Emerging markets (EM) equities were among the worst hit as global markets sold off in response to the COVID-19 pandemic. However, emerging markets look compelling from a valuation standpoint and could benefit from the swift and sizeable response from policymakers in developed markets.

Setting the scene

Investors have been concerned that emerging markets, which generally have less domestic policy firepower and flexibility in this crisis, have been more restrained. However, emerging markets benefit from the stimulus in developed markets because they are linked to final demand in the developed world via the raw materials and the technology they produce and they are impacted by the value of the US dollar, as the reserve currency.

Therefore, this unprecedented policy stimulus supports external demand for emerging economies and it will push down the value of the US dollar which is beneficial for emerging markets growth.

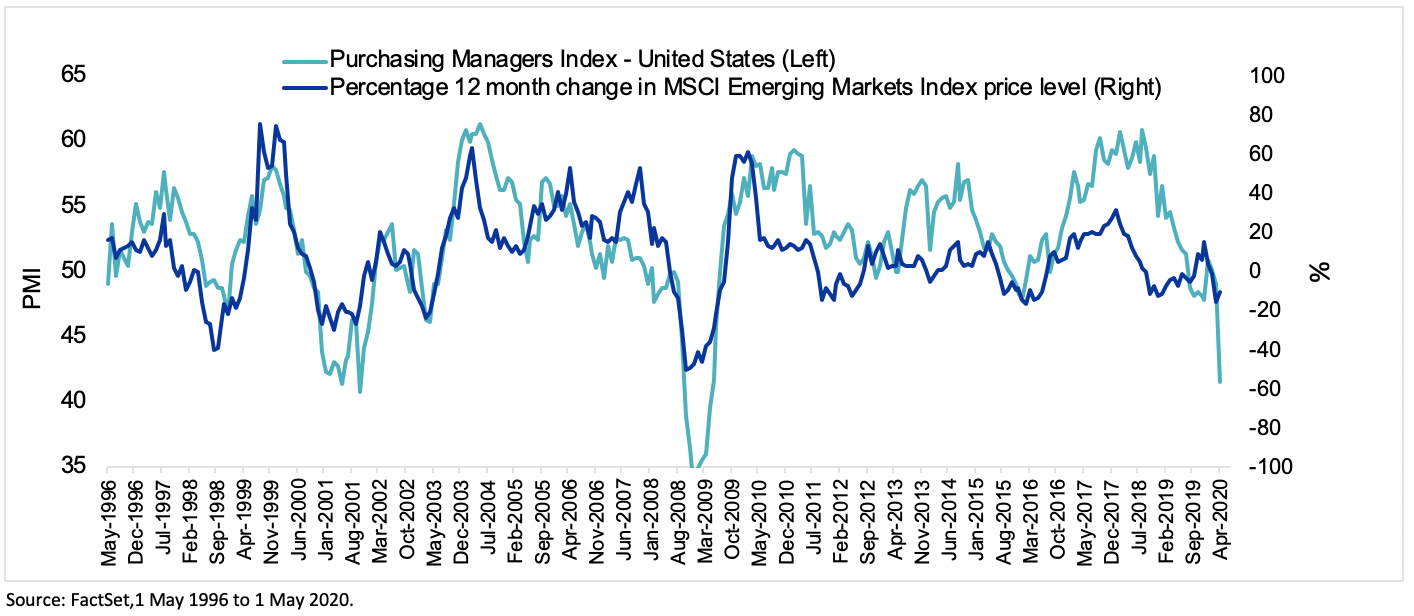

The correlation between the performance of the MSCI Emerging Markets Index and the US Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) has been high and this crisis has been no different. However, should US manufacturing PMIs turnaround, EM markets could potentially follow suit.

