Inside Computershare, the ‘boring’ ASX 200 compounder with global scale

Every day, ASX investors interact with a global giant they

Rask Media > Computershare Ltd (ASX:CPU)

Computershare Limited (ASX:CPU) is best known for its share registry services and employee share plans, but also provides mortgage services. It was founded in Melbourne in 1978 and has now become a global business with over 75 million customer records and 12,000 staff.

Every day, ASX investors interact with a global giant they

Here’s today’s The Match Out report from Market Matters’ James

Sonic Healthcare Ltd (ASX: SHL) has traditionally viewed as an

Here’s today’s The Match Out report from Market Matters’ James

The S&P/ASX 200 (INDEXASX: XJO) and All Ordinaries (ASX: XAO)

On Wednesday, the Australian share market, or S&P/ASX 200 (INDEXASX:

The S&P/ASX 200 (ASX: XJO) started the shortened week positively

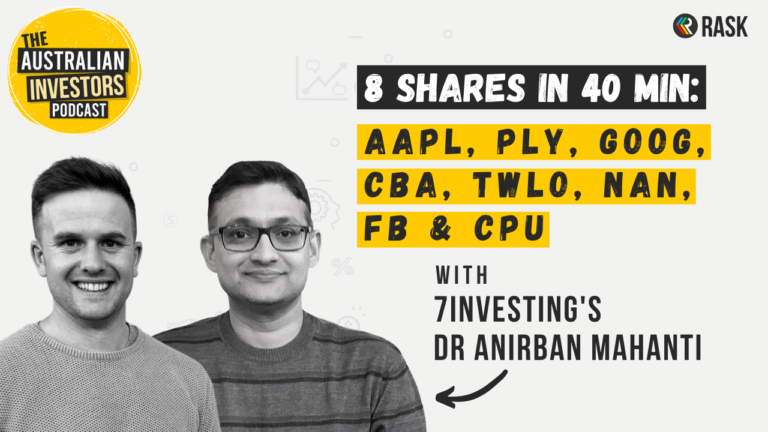

On this Australian Investors Podcast episode Dr Anirban Mahanti and

The Computershare Ltd (ASX: CPU) share price will be on

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.