Bravura Solutions Ltd (ASX: BVS) shares have fallen 23% since the company’s FY20 results release. Is it time to buy?

What does Bravura do?

Bravura Solutions has grown to become a world leader in developing and providing enterprise software and software-as-a-service (SaaS) across the wealth management and funds administration industries.

Its flagship product Sonata provides a unified platform to consolidate multiple legacy IT systems into one customer-centric solution. By using Sonata, clients can save costs on maintaining multiple software systems and increase customer engagement with 24/7 customer access to self-service portals.

Bravura operates in a competitive, constantly changing industry. To remain as competitive as possible, Sonata uses an open-source platform, allowing clients to make changes and improve the functionality of the platform. This involves constant investment into the Sonata product, with $36.3 million invested in R&D in FY20 alone.

FY20 results

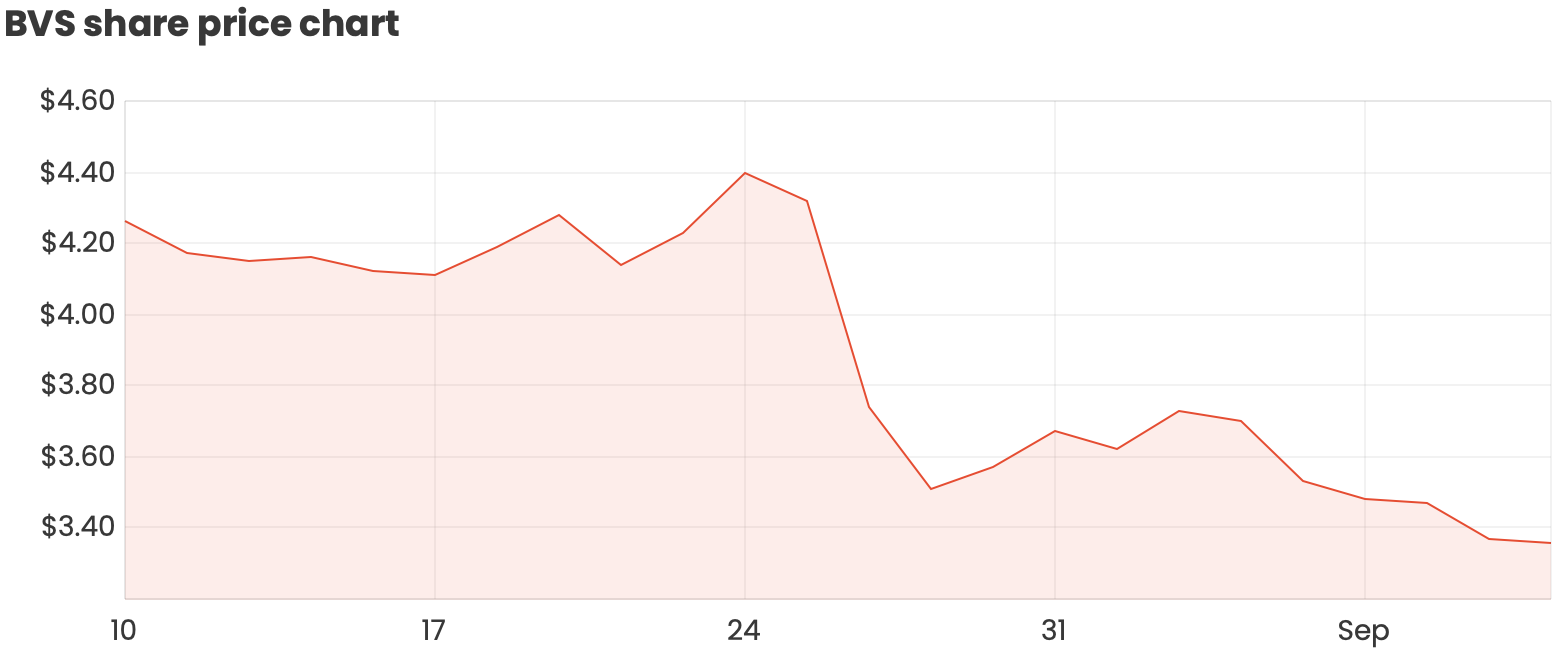

The market didn’t react well to the release of Bravura’s FY20 results. Since the release in late August, the Bravura share price has fallen from $4.32 to its current price of $3.37 (at the time of writing).

Some analysts have predicted a decrease in the number of new clients as a result of COVID and broader macroeconomic uncertainty. Despite this, the group reported revenue of $274.2 million, up 6% on FY19. EBITDA saw a significant increase to $57.8 million, up 19%.

The reason for the significant downturn in share price seems somewhat unclear. The COVID-19 pandemic has not significantly changed the fundamentals of its operations.

Bravura employees have been able to work from home since the pandemic began, and cash flows have remained resilient as client contracts remain on a 5-10 year-long timeframe. Indeed, the sales cycle had to be lengthened due to COVID-19, but there is yet to be seen any significant damage as a result of the pandemic.

Why I still like Bravura’s fundamentals

Share price aside, I think Bravura has some really attractive features that should be sustainable into the future:

- Scalability – For the fourth year in a row, Bravura has been able to achieve a higher EBITDA and NPAT margins than that of the previous year. A high fixed cost base means an increase in sales will drive operating efficiencies and bring up margins.

- Strong balance sheet – A strong cash balance of just under $100 million. It should be able to meet any financial obligations even with COVID-19 impacts.

- Recurring revenue – The majority (77%) of its revenue comes from a recurring revenue stream. Strategic partnerships and 5-10 year client contracts drive higher and longer revenue streams.

- Increased need for regulatory compliance – Sales are being driven by the need to support continuous regulatory change.

Takeaway

It could be argued that Bravura is facing a challenging macroeconomic environment with constant R&D investment needed to keep up in a competitive industry. However, I think it is well-positioned and has more opportunity to scale well into the future.

I like how management has grown the company, and I think it still operates on strong fundamentals. I would be a buyer of Bravura today, but might keep an eye on the price for now in hope of picking it up at a bigger discount.