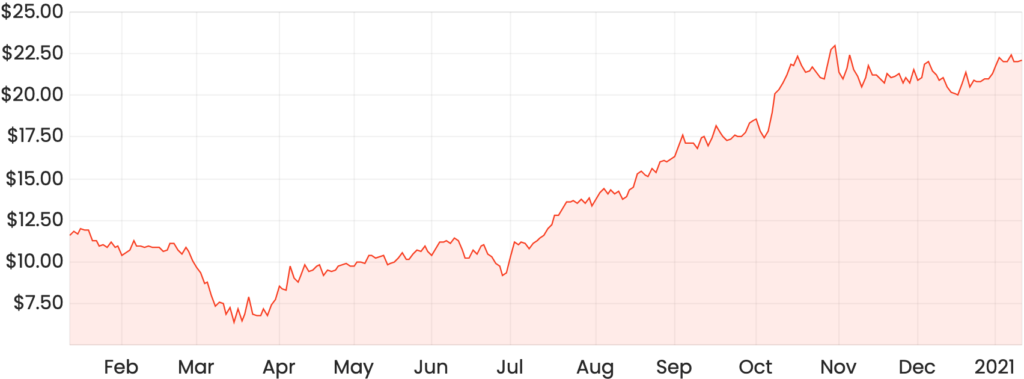

The HUB24 Ltd (ASX: HUB) share price has surged more than 80% in the past year. Is there further upside left in HUB shares for 2021?

HUB24 share price chart

About HUB24

HUB24 is one of Australia’s fastest-growing investment and superannuation platforms. Netwealth Group Ltd (ASX: NWL) is perhaps HUB24’s most comparable listed rival.

HUB24’s platform allows advisers access to a broad range of investment options on behalf of their clients. These investment options include ASX and internationally listed equities (on over 14 exchanges), more than 1,000 managed funds, 200 Australian and international managed portfolios, term deposits, margin lending and insurance.

HUB’s recent acquisition spree

HUB24 announced three strategic announcements on 28 October 2020.

For a total outlay of $93 million, HUB24 acquired competing platform provider Xplore Wealth Ltd (ASX: XPL), accounting and wealth solutions provider Easton Investments Ltd (ASX: EAS) and the Portfolio Administration and Reporting Service from Ord Minnett.

HUB24 believes the acquisitions should benefit the group through the addition of new clients and enhance data and technology services. The acquisitions are expected to produce 13% earnings per share (EPS) accretion by FY22 and synergies of $10 million from FY24.

How is the business performing?

HUB24 most recently updated the market at its annual general meeting (AGM) in November last year.

HUB24 CEO Andrew Alcock highlighted that funds under administration (FUA) had reached $19 billion as at 30 September 2020. On the close of FY20, FUA was $17.2 billion, representing a 34% increase from FY19. Over FY20, HUB24’s market share expanded from 1.5% to 2.1%.

Other financial highlights from FY20 included 37% growth in platform revenue to $74.3 million, underlying EBITDA up 60% to $24.7 million and underlying net profit after tax (NPAT) up 49% to $10.1 million.

Is it too late to buy HUB shares?

Turning to valuation, HUB24 has a current market capitalisation of $1.47 billion, with shares trading on a P/E ratio of 171x and a dividend yield of 0.31%. Clearly, the market is expecting big things from HUB24.

Back on 18 December 2018, I wrote my first article for Rask Media on HUB24. At the time, I suggested HUB24 may justify a valuation of $1.6 billion. This implies about 9% upside from the current share price.

However, an article published this week in Money Management made me sit up and take notice. The article confirmed that competing platform provider, WealthO2, had appointed industry titans Macquarie Wrap founder Neil Roderick and HUB24 founder Darren Pettiona. Further, the article pointed out that WealthO2 had recently surpassed $2.3 billion in assets under management in less than 4.5 years.

This highlights to me that while HUB24 has historically been a disruptor, it may soon become disrupted by emerging players.

All things considered, I would personally not be buying HUB24 shares at today’s prices.