It is time to look past Woolworths Group Ltd (ASX: WOW) and Coca-Cola Amatil Ltd (ASX: CCL) in search of growth and quality?

‘Blue-chip’ is a term often applied to the more established, higher-quality businesses; a name that originates from the poker table where the highest value chips were traditionally blue in colour. These stalwarts are typically considered lower risk and are the stocks sensible investors supposedly focus on.

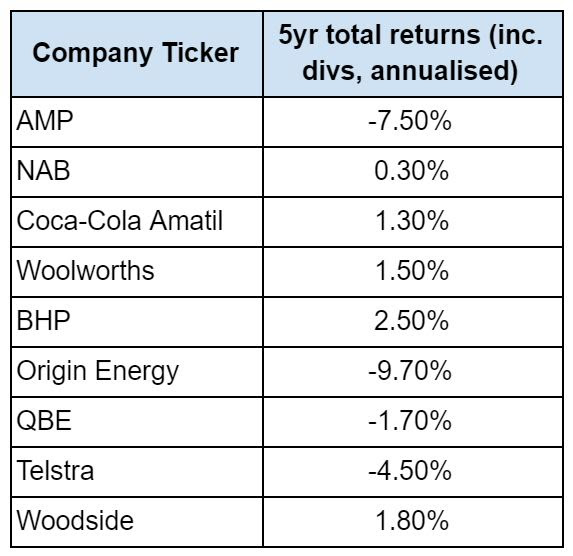

Perhaps. But for many of these so-called blue-chips, the shareholder experience has been woeful. Consider these examples from the S&P/ASX20 (INDEXASX: XTL), all of which have substantially lagged the broader market since 2013 — a period that saw the All Ordinaries (INDEXASX: XAO) deliver a 6.2% average annual total return.

To be fair, these are far from the worst returns you’ll see on the market. And, despite shareholder woes, many of these will no doubt be around for many, many years to come. But it’s a useful reminder that even the biggest and (seemingly) best companies can lead to disappointment — even over the long term.