Chart 1: US ISM Manufacturing PMI and MSCI Emerging Markets Index

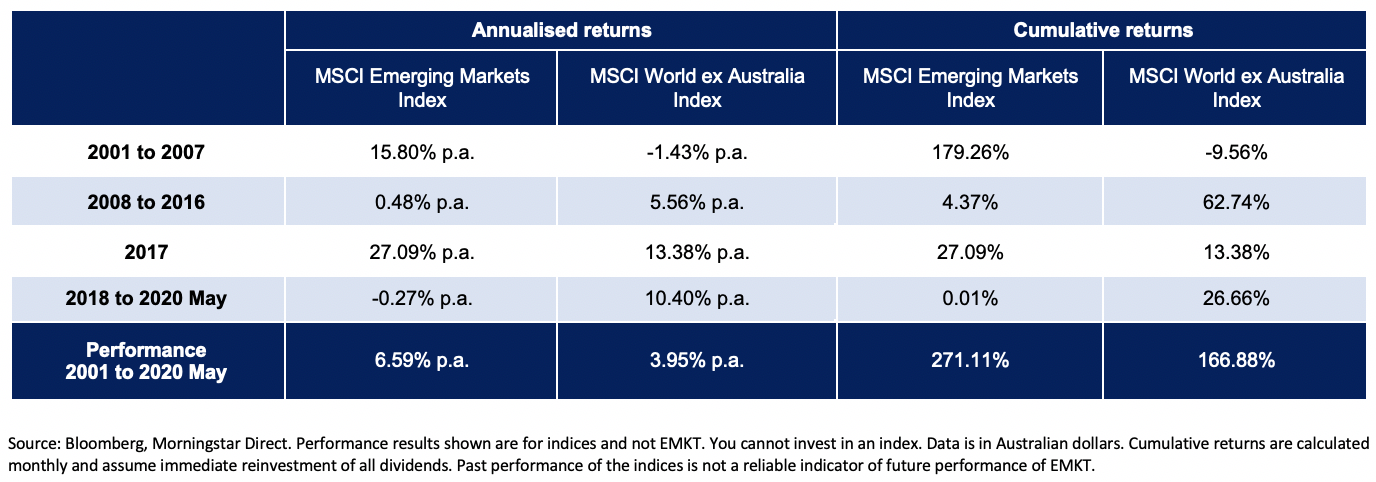

Since 2001, emerging markets have outperformed developed markets, though it has been a wild ride. Australian investors with global equity portfolios that had exposure to EM equities were rewarded in the lead up to the GFC (2001 to 2007 below) benefiting from the emerging markets boom.

They then underperformed, prior to a stellar year in 2017. Since then, emerging markets have underperformed developed markets as the US dollar strengthened. However, with greater policy stimulus in developed markets it is expected there will be pressure on the US dollar. This bodes well for emerging markets.

Table 1: Annualised and cumulative returns for emerging markets versus developed markets over past 20 years

