At the time of writing, IOOF Holdings Limited (ASX: IFL) shares offer a trailing 12-month dividend yield of 7.19%. This does not include the benefits of franking credits, which would supercharge this yield.

High dividend yields in combination with other valuation metrics can be a sign a share price is undervalued. However, they can equally be a warning sign that the company has underlying issues.

Dividends yields vary based on changes in the amount of dividends a company pays or changes in its share price. Therefore, a falling share price can make a company appear to have a high dividend yield.

This article will assess IOOF’s recent dividend history.

What does IOOF do?

IOOF is one of, if not, Australia’s largest providers of financial advice, products and services. Today, IOOF has around 500,000 customers and funds under management, advice and administration (FUMA) of $202 billion.

IOOF’s dividend history

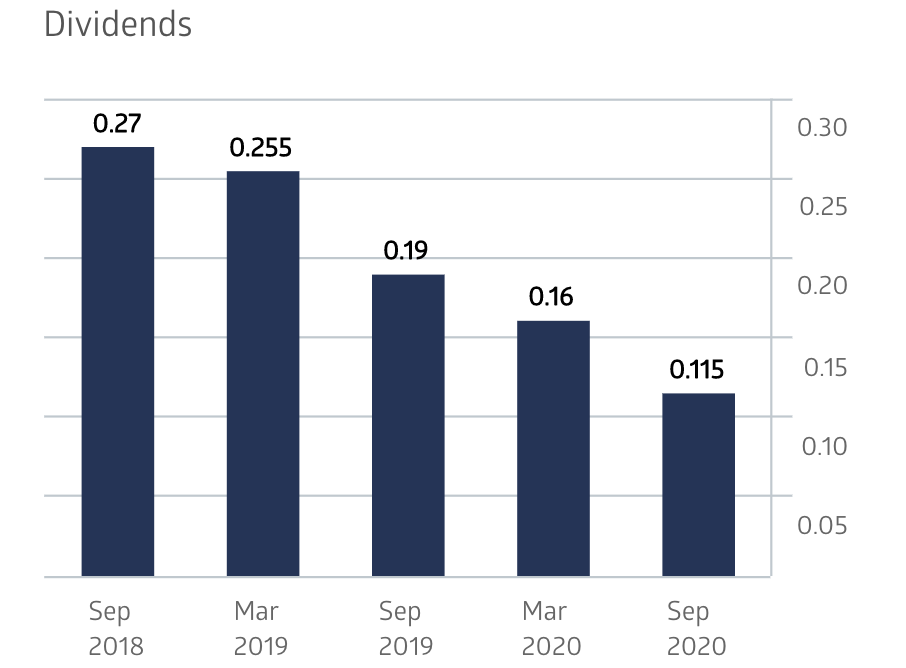

Below is a chart of the last five dividends (interim and final) paid to IOOF shareholders in cents per share. Clearly the dividend trend is going in the opposite direction to what investors would like.

Below is a timeline of comments made by IOOF on dividends paid.

September 2018

Management stated in IOOF’s 2018 annual report: “Underlying profit for the year was a record for IOOF at $191.4m – up 13% on 2017’s strong result. For our shareholders, this translated into a total dividend for the full year of 54cps”.

March 2019

In IOOF’s 1H19 financial result announcement, IOOF Acting CEO Renato Mota commented: “IOOF has reverted to its dividend payout ratio policy of 60–90% with 25.5 cents per share at the upper end of this range. A 27 cent per share dividend in the two previous periods was paid to maintain yield to pre-existing shareholders who might otherwise have had their returns diluted following IOOF’s October 2017 capital raise. The return to policy is reflective of the substantial economic completion of the ANZ Wealth Management acquisition during the half-year.”

September 2019

In IOOF’s FY19 financial result announcement, IOOF CEO Renato Mota remarked: “The Board declared total fully franked dividends for the half year of 19 cents per share, comprised of a final dividend of 12cents per share and a special dividend of 7 cents per share. This takes into account the impact on NPAT of the provision for remediation and is reflective of the economic performance of the business.”

The above-mentioned remediation provisions comprise $182.7 million in remediation costs and $40.4 million in program costs. The provisions stem from the findings of an external advice review undertaken by IOOF to meet the prescribed license conditions of its regulator, APRA (Australian Prudential Regulation Authority).

March 2020

In IOOF’s 1H20 financial result, chief executive Renato Mota declared: “The reduction in the dividend compared to prior corresponding period (pcp) primarily reflects the reduced pre-tax coupon interest in the period of $8.2 million compared to $28.9 million, pcp.”

September 2020

In IOOF’s FY20 results announcement, CEO Renato Mota mentioned: “The Board declared a final second-half dividend of 11.5 cents per share, down 28% from the prior half dividend of 16cents per share. The total dividend payout ratio for the year is 75%. The Board has assessed the reduction in dividend to be a prudent measure in the current economic environment. Post completion of the MLC acquisition, the Board will reassess the appropriate dividend setting and payout ratio range.”

IOOF announced it would acquire MLC from National Australia Bank Ltd (ASX: NAB) for $1.44 billion in August this year.

Dividend bargain or trap?

In my view, IOOF’s current high dividend yield is not evidence of a bargain. IOOF’s declining dividend is an indication of poor performance and could be a warning of underlying organisational issues. I think the acquisition of MLC has made IOOF bigger, but not necessarily better.

I believe there are better options on the ASX for dividend focussed investors, such as Challenger Ltd (ASX: CGF). Click here to read my recent analysis of Challenger.