With buy now, pay later shares all the rage right now, I thought I’d shine a spotlight on a sector that once received similar levels of hype: infant formula.

In the ASX infant formula space, there are 3 shares in particular that provide pure-play exposure.

Of course, the largest and most popular of them all is none other than a2 Milk Company Ltd (ASX: A2M

), the dual-listed market darling that has enjoyed tremendous success since listing on the ASX in 2015.

Following the takeover of Bellamy’s last year by Chinese dairy group Mengnui, the next biggest ASX-listed player is Bubs Australia Ltd (ASX: BUB), the nation’s largest producer of goat milk products.

Finally, at the smaller end of the ASX lies Nuchev Ltd (ASX: NUC), a direct competitor to Bubs through its Oli6 brand of goat milk products. Nuchev landed on the ASX boards in December 2019 and is founded and led by Ben Dingle, co-founder of Synlait Milk Ltd (ASX: SM1).

Here’s a snapshot of how the three companies stack up:

Products

When it comes to analysing a company, one of the very first steps is understanding what the business actually does. So to get a better handle of this, let’s run through the product ranges of each of these three companies.

a2 Milk

Although not comprehensive, the photo above is the essence of a2 Milk’s product line up. The company’s portfolio consists of:

- Infant formula – through its a2 Platinum brand

- Liquid milk – fresh full cream, light and no fat milk; plus creamers & flavoured milk in the US

- Other nutritional – including standard milk powder (full cream and skim), a2 Smart Nutrition (designed for children aged 4-12), and a2 Nutrition for Mothers (designed for women pre, during and post-pregnancy)

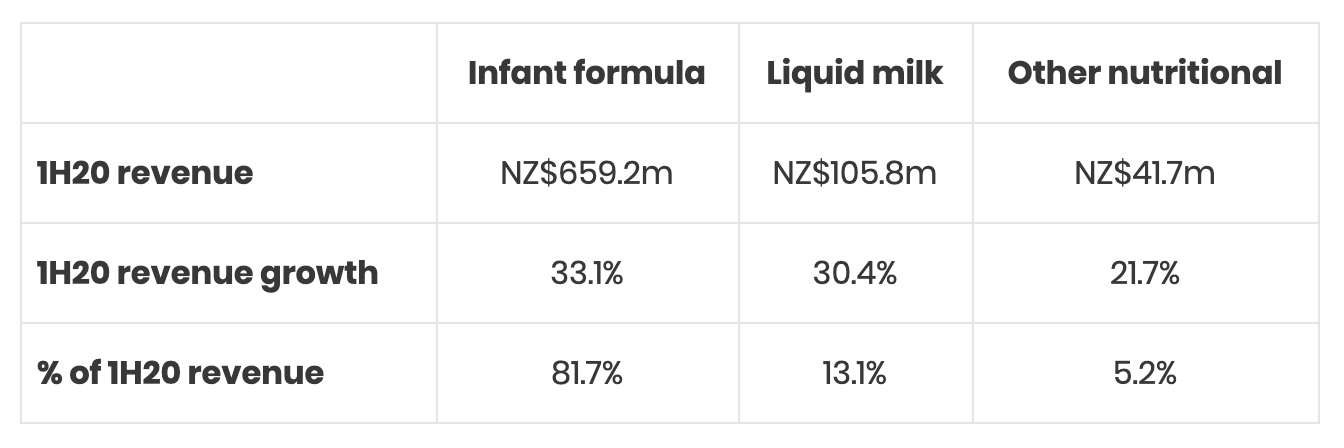

Here’s a breakdown of how these product segments performed in the first half of FY20:

Infant formula is by far a2 Milk’s biggest breadwinner, with an established position in the domestic ANZ (Australia and New Zealand) market and a growing presence in the lucrative Chinese market – via both online and offline channels.

Bubs

Bubs has the largest product range of the three and is the only company on this list that firmly ventures out of the dairy space.

