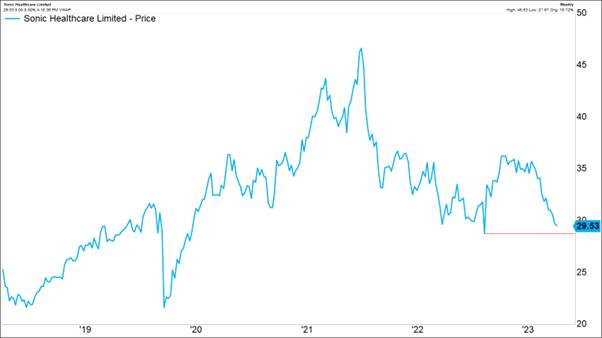

Sonic Healthcare Ltd (ASX: SHL) has traditionally viewed as an ASX share that provides a mixture of dividends and defensive growth for investors. However, SHL shares have been sold off 17% over the last 6 months. We examine whether SHL shares are a buy today.

Sonic Healthcare Ltd (ASX: SHL) share price

Why has Sonic Healthcare Ltd (ASX: SHL) been an outperforming ASX share over the long run?

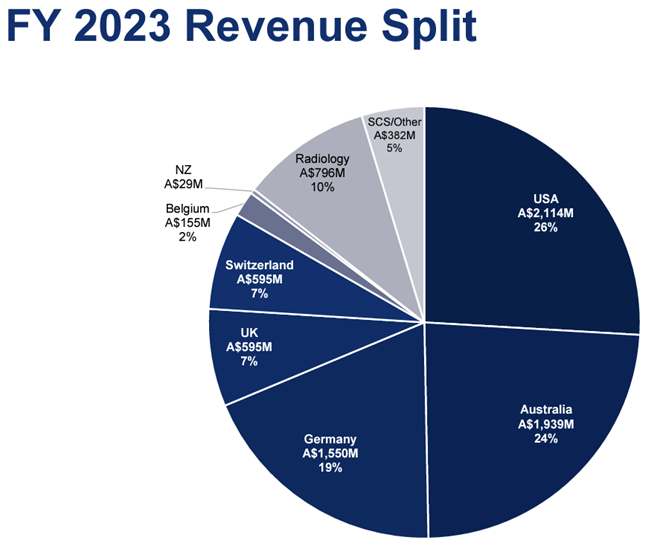

Sonic Healthcare is a globally leading pathology and radiology business in the US, Australia, Europe and the UK.

Source: SHL FY23 results presentation

Why has Sonic Healthcare Ltd (ASX: SHL) been an outperforming ASX share over the long run?

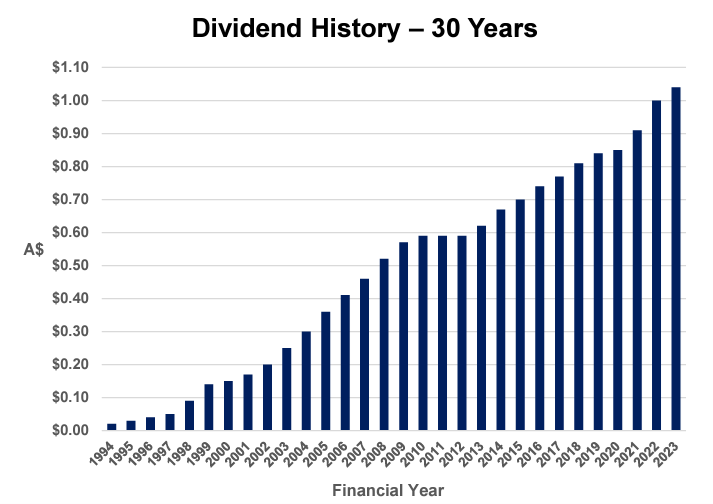

SHL has a track record of earnings accretive M&A and organic growth through efficiencies of scale, enabling it to consistently grow its dividend. Sonic earnings are underpinned by the unfortunate reliability of illness and disease.

In fact, SHL has a streak of 19 consecutive years of increasing its nominal annual dividend (excluding franking, which varies for SHL due to offshore earnings), putting it in rare air among ASX-listed companies.

