The Tyro Payments Ltd

(ASX: TYR) share price was trading higher yet again today, following the release of its latest trading update during COVID-19. As I write this, Tyro shares have more than tripled since March 2020.

For context, the broader Australian share market or S&P/ASX 200

(ASX: XJO) was trading up 0.18% after the open.

What do Tyro Payments do?

Tyro is a technology company that provides payment solutions and business banking products. It is partnered with over 32,000 Australian merchants. In the first half of FY20, the company processed $11.1 billion in transaction value which generated $117.3 million in revenue.

It also originated $37.4 million in loans and held merchant deposits totalling $39.7 million. It was founded in 2003 and now it’s the fifth-largest merchant acquiring bank by a number of terminals in the market.

Featured video: how to value tech stocks

The video above, taken from our free share valuation course, explains how to value a company — such as a tech stock like Tyro or a supermarket like Woolworths Ltd (ASX: WOW) — just like a professional analyst. We even give you our spreadsheets to download. Click here to take the course.

Tyro Payments’ update

Since Tyro Payments provides services to thousands of small retail businesses, from cafes to clothing stores, the company has been a key focus for technology investors and market pundits more broadly.

Will COVID-19 severely dampen its business model and prospects?

Will it rebound?

Are people still shopping?

These are the types of questions investors are asking and, as a result, following along with Tyro’s updates very closely.

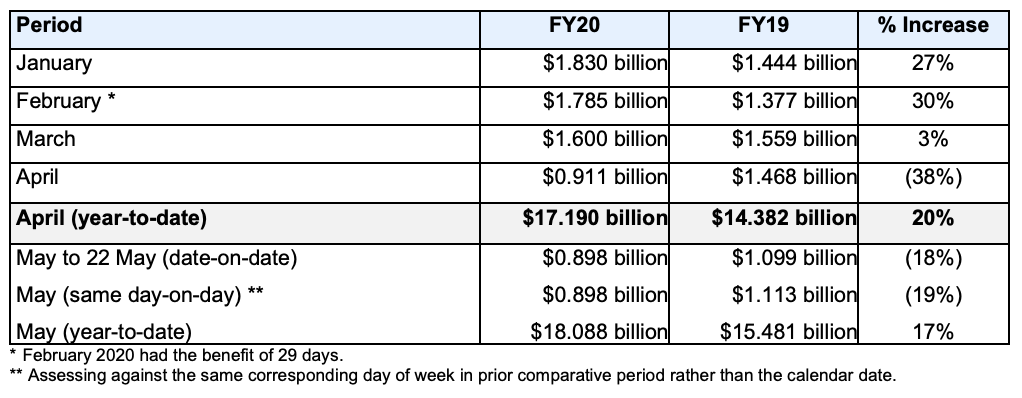

The latest update from Tyro showed that payment transaction volume over its platform in May 2020 had fallen 18% versus the same time period in 2019.

Here are the key updates from the company’s investor release:

On face value, an 18% fall sounds scary and might suggest investors should be concerned about it, and maybe even Afterpay Ltd (ASX: APT) or Splitit Ltd (ASX: SPT) which are similar but different businesses operating in the payments space.

However, the good news investors probably took away from the update was that things may actually be getting better. The reason for this is that during April, transaction volume was down 38% versus the 2019 period whereas in May payments were down ‘only’ 18%, suggesting that the tide may have turned.

Buy, Hold or Sell?

Tyro shares are up more than 300% since their lows in March 2020.

While one part of me says it could be a little too early for investors to get too excited — and the company’s valuation already looks very stretched — maybe the worst is behind Tyro and Australia? If that’s the case, Tyro is one for the watchlist.

Personally, I think there are better technology opportunities available for investors right now.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: at the time of publishing, Owen does not have a financial interest in any companies mentioned.