Bubs’ product portfolio consists of:

- Goat milk infant formula

- Cow’s milk organic infant formula

- Organic baby food & toddler snacks – including puree, cereal and rusks

- Adult goat dairy powder – sold under the CapriLac and Deloraine brands

- Fresh dairy products – including fresh goat milk sold under the CapriLac brand

Additionally, through its acquisition of Deloraine Dairy in April 2019, Bubs provides canning services of nutritional dairy products.

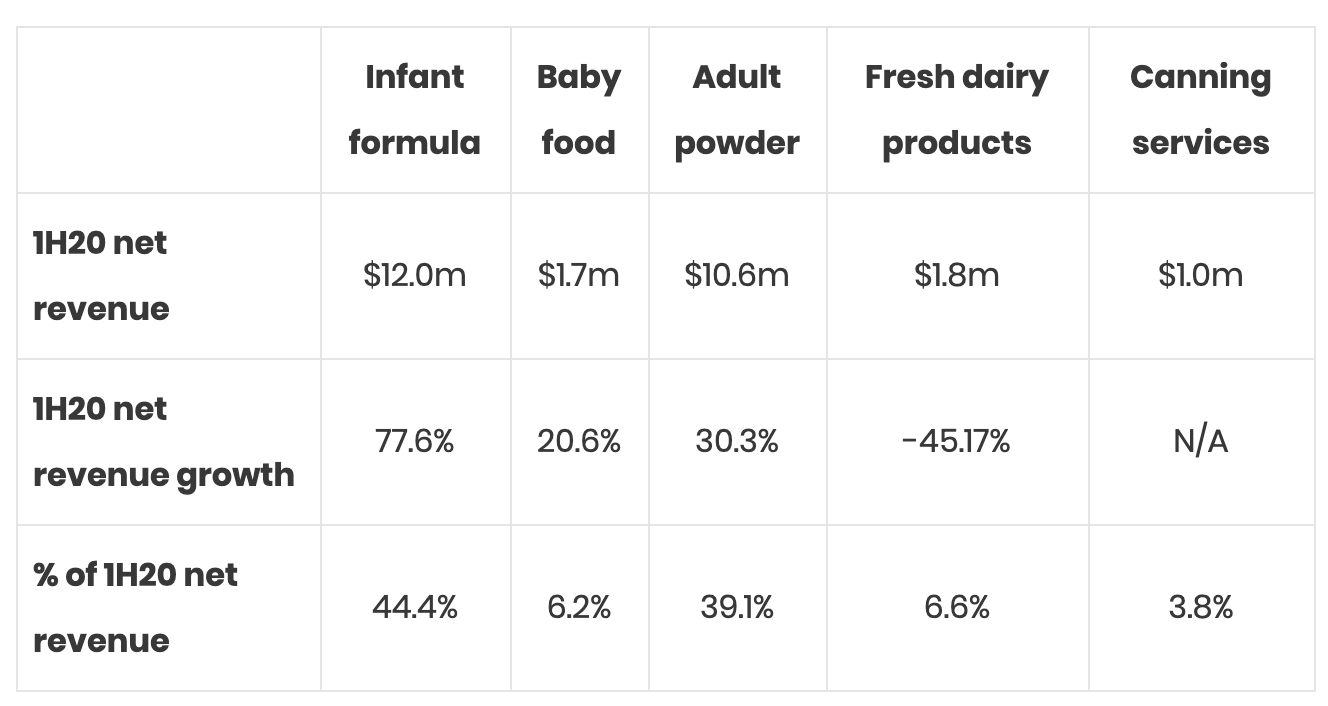

Here’s how these product segments contributed to Bubs’ top line in the first half of FY20:

The most recent half saw Bubs continue to invest in the growth of its high-margin products, primarily infant formula. In the fresh dairy segment, the company deleted yoghurt products from its line up due to poor profitability, while the Coach House Dairy brand (known for chocolate milk) was sold off in mid-2019.

