested in finding out how to value Westpac, you can click right here.