The Apple Inc (NASDAQ: AAPL) stock price has been a stellar performer for investors but what comes next? As part of the FAANG stock series Aoris take a look at the era Apple left behind and what’s next for the technology giant.

The era Apple has left behind

Apple co-owns the smartphone and tablet markets with Samsung, but it dominates the business of device dollars. In 2018 Apple captured approximately 16% of smartphone shipments, 51% of smartphone revenue and 73% of smartphone profits (Source: Counterpoint Research).

In achieving this position as one member of the device duopoly, Apple has ‘eaten its own children’ by discontinuing the iPod, successfully transitioning leadership of the company from an iconic founder, and redefining the consumer electronics shopping experience through the Apple Stores.

It was almost solely responsible for the demise of Nokia, once Europe’s largest public company; BlackBerry, once so popular it was dubbed ‘CrackBerry’; and the mobile phone businesses of Ericsson and Motorola. It has seen off tablet and handset competition from fellow FAANGs Amazon (Fire), Google (Pixel) and Nokia once again, this time under the ownership of Microsoft.

Consumer desire for its devices has proved remarkably resilient in the face of low-cost alternatives from Chinese phone makers such as Xiomi, Oppo and Vivo. Such has been the strength of Apple’s brand that new phone launches are routinely met with blanket front-page news coverage around the world and around-the-block queues of Apple devotees eager to fork out US$1000 for a shiny new phone.

The era Apple has entered

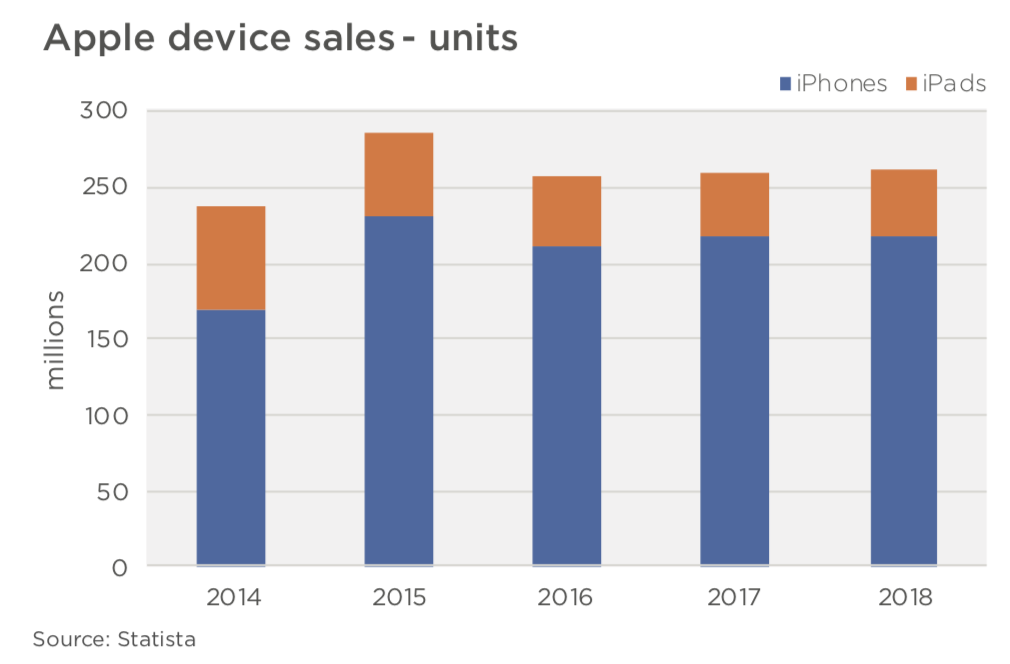

The smartphone and tablet markets are rapidly maturing. The number of iPads Apple sold peaked in 2015 and has been essentially flat ever since. Smartphone unit sales across all vendors has been flat for the last four years at about 1.4 billion, according to IDC. The number of smartphone owners globally is growing, but the annual number of smartphones sold is not.

Apple’s iPhone revenue in the March quarter of 2019 was the lowest in a Q1 period for five years. Apple has tried to create revenue growth in a flat smartphone market by raising prices, but this has exacerbated the problem. Consumers have proven less acquiescent to US$1000+ price points than Apple had expected. Rather than shortening the time between upgrades, as Apple had hoped, consumers are holding on to their phones for longer.

Apple did attempt to encourage iPhone owners to upgrade early by deliberately limiting battery life in older models, but instead caused a major controversy and some damage to its hallowed brand. Apple Watch and AirPod earbuds have proved successful but are relatively small profit contributors. Other hardware initiatives have proved disappointing – Apple’s HomePod has a 3% share of the smart speaker market, and its AirPower charging pad was withdrawn from the market before it was even launched.

Apple is now looking to services to reinvigorate growth. One of these is Apple Music, which has an impressive 50 million paying subscribers; half the number of Spotify, though it is facing serious competition from Amazon Music and Google Play, and is itself competing with Apple’s iTunes. Apple has big ambitions in healthcare, which CEO Tim Cook recently told the Financial Times could become Apple’s ‘greatest contribution to mankind’.

Apple has a vast and growing ‘services’ profit stream from its 30% share of revenue generated from the apps that sit on its operating system. However, the 30% ‘take’ is facing huge resistance from app developers, and both the US Supreme Court and the European Commission are investigating Apple for anti-competitive behaviour.

[ls_content_block id=”22205″ para=”paragraphs”]

[ls_content_block id=”14942″ para=”paragraphs”]