Nuchev

Nuchev is focused on developing, marketing and selling a range of Australian-made goat nutritional products, primarily through its Oli6 brand.

The Oli6 product portfolio is as follows:

- Goat milk infant formula – available in cans, pouches, and sachets

- Adult goat milk powder – available in cans and pouches

Due to its size and straightforward product range, Nuchev doesn’t report segment revenue in terms of product type. The company may decide to provide more colour on this as it grows.

Markets/Geographies

In addition to knowing what a company sells, it’s also important to know where these products are sold. So, let’s dive into the key markets for each of these companies.

a2 Milk

Here’s a run-down of a2 Milk’s current markets:

- Australia and New Zealand – infant formula, liquid milk and milk powder

- China – infant formula, liquid milk and milk powder

- Singapore – liquid milk

- Hong Kong – infant formula

- South Korea – infant formula & liquid milk (via distribution partnership)

- USA – liquid milk

- Canada – liquid milk (via licencing agreement)

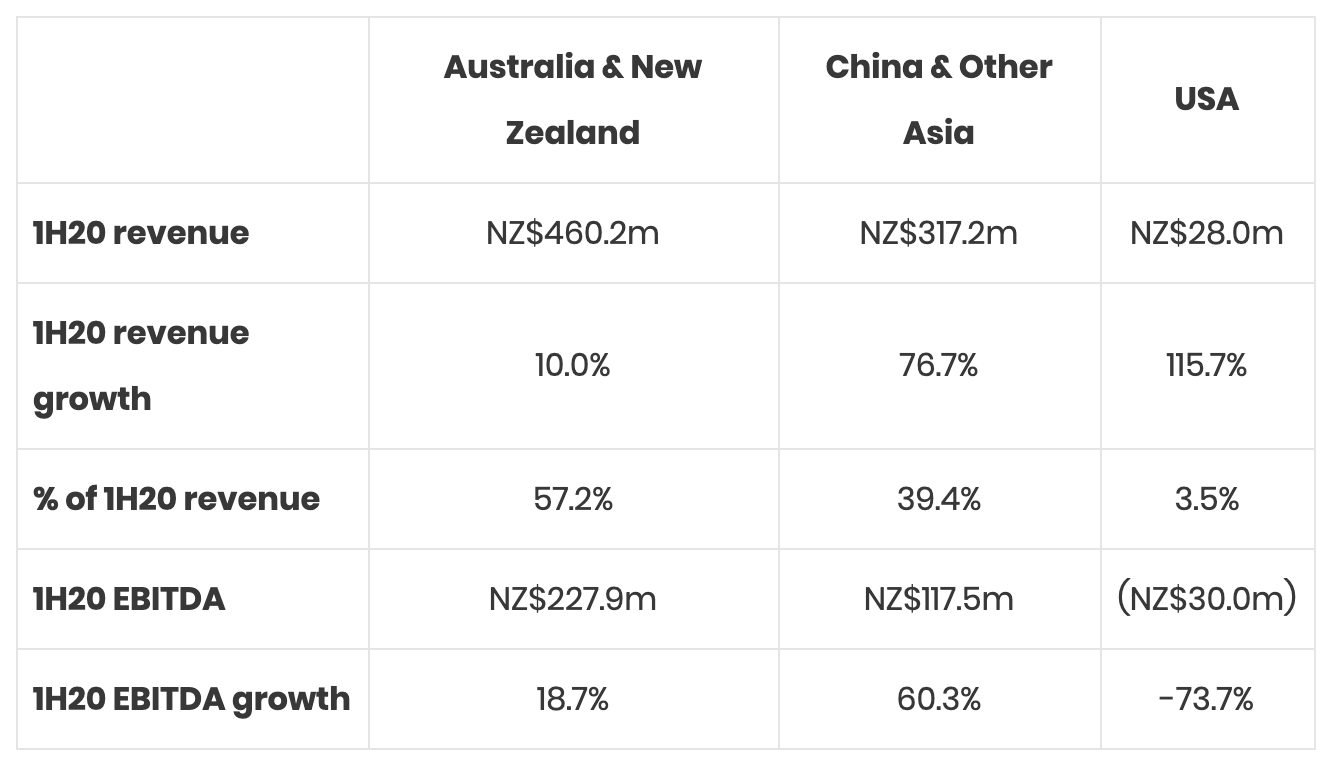

And here’s a breakdown of regional first-half FY20 revenue:

The table above excludes NZ$1.4 million of sales from a2 Milk’s discontinued UK liquid milk operations, which were wound down over 1H20. The company entered the UK market in 2011 but struggled to gain footing. When announcing its decision to exit the UK in August last year, a2 Milk noted it would instead focus on realising significant value from its core regions of China and the US.

Meanwhile, the company’s expansion into Canada was announced in mid-March this year. Therefore, this region didn’t contribute to revenue in 1H20.

Bubs

Bubs has established a strong presence in the Australian market and is gaining traction overseas through strategic partnerships and distribution agreements.

Here’s how Bubs breaks down its revenue in terms of geography:

- Australia – infant formula, baby food and adult goat dairy products (powder & fresh milk)

- China – infant formula, baby food and adult goat dairy products (powder & fresh milk)

- Other international, which includes:

- Singapore – infant formula & baby food

- Vietnam – infant formula & baby food

- Hong Kong – infant formula & baby food

Here’s how this shakes out in Bubs’ financials:

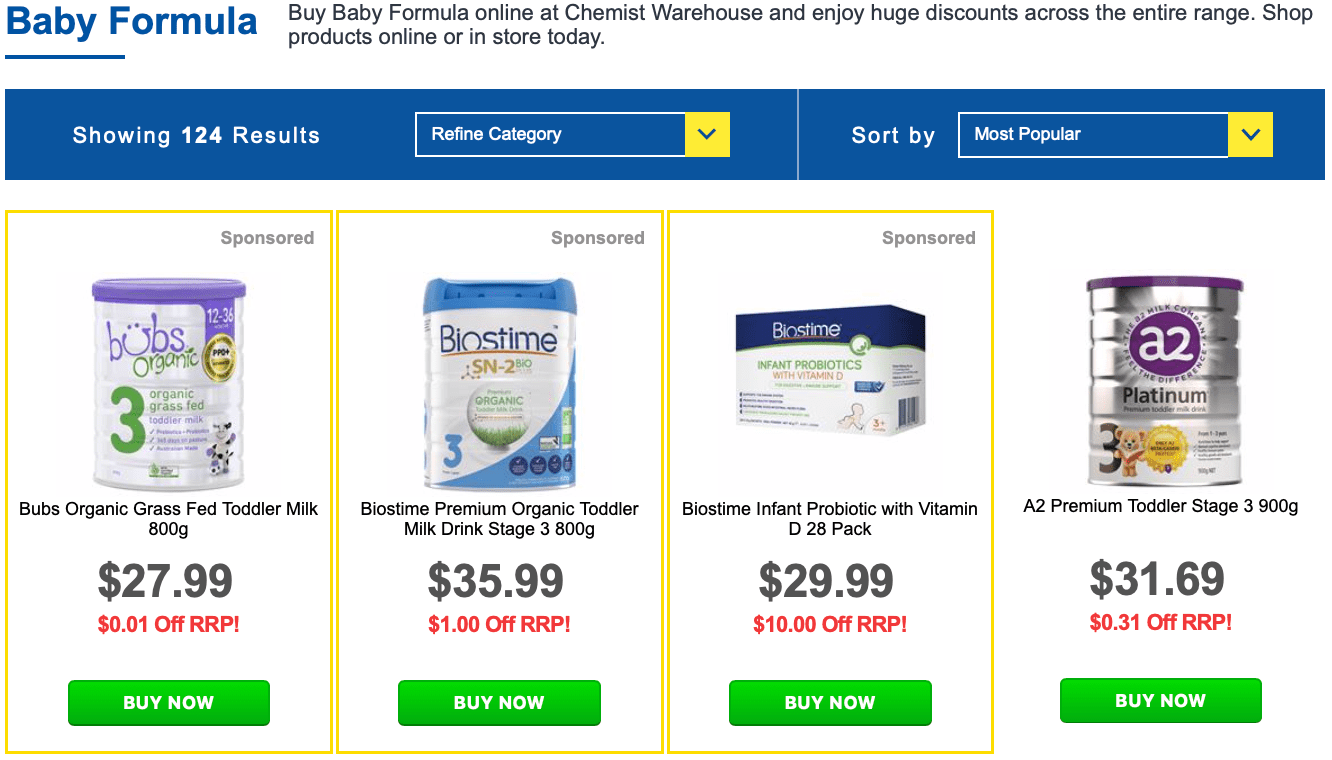

Bubs distributes its products through the top four infant formula retailers in Australia: Coles, Woolies, Chemist Warehouse and Big W. Notably, it signed a 4-year, equity-linked alliance with Chemist Warehouse in mid-2019, through which Chemist Warehouse will gain up to 49 million Bubs shares in return