The Tyro Payments Ltd (ASX: TYR) share price was trading 4.56% higher today following news of a trading update.

For context, the broader Australian share market or S&P/ASX 200 (ASX: XJO) was trading at 5445.8, down 0.76%.

About Tyro Payments Ltd

Tyro Payments Ltd is a finance and technology business engaged in the provision of merchant credit, debit and EFTPOS services. You might have used its software at a retailer or cafe and not even known it existed. The company was founded by Peter Haig, Andrew Rothwell, and Paul Wood in 2003 and is based in Sydney, Australia.

Tyro Payments update

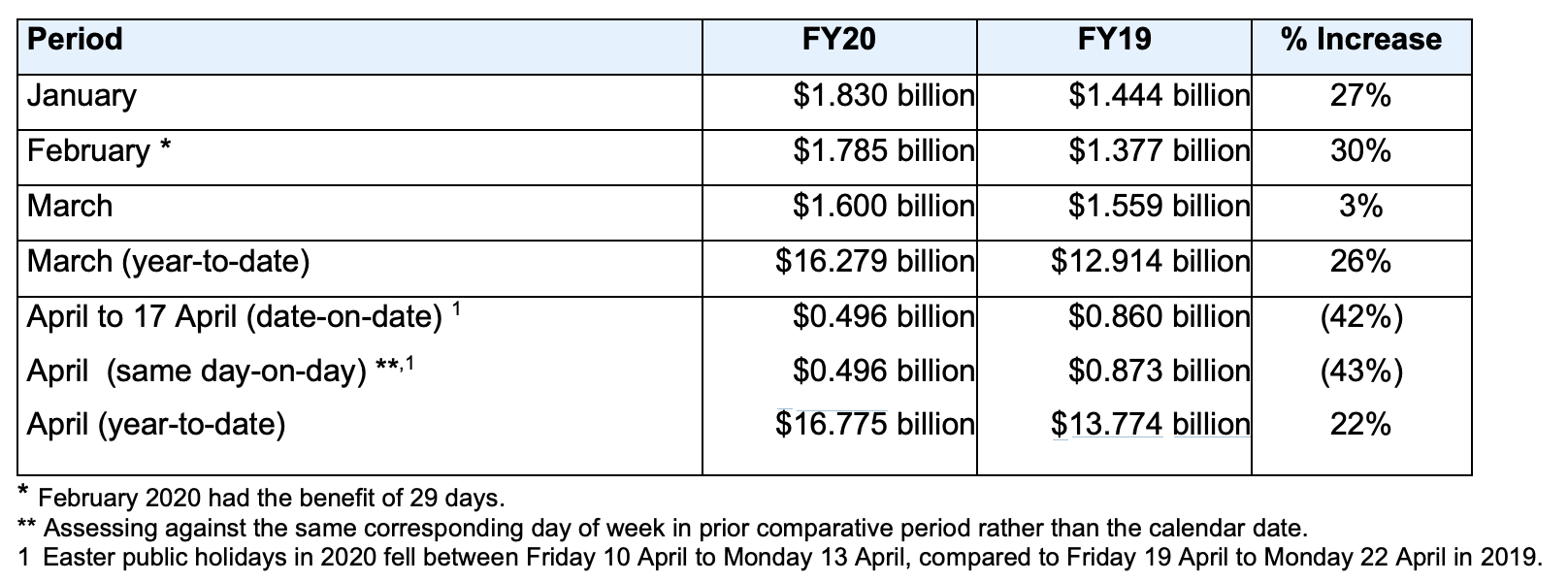

In an ASX update today, Tyro Payments reported that the total transaction value going through its platform was up 22% for the year to April, 2020. In all, Tyro reported $16.775 billion of transaction value, up from $13.774 billion in the same period last year.

Investors who were worried about the performance of Tyro are no doubt reassured by this update since it shows the company is growing throughout the COVID-19 slowdown.

Alongside Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P), Tyro has been one of the ASX’s strongest performers despite the expected economic slowdown in recent months. That said, the company’s share price is actually below where it started in 2020.

If you’re interested in Tyro Payments, you should read this article discussing technology stocks on the ASX.

Tyro Payments shares were last seen trading at $2.98, giving the company a market capitalisation more than $1 billion.

[ls_content_block id=”18457″ para=”paragraphs”]