Now that ASX reporting season is over, here are two ASX tech shares that reported impressive results. I think these shares are worth adding to your watchlist in March.

NextDC

Rising bond yields have put the valuation of data centre operator NextDC Ltd (ASX: NXT) in the crosshairs, with its share price down around 15% over the last month.

NXT share price

However, I think NextDC’s first-half FY21 results confirmed its upwards trajectory, with data services revenue and underlying EBITDA up 27% and 29%, respectively.

The valuation of NextDC is admittedly fairly lofty given its current earning capacity. However, in my view, the growing underlying thematic of data storage and cloud capabilities seems likely to be ongoing for years to come, as more businesses choose to transition to the cloud.

Over the half-year, customers and contracted utilisation were up 16% and 33%, respectively, indicating a growing demand for NextDC’s services that has been ongoing since the onset of COVID-19.

Management upgraded FY21 guidance, with growth in recurring services revenue and long-term customer contracts contributing factors.

For more reading on NextDC and its associated tailwinds, check out this article: Why I recently bought NextDC shares.

Aussie Broadband

Considering that Aussie Broadband Ltd (ASX: ABB) shares listed on the ASX last year at just $1 per share, the market was expecting some strong results coming out of its most recent half-year FY21 report.

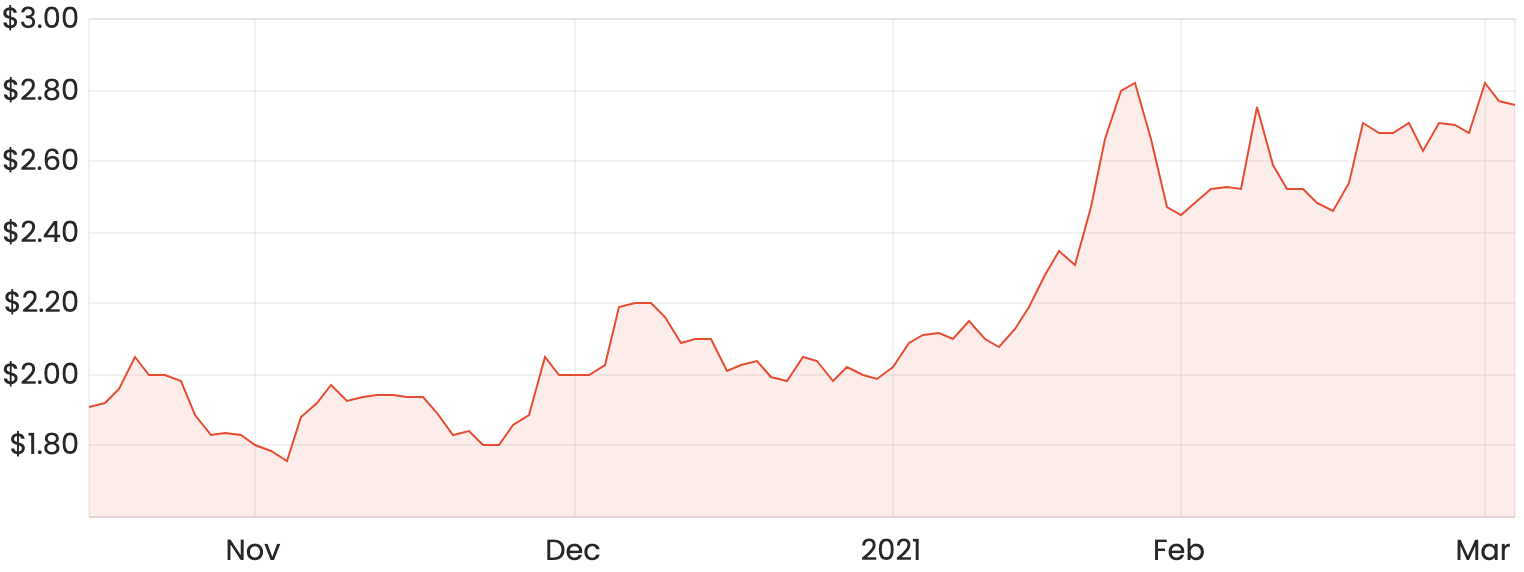

ABB share price

Investors were not left disappointed, with the company upgrading previous guidance with full-year revenue expected to come in between $345 million and $355 million, and normalised EBITDA between $13 million and $15 million.

Aussie Broadband currently has an estimated 4.2% of the broadband market share. On this basis alone, it seems as though the company still a large growth runway if it can continue to win new customers from the larger players, such as Telstra Corporation Ltd

(ASX: TLS) and TPG Telecom Ltd (ASX: TPG).

The growth trajectory here is undeniably impressive. Aussie Broadband has come from 27,000 customers in June 2017 to 300,000 in October last year.

Over the most recent half-year, new residential broadband connections were up 30% on the prior period to 313,193 connections. Business connections were up from 19,734 to 29,441.

While 368,172 connections were forecast for FY21 in the original prospectus, this has since been upgraded to be between 380,000 and 410,000.

Aussie Broadband does not compete by offering extremely competitive prices, but rather offers faster speeds, better reliability and a positive customer experience.

Its success is a testament to the fact that consumers are more than happy to cough up the extra money if a better service is offered, which seems like a fairly hard task given the relatively homogenous nature of internet retailing.

Its valuation has run hard recently, but I think Aussie Broadband is undoubtedly one for your ASX watchlist this year.

For more reading on Aussie Broadband, check out this article: Why I think Aussie Broadband shares could be a buy.