for stocking the full Bubs product range across its network, along with providing sales and marketing services. An example of these services can be seen when searching for baby formula on Chemist Warehouse’s website – a Bubs product is shown at the top under a sponsored listing (see below).

Bubs has a presence in the lucrative Chinese market through strategic cross-border e-commerce (CBEC) partnerships and the Daigou network. Last year, it formed a joint venture with Beingmate, one of China’s leading domestic infant nutrition companies, to sell its portfolio of infant formula and baby food products in China. Through this joint venture, Bubs secured a distribution agreement with Kidswant, China’s largest mother and baby store chain.

Bubs also has partnerships with e-commerce giants Alibaba and JD.com, which both have ties to investments in Bubs shares. Nancy Zhang and husband Richard Liu, founder of JD.com, were cornerstone investors in Bubs’ IPO, while C2 Capital (which counts Alibaba as an anchor investor) has a 15% shareholding in Bubs.

Nuchev

Nuchev sells its Oli6 products in Australia, China and more recently, Hong Kong. Its key distribution channels in Australia are retailers Coles and Chemist Warehouse. The company has a presence in China through CBEC partnerships and the Daigou network. Meanwhile, in mid-2019, Nuchev inked a deal with a distribution partner in Hong Kong to sell Oli6 products in Watsons, a premium pharmacy retailer, and other general pharmacies.

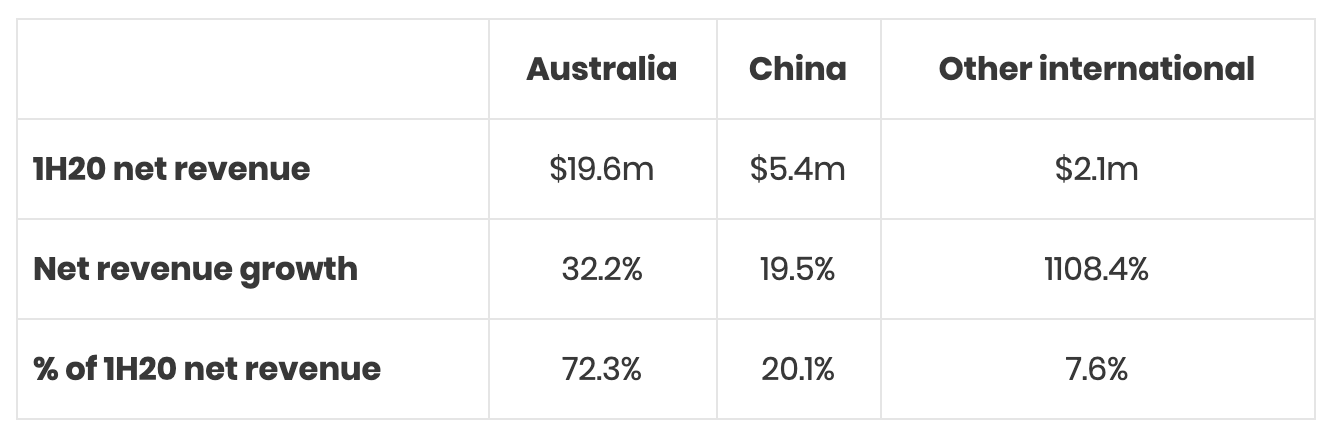

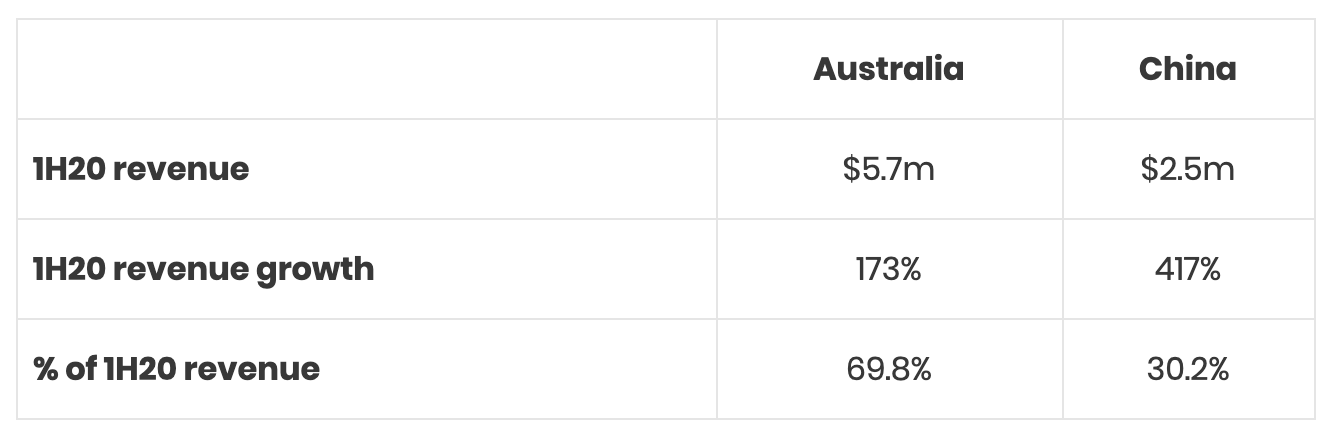

Here’s a breakdown of Nuchev’s regional performance in the first half of FY20:

Looking forward, Nuchev has named Singapore, Vietnam, Taiwan and South Korea as additional markets it can expand into in the near-term to increase sales volumes.

So what’s the verdict?

I think it goes without saying but this forms just the start of understanding each of these companies and, in turn, being able to analyse and compare them. If you’re interested in taking a deep dive into one (or all) of these shares, I’d suggest looking into supply chain & distribution, management quality, competitive advantages (if any), growth strategies and, of course, risks.

I’m currently a happy shareholder of a2 Milk, with its capital-light business model, brand power and supply-side competitive advantages all but a few factors that drew me in. As for the other two companies, Bubs is high on my watch list right now, while I’d need to do more work on Nuchev since it’s a business I’m less familiar with.

If you’re interested in learning more about a2 Milk shares, I’d urge you to read this fantastic piece from Matt Joass of Maven Funds Management: The Story of the 2,200% Monster Next Door.

If you have your sights set on the up and comer Bubs, check out this popular article by Rask Media’s Jaz Harrison: 3 Reasons Why the Bubs Share Price Is Worth Watching.

And if you want to invest in the smaller cap space, another share to watch is Clover Corporation Limited (ASX: CLV). Although it doesn’t directly sell infant formula, Clover is exposed to the booming industry by supplying a key ingredient: omega-3 fatty acids. Using its microencapsulation technology, the company produces nutritional ingredients that go into things like infant formula, baby food and supplements.