The market wasn’t too pleased with a trading update provided by Cleanspace Holdings Ltd (ASX: CSX), which sent its share price down 55% by the end of Monday’s trading session.

This update comes roughly one month after releasing its 1H FY21 results, which sent the CleansSpace share price on a similar trajectory.

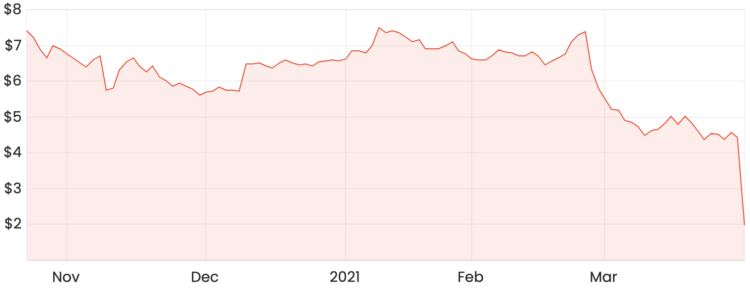

Since listing on the ASX in October last year, CleanSpace shares have now lost around 73% of their value.

CSX share price

What does CleanSpace do?

CleanSpace is a Sydney-based company that designs and manufactures respiratory protection equipment for healthcare and industrial applications.

CleanSpace turned out to be a beneficiary at the onset of the COVID-19 pandemic due to a global shortage of masks and other protective equipment, which saw medical professionals turn to alternative options.

2H FY21 trading update

The company announced on Monday it had experienced a slowdown in sales in Q3 (quarter ending 31 March 2021) as a result of ongoing complications from COVID-19. As such, it expects to report revenue of around $7 million for the period.

To put that figure into perspective, CleanSpace reported 1H FY21 revenue of a little under $40 million. In other words, quarterly revenue has fallen from roughly $20 million last year to $7 million, or a 65% drop.

Challenging conditions

A shift in North America healthcare procurement has been the major headwind on sales this quarter with a range of compounding factors that have contributed to the slowdown.

Management indicated the acceleration of vaccination programs, spending constraints and a backlog of lower-tech disposable masks have driven the decline in sales. With conditions still unprecedented, management believes this volatility is likely to continue.

Future outlook

Despite the results, management insists the company is still operating on the same solid fundamentals and they’re confident its historically high growth rates will normalise in the medium term.

The company operates in a large $6.3 billion total addressable market (TAM) and management believe its differentiated technology, strong customer base and scalable business model will help give the company a leg up on the competition as it expands into new markets.

Buy/hold/sell?

Buying after large selloffs can sometimes present an opportunity to take advantage of the market overreacting to negative news.

For a short-term trade, there’s a lot of luck involved as no one can say for certain what the share price will do over the next few days.

If you’re planning on holding the stock for a longer time period, I would argue that a safer option would be to wait for the next trading update to assess whether conditions are improving.

This would allow you to assess the long-term outlook for the company a bit better and potentially avoid exposing yourself to consecutive downgrades.

For more share ideas, click here to read: ASX tech shares were hit hard yesterday: I’d happily buy these 3: JIN, XRO & ALU.