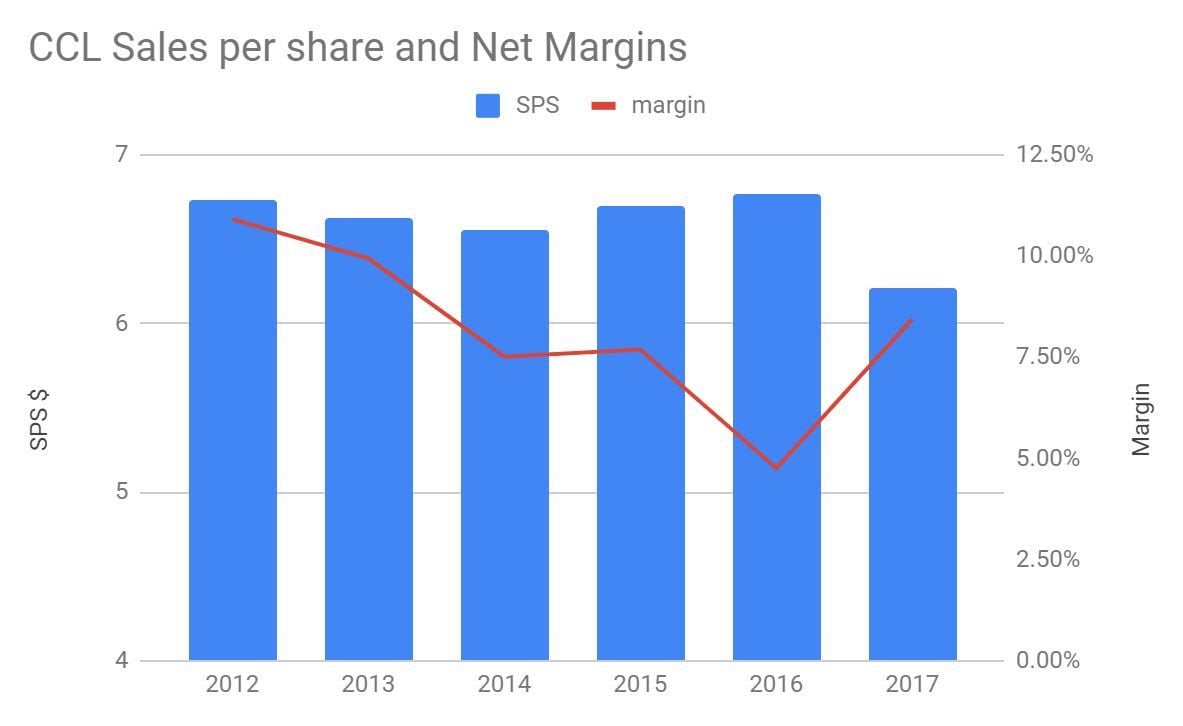

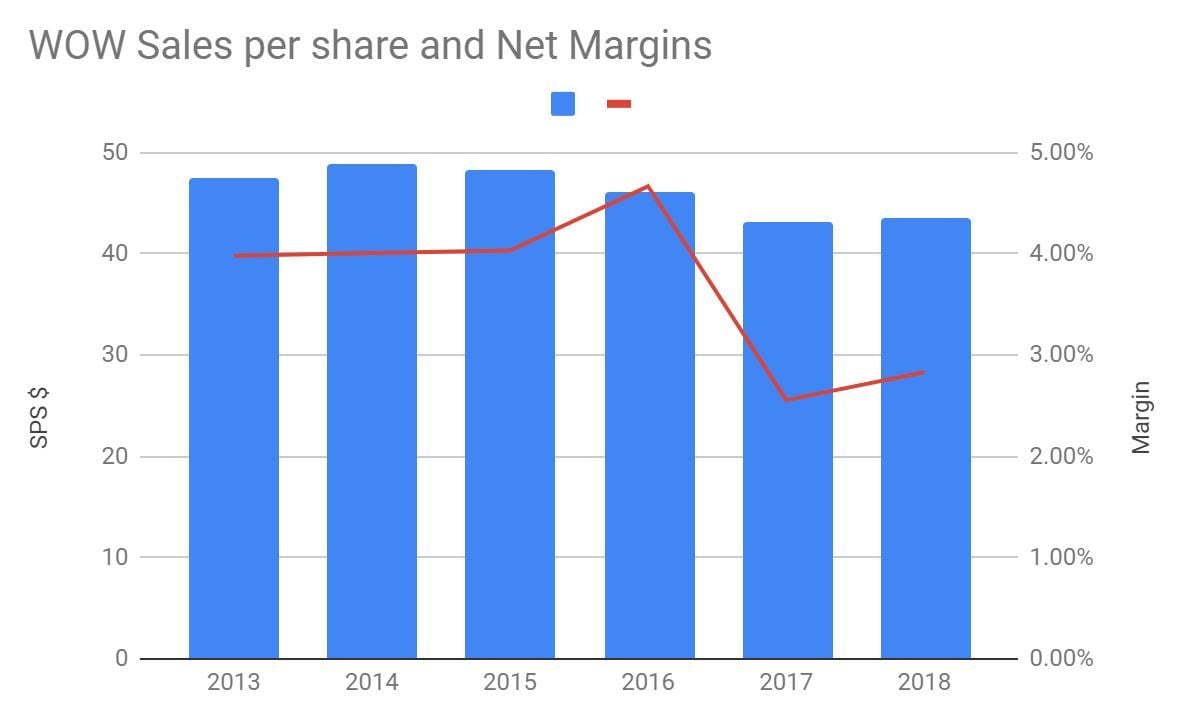

And if you were to make an argument for quality, investors must be ever mindful of price. Both Woolworths Group

and Coca-Cola Amatil are good examples here.

Both will likely be around for a long time yet, and both will likely remain profitable. But these are extremely mature businesses with limited growth prospects and increasing competitive threats. Neither has covered itself in glory in recent years:

With Woolies and CCA trading on forward earnings multiples of (approx.) 23x & 19x it’s going to be tough for investors to earn a decent return. Especially as interest rates start to normalise.

Perhaps there’s an argument if your focus is dividends, but with Woolworths on a mere 3.4% yield (fully franked), and CCA on ~5% (partially franked) yield, income investors will likely find better options elsewhere.

Just because a business may be small relative to the big blue-chips, or has a shorter history, doesn’t mean it is a risky investment. Indeed, although many of the top recommendations on Strawman are relative minnows, most have stronger balance sheets and are delivering superior growth. They certainly seem to have much more potential.

But, I could be wrong. As always, if you have a different view jump onto Strawman and let’s have at it!