National Australia Bank Ltd (ASX: NAB) has cut its dividend in its half year FY19 result, is the share price a buy?

NAB is one of the four largest financial institutions in Australia in terms of market capitalisation, earnings and customers. However, in 2018, it was Australia’s largest lender to businesses and has operations in wealth management and residential lending.

The Big Dividend Cut In NAB’s Half Year Result

The NAB board has implemented a sizeable 16% cut to the interim dividend to 83 cents per share, down from 99 cents per share. This is pretty painful for retirees who rely on the banks for income.

In terms of the profit reported by the major ASX bank, NAB grew its cash earnings by 7.1% to $2.95 billion compared to last year.

Excluding Royal Commission related customer remediation of $325 million, cash profit of $3.28 billion was flat versus the same period a year ago. Statutory net profit also grew by 4.3% to $2.69 billion.

Perhaps worryingly, NAB’s credit impairment charge increased by 20.4% to $449 million. This is a still a small percentage of its loans but there is a clear increase from the March 2018 result to the September 2018 result, and then to this result.

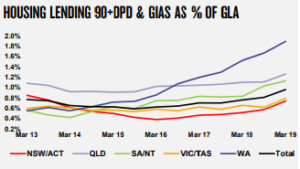

Just like Australia and New Zealand Banking Group (ASX: ANZ) yesterday, NAB is also showing rising Australian 90+ day mortgage arrears.

NAB reported that its Common Equity Tier 1 (CET1) ratio improved by 0.20% (20 basis points) to 10.4% at March 2019, leaving it well placed to reach APRA’s ‘unquestionably strong’ target of 10.5% target by January 2020.

NAB Management Comments

NAB CEO Philip Chronican said: “The past six months has been a challenging period for NAB. The Royal Commission highlighted a gap between where we are today and where we need to be to meet customer and community expectations.

“As we look ahead, the operating environment remains challenging. Economic growth is slowing but forecast to remain above 2% in 2019, housing credit growth is slowing, regulatory change is high and customer and community expectations have increased.”

Is NAB A Buy?

NAB may be putting its balance sheet into a better position with the dividend cut but I don’t think its retiree shareholder base will like it.

It’s also a worrying sign that both its arrears and credit impairment charges are rising, which may suggest there could be further trouble ahead if house prices keep dropping.

I’m not interested in buying NAB shares for my portfolio now and I won’t remotely consider it unless Australia is deep in a recession. I’d rather go for the reliable ASX shares in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]