The only shares that have a streak of 19 years or longer are Computershare Ltd (ASX: CPU), CSL Limited (ASX: CSL), Seven Group Holdings Ltd (ASX: SVW), and Washington H. Soul Pattinson and Co. Ltd (ASX: SOL).

Recently, SHL shares have sold off amidst a broader-based healthcare selloff which has dragged down other ASX shares such as CSL Limited (ASX: CSL), Resmed CDI (ASX: RMD), and Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) creating opportunities for opportunistic investors. We outlined what’s happening with two of these shares here and here.

Why have ASX healthcare shares outperformed long-term?

As Charlie Munger said, “time is the friend of a wonderful business”.

- Secular earnings growth tailwinds from an ageing population, baby boomers that have the ability to pay (they can afford it) and willingness to pay for high-end treatments even if not covered by private health insurance reimbursement. With advancements in medical technology and drug development, we expect these structural trends to continue.

- It is a defensive sector which is largely recession proof due to the non-discretionary nature of healthcare spend. Over the past 20 years, healthcare shares have outperformed the S&P/ASX 200 (INDEXASX: XJO) in down markets and have provided a lower volatility return profile for investors in all markets.

- On the ASX, we are fortunate to have high quality businesses such as CSL Limited (ASX: CSL), Cochlear Limited (ASX: COH), Resmed CDI (ASX: RMD), Sonic Healthcare Ltd (ASX: SHL) and Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC), all enjoying a return on equity of ~10%-25%, to choose from in the healthcare sector.

Focusing on Sonic Healthcare, diagnostic testing is a growing industry due to the increasing prevalence of chronic diseases, and advancements in diagnostic techniques and personalised medical treatments.

Laboratories are attractive businesses given the capital light nature and pricing power at scale driven by brand reputation, volume capacity and bargaining strength with suppliers. The client base of a pathology business is sticky, which means it attracts a premium valuation.

