Commonwealth Bank of Australia (ASX: CBA) is Australia’s largest bank by a big margin, but are CBA shares really worth more than $78? In this article, I take a look at one way to think about a bank’s share valuation.

About CBA

Commonwealth Bank of Australia or CBA is Australia’s largest bank, with commanding market share of the mortgages (24%), credit cards (27%) and personal lending markets. It has 16.1 million customers, 14.1 million are in Australia. It is entrenched in the Australian payments ecosystem and financial marketplace.

One Way To Value CBA Shares

There are many ways to value a company, some better than others. Arguably the best way to value shares is with a discounted cash flow (DCF) analysis, but this can be very complex and requires a lot of assumptions.

For a quick, simple (and rough) valuation of bank shares like CBA, we can use the dividend discount model (DDM).

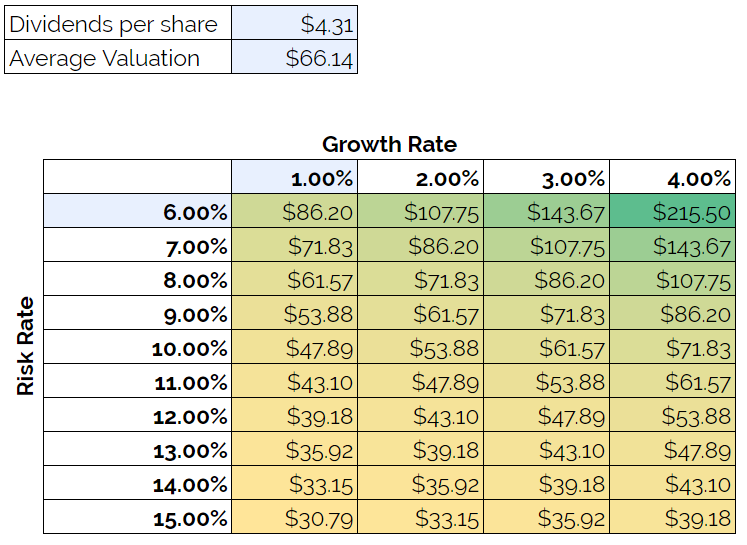

Using this dividend discount model, we take the most recent dividends paid by Commonwealth Bank and divide it by the required rate of return (or risk rate) minus the growth rate. The 2019 full-year dividend was 431 cents per share (cps), the same as in 2018.

I won’t go into much detail here on how the calculation is done, but the short video below explains how to use the model and how to determine a risk rate.

If we use a spreadsheet, we can come up with a valuation for CBA that takes the average of lots of different assumptions. What we end up with here is an average CBA share valuation of $66.14, about $12 lower than the current market price.

However, we may be better off looking at the top left-hand corner of the table, because a company as well-established as CBA will have a relatively low risk rate and we know the growth rate over the last few years has been very low.

Based on those results, we might say a fair valuation for CBA shares is closer to $70 per share.

Time To Sell CBA?

This simple valuation should not be relied upon because a DDM should always be used in conjunction with other valuation methods and research. However, it does serve as one indicator that CBA shares may be trading at a premium and would be particularly susceptible to a dividend cut.

With banks still feeling the impact of the Royal Commission and low interest rates hurting profitability, I’d rather invest in one of the proven businesses in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not have a financial interest in any of the companies mentioned.