The Retail Food Group Limited (ASX: RFG) share price fell another 13% on Wednesday as the embattled retail franchise business continues to deal with the fallout from a media investigation and profit downgrade.

Retail Food Group is the name behind brands such as Gloria Jeans, Crust Pizza, Pizza Capers, Donut King and more. It leases the brand names to would-be business owners.

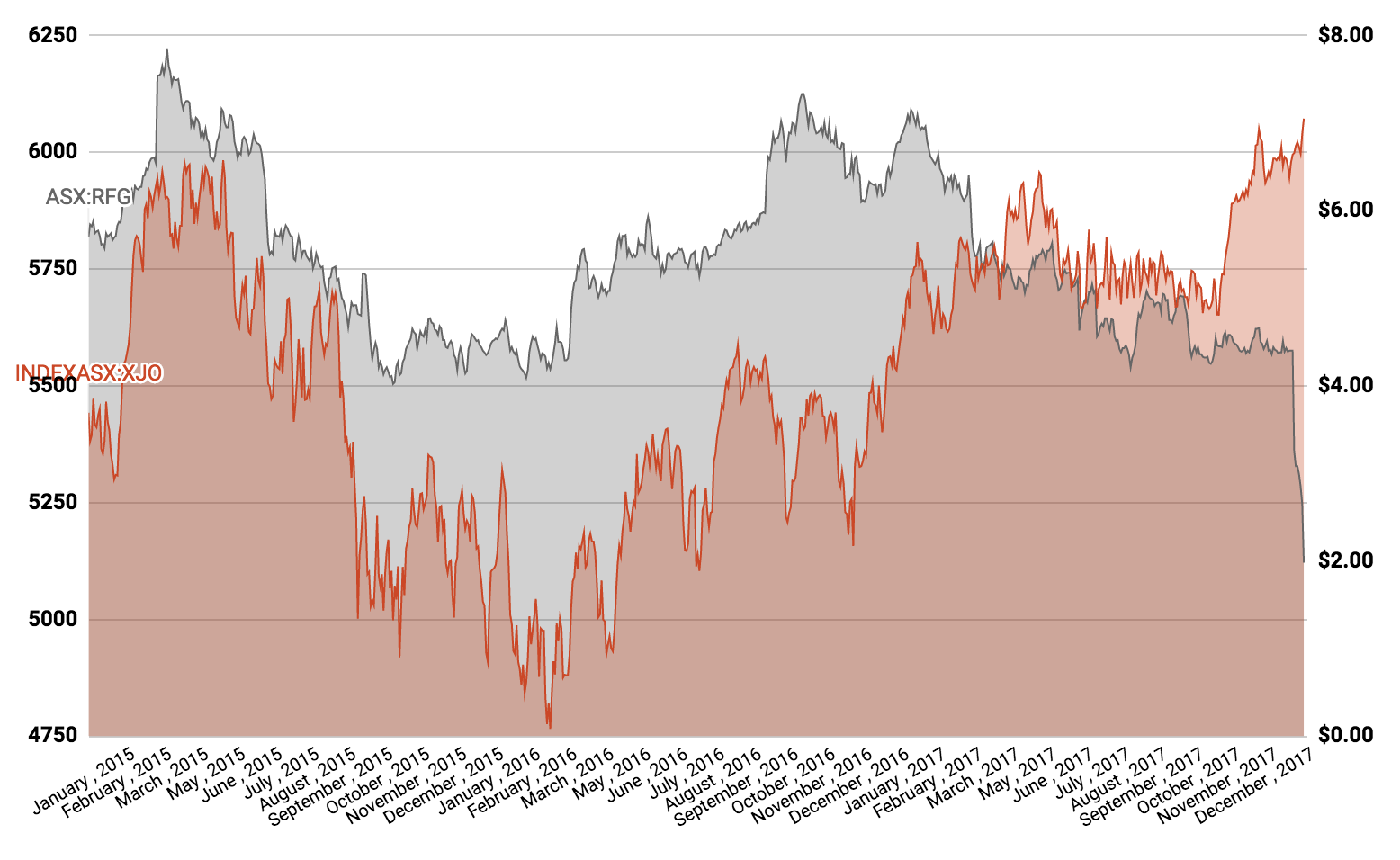

RFG Share Price

Earlier this month, Fairfax Media released the findings from its hard-hitting investigation into alleged franchisee mistreatment, saying that many of the small business owners are under intense pressure to keep their operation afloat.

Retail Food Group responded earlier this week by saying that the reporting did not, “accurately reflect its current business, its proactive efforts to better assure employee entitlement compliance and the levels of support it provides to franchisees.”

However, it acknowledged “isolated incidents” occur from time to time.

A day later Retail Food Group released a trading update which included a profit downgrade for the upcoming half-year financial period.

CEO Andre Nell said, “The retail market is expected to remain challenging for the near future and we remain focused on responding to this challenge through delivering franchisee support initiatives and reducing corporate costs.”

It forecast profit to come in at $22 million for the half year, down from $33.5 million in the same period last year.

In the analyst community, two analysts currently rate Retail Food Group shares as a “hold”, according to The Wall Street Journal. In the past three months, the total number of analysts covering the company has fallen from five to two.

At the time of writing, Retail Food Group shares were trading at $1.76.

Keep Reading: