The Service Stream Limited (ASX: SSM) share price will be on watch today after the company delivered its FY20 report after the market closed on Tuesday.

Service Stream is an essential provider of network services to the telecommunications and utility sectors in all Australian states and territories.

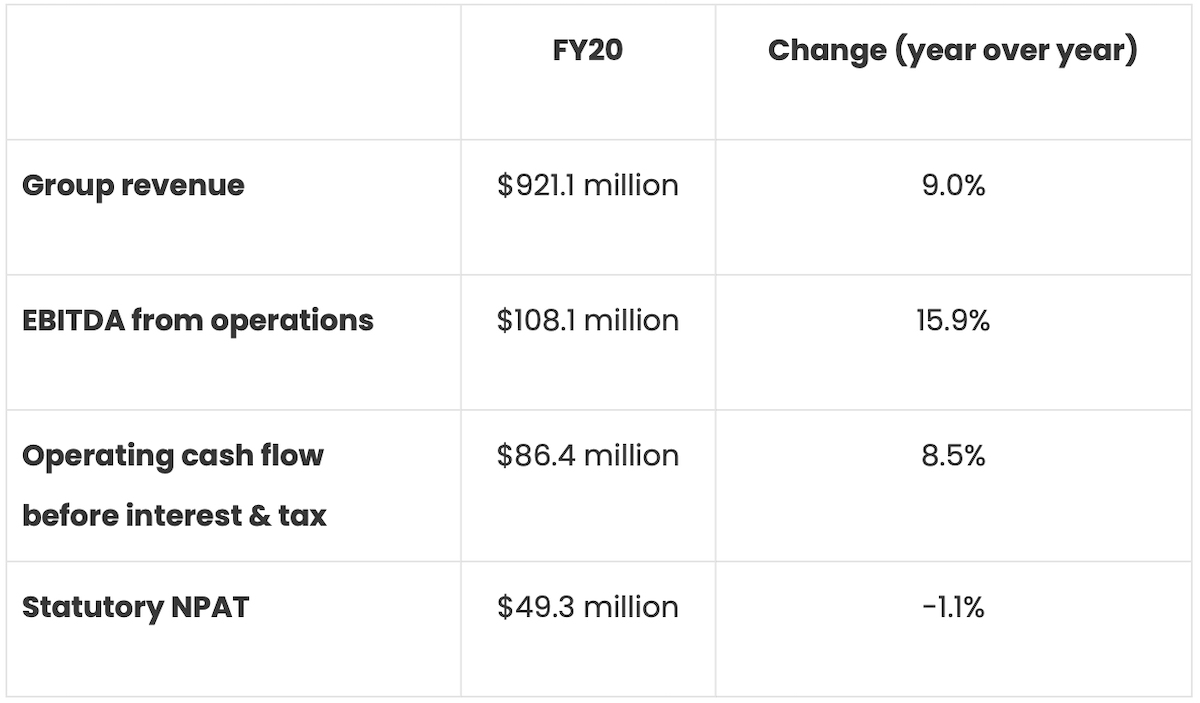

What did Service Stream report?

Looking at segment results, Telecommunications contributed $544.2 million of revenue, a decrease of 7.7% on FY19. Service Stream said this was due to the successful conclusion of its nbn design and construction (D&C) operations, along with clients delaying the commencement of wireless projects due to COVID-19.

Revenue associated with fixed-line activation and maintenance services increased during the year. However, the company noted it experienced COVID-related reductions across some operations and maintenance (O&M) activities in the second half.

Service Stream’s other key business segment is Utilities, which increased its revenue by 45.3% to reach $384.1 million. This was the result of the inclusion of a full year of revenue from Comdain Infrastructure, an engineering and asset management services company that Service Stream acquired at the end of 2018.

Elsewhere in the Utilities division, revenue from metering services and new energy activities was largely flat over the prior year.

Service Stream’s dividend

Service Stream declared a final dividend of 5 cents per share (cps), fully franked, 9% lower than the 5.5 cps final dividend in FY19.

This brings full-year dividends to 9 cps, consistent with FY19. Service Stream increased its dividend payout ratio in order to maintain the dividend – FY20 dividends reflect a payout ratio of 74.2% of statutory earnings per share compared to 68.8% in FY19.

Service Stream shares closed at $1.82 yesterday, meaning shares are currently offering a juicy dividend yield of around 4.95%.

Impact of COVID-19

Service Stream noted that although there have been some negative impacts to its operations from COVID-19, demand for essential network services has remained firm. As a result, the company’s earnings to date have not been significantly affected.

Some of the impacts of COVID-19 include increased costs to support safety-related protocols across the business, customer-initiated moratoriums on electricity and gas disconnections, reduced residential land development activity, and the deferral of some maintenance activities and projects.

Nonetheless, Service Stream assured investors its balance sheet, cash flow and liquidity remain strong, and confirmed it has not drawn upon JobKeeper or other government support packages.

Outlook

Looking ahead, managing director Leigh Mackender said: “Service Stream remains well positioned to deliver consistent performance into the future and expects earnings to continue to be resilient, supported by the business holding a significant contract base of strong annuity-style revenues, exposed to essential infrastructure networks.”

Commenting on Service Stream’s focus in FY21, Mr Mackender concluded: “Priorities for the coming year include securing organic growth opportunities from a significant and expanding internal pipeline; re-securing those agreements which are due to expire, and further progressing strategic growth opportunities aligned to our core sectors, supporting ongoing growth and diversification.”

Unsurprisingly, the company refrained from providing any guidance.

Today is set to busy day of reporting with results expected from the likes of CSL Limited (ASX: CSL), a2 Milk Company Ltd (ASX: A2M), and WiseTech Global Ltd (ASX: WTC), to name just a few.

For all the latest coverage on reporting throughout August, be sure to bookmark Rask Media’s reporting season page and ASX reporting season calendar.

[ls_content_block id=”14948″ para=”paragraphs”]