Is the Australia and New Zealand Banking Group (ASX: ANZ) share price a buy after releasing its half year result to 31 March 2019?

ANZ is a leading Australian and New Zealand banking institution, with a presence throughout the oceanic region. ANZ is one of the Big Four Aussie banks and derives much of its revenue from mortgages, personal loans and credit.

Here’s What ANZ Reported In Its HY19 Result

ANZ Bank reported that statutory profit after tax fell by 5% to $3.17 billion.

The bank’s continuing operations cash net profit after tax (NPAT) was up 2% to $3.56 billion, however the continuing operations cash profit per share (EPS) actually increased by 5% because of the share buy-back ANZ was doing. In other words, ANZ was reducing the number of shares and the profit was shared between fewer shares, boosting the profit on a per-share basis.

Some of the other statistics moved in the right direction. ANZ Bank’s return on equity (ROE) increased to 12% from 11.9%. Its Common Equity Tier 1 (CET1) Capital Ratio increased to 11.5% (up 0.45%, or 45 basis points), meaning it is supposedly slightly ‘safer’ than it was before with high capital levels.

ANZ’s gross loans and advances increased by 3% to $613.8 billion and customer deposits increased by 4% to $493.4 billion.

On the cost side of things, full time equivalent staff decreased by 5%. For ANZ this is good, but obviously for the employees who have been let go it isn’t a positive at all.

Most of the aspects of the report seemed positive, particularly compared to its peers of National Australia Bank Ltd (ASX: NAB), Westpac Banking Corp (ASX: WBC) and Commonwealth Bank of Australia (ASX: CBA).

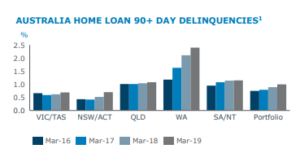

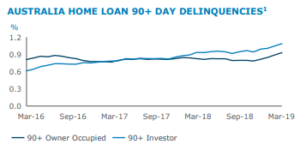

However, Australian home loan arrears are increasing across the board, which can be seen in the two graphs below.

ANZ HY19 Dividend

The big ASX bank decided to keep its half yearly dividend at $1.60 per share, which wasn’t really a surprise.

ANZ Management Comments

ANZ CEO Shayne Elliot said: “While our performance this half was solid, there are headwinds facing the sector and we are taking appropriate action.

“Retail banking in Australia will remain under pressure for the foreseeable future with subdued credit growth, intense competition and increased compliance costs impacting earnings.”

Is ANZ A Buy?

This may end up being the best half result of the big ASX banks. Managing to grow profit per share by 5% is a solid figure in this environment. But, there’s more to investing than the latest result.

I don’t think it’s a wise idea to buy any of the big banks at the moment (if ever), they are simply too big to grow meaningfully and face a lot of near term headwinds such as falling Australian house prices.

If you like the idea of a blue chip but want other ideas, the proven and reliable ASX shares in the FREE report below could be good ideas.

[ls_content_block id=”14945″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]