The Booktopia Group Ltd (ASX: BKG) share price edged higher today as the online book retailer released its half-year results.

Booktopia is the largest Australian-owned online book retailer, starting out in 2004 and listing on the ASX in December 2020. It generates the majority of its revenue by selling physical books, although it also sells eBooks, DVDs, audiobooks, magazines and stationery.

Booktopia noted that strong ongoing demand from customers and increased distribution capacity helped the company deliver a record first-half result. Here are the key points.

Unpacking Booktopia’s record results

The company said the COVID-19 pandemic created a positive business environment for its operations. This led to a significant uplift in online retailing, where many new online shoppers entered the market and existing shoppers increased the frequency of purchasing.

As a result, Booktopia experienced increased customer demand during lockdowns, and this heightened demand has reportedly continued even as restrictions have been relaxed.

Booktopia’s revenue grew by 51% during the half to $112.6 million, driven by particularly strong performances in New South Wales and Victoria.

The retailer’s average order value increased from $61.96 in 1H20 to $69.72 in 1H21, while the average selling price climbed from $24.39 to $26.11, as shown in the charts below.

The company shipped 4.2 million units during the half, representing a 39% increase over the prior corresponding period of 1H20, while the number of active customers grew by 25% to 1.71 million.

While COVID-19 boosted demand, it also presented challenges for Booktopia’s supply chain. The company faced issues with the delivery to customers and the sourcing of products, especially products from international suppliers. Some products continue to be difficult to source from international suppliers, creating delays for customers.

Zeroing in on the bottom line, Booktopa said its ballooning net loss was driven by the conversion of preference shares and $4 million of IPO costs.

The company finished the half with $16 million cash on its balance sheet and minimal debt.

Guidance upgraded

Booktopia said it has started the second half on a strong note, with January and February revenue growth tracking ahead of expectations.

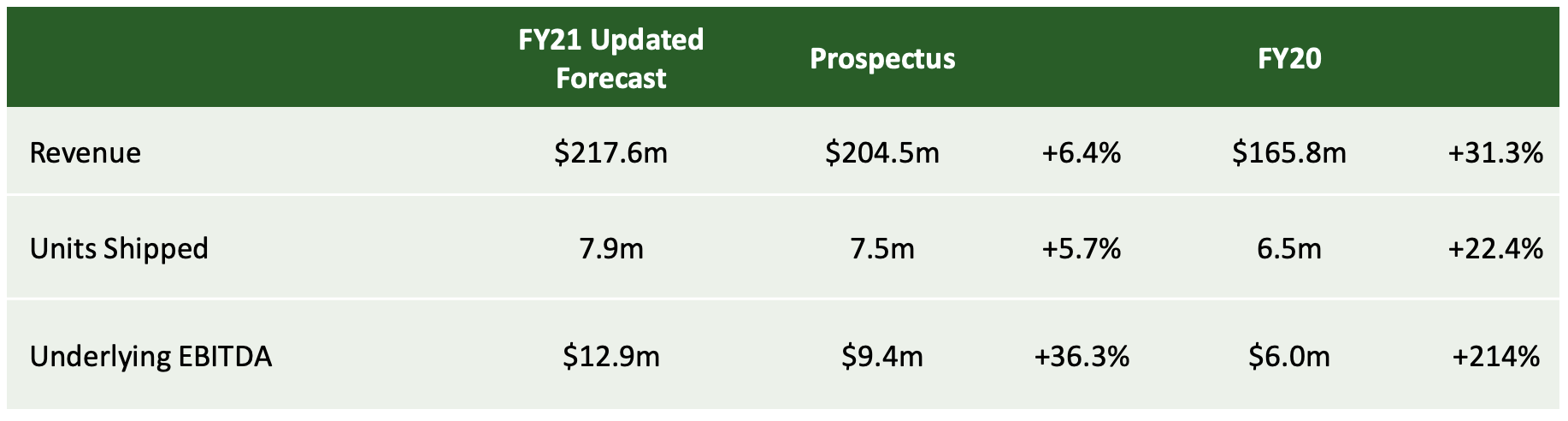

On the back of the first-half results and strong start to the calendar year, management has increased the full-year guidance it provided in its prospectus. The changes are summarised in the table below:

Booktopia will continue its growth strategy, investing in key areas of the business to cement its online market leadership and drive increased market share.

The company will also continue to invest in its distribution facilities, automating key activities to allow for increased inbound and outbound capacity, process optimisation and the ability to hold additional inventory.

Throughout 2020, Booktopia invested $12 million into the expansion of its 14,000 square metre distribution centre in Sydney’s west. As a result, the company doubled its capacity and is now able to ship up to 60,000 books across 145,000 titles per day.

Now what?

Booktopia has certainly been a beneficiary of COVID-accelerated trends, but I’m wary of the increasingly competitive industry environment.

Of note, Booktopia is battling it out against Amazon.com (NASDAQ: AMZN) subsidiary The Book Depository. However, with the shift to e-commerce still relatively in its infancy, this could be a rising tide lifts all boats scenario where multiple players come out on top.

If you’re looking for share ideas, I suggest getting a Rask account and accessing our in-depth, analyst-backed stock reports. Click this link to join for free!