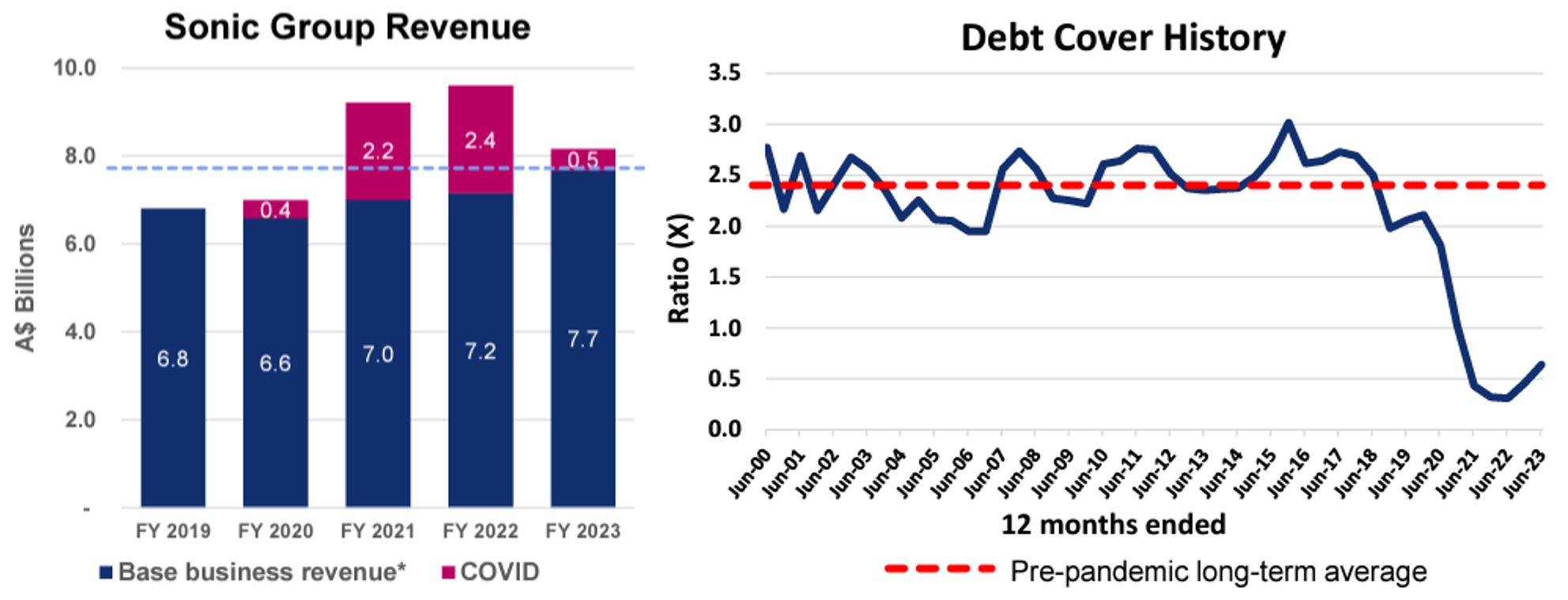

Covid testing volumes have normalised but sugar-hit cash flow can be deployed accretively

Pathology labs made windfall profits from the pandemic from widespread PCR testing. SHL appears to be emerging from this covid boom with pathology volumes normalising and we think earnings have found a base for growth to resume in its key markets. Compared to 2019 (pre-covid), base pathology volumes are 5% higher in 2023 (1% CAGR FY19-23), suggesting that covid actually dampened volume growth relative to the long-run growth rate (4% FY12-19) while the focus shifted to the pandemic.

Cashflow from covid testing has significantly strengthened the balance sheet by reducing net debt to EBITDA cover to 0.6x, down from the long run average of 2.5x.

These earnings have been used to make bolt-on acquisitions to benefit the base business, with growth set to resume.

Source: SHL FY23 results presentation

Internationally, SHL has identified Germany as a region prospective for M&A, with the potential for revenues to overtake that of the Australian business.

Sonic announced two tuck-in acquisitions in April 2023 of Medical Laboratories Dusseldorf and Diagnosticum Laboratory Group in Germany for a combined total of €370 million. The June acquisition of Synlab Suisse for €153 million gains a foothold into a new region, being Switzerland.

For these transactions, SHL has said that the acquired companies will be immediately earnings accretive with synergies across infrastructure and operations (including procurement).

Sonic also has 20% stakes in Microba Life Sciences Ltd (ASX: MAP) which does gut microbiome testing and Harrison.ai which is developing AI diagnostic tools.

Data suggest supportive outlook

Medicare data from August 2023 shows base pathology and diagnostic imaging benefits are growing strongly above pre-pandemic levels, with Sonic directly expected to capitalise on this industry growth.

Excluding COVID-19 testing, pathology benefits are +9.1% year-on-year in Aug-23 and diagnostic imaging benefits are +13.7% year-on-year in Aug-23. Relative to pre-pandemic data in Aug-19, pathology benefits are +9.6% ahead, and diagnostic imaging benefits are +26.8% ahead.

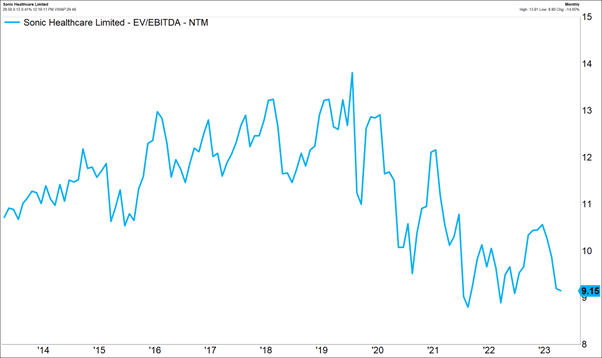

SHL shares undervalued on a long-term view

SHL shares trade on just 9.15x forward EV/EBITDA, a level that represents a near 10-year low and has historically been a support level over the last few years.

Source: Factset

We believe a return to earnings growth, which the data suggests is likely, should see shares re-rate with the P/E multiple expanding from its current 20x level, combined with the ‘E’ growing gives SHL shares reasonable upside.

A strong balance sheet and a 3.65% dividend yield provide downside support for the share price at current levels. Dividends are typically paid in March and September. The last four dividends have been fully franked.

Source: Factset

We think shares could find support at current levels, with the 3-year low of $28.78 in February 2023 potentially providing support for the share price.