Valuations are compelling

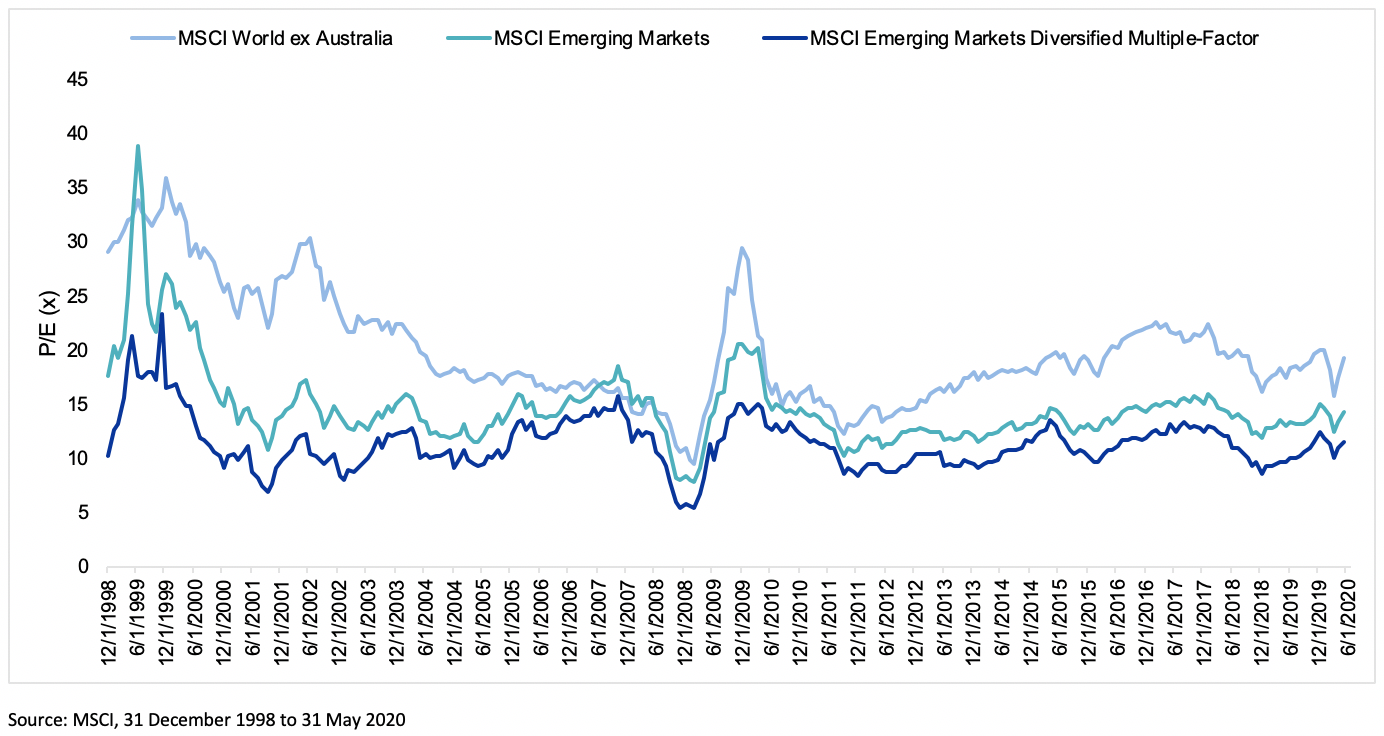

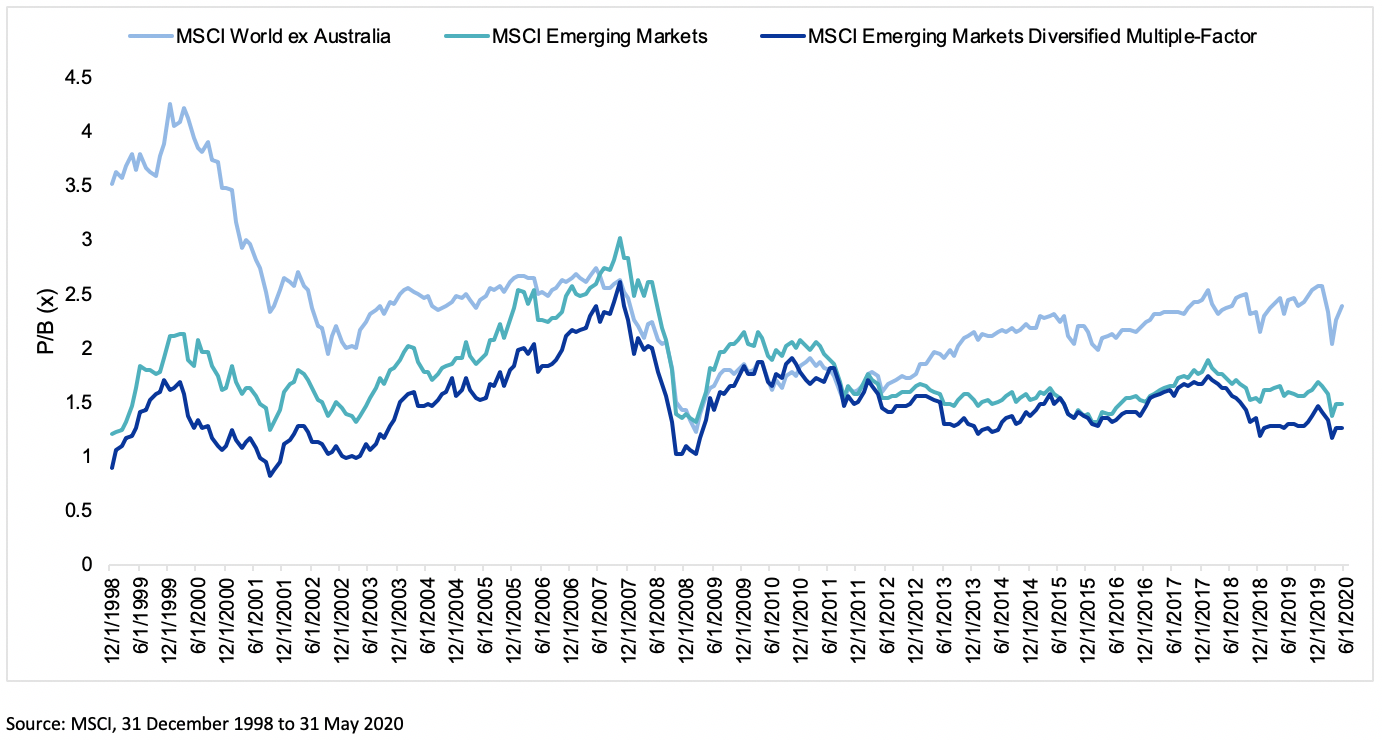

Right now, EM equities look compelling from a valuation standpoint and are trading at a significant discount to companies in developed markets.

EM equities are currently trading at 37% and 24% discount on a price-to-book basis and price-to-earnings basis to developed markets respectively and are nearly at the bottom of the long term range, unlike developed markets which have bounced back more and are trading at historically high ratios.

Chart 2: Relative P/E of developed markets and emerging markets

Chart 3: Relative P/B of developed markets and emerging markets

A smarter way to invest in EM equities

Investing in emerging markets has traditionally been expensive and returns among active managers vary significantly from year-to-year because it is almost impossible for active managers to time factors in emerging markets.

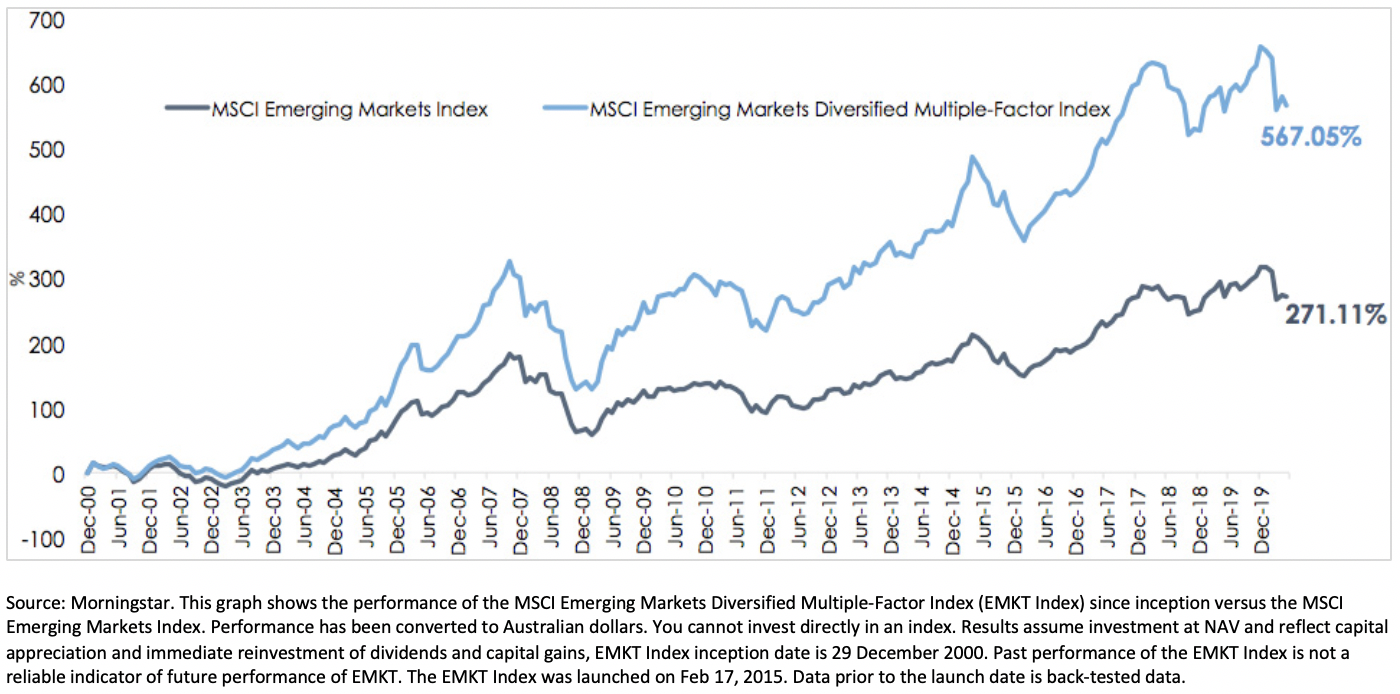

Over the long term, a multi-factor approach has exhibited significant outperformance. This is illustrated in the below chart.

Accessing EM equities

The VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT) tracks the MSCI Emerging Markets Diversified Multiple-Factor Index (EMKT Index) and provides investors with access to a diversified portfolio of emerging markets companies that demonstrate four factors: Value, Momentum, Low Size and Quality.

This report was written by Russel Chesler

, Head of Investments & Capital Markets at VanEck Australia. To get in contact with Russel, click here to visit the VanEck website.

[ls_content_block id=”14942″ para=”